Bitcoin’s ETF-Driven Rally Signals Institutional Momentum Amid Low Volatility

Contents

Toggle- Quick Breakdown

- Institutional flows lead as retail stalls

- Volatility and macro catalysts could set the stage

Quick Breakdown

- Bitcoin’s market cap rises 8% to $4.18T as ETF inflows hit record levels.

- Ethereum volume drops 3%, signaling weak retail activity.

- Low volatility and macro catalysts point to a major Q4 price move.

Bitcoin is entering a new phase of strength, with analysts suggesting the latest rally is being fueled not by retail hype but by deeper structural flows tied to institutional investment. According to market data shared by 10x Research, exchange-traded fund (ETF) inflows are climbing to record levels, even as volatility remains unusually muted —a combination rarely seen in previous bull runs.

10x Weekly Crypto Kickoff – The Volatility–ETF Signal: What’s driving the Next Market Move

Bitcoin’s rally has entered a new phase — one that feels less like speculation and more like conviction.

ETF inflows are hitting near-record levels, open interest is at cycle highs, and… pic.twitter.com/1RFUAKHgor

— 10x Research (@10x_Research) October 5, 2025

Institutional flows lead as retail stalls

The report highlights a notable divergence between Bitcoin and the broader crypto market. Bitcoin’s weekly trading volume surged to $60 billion, up 21% from the average, while Ethereum’s slipped 3% to $38.7 billion. Despite the volume gap, total cryptocurrency market capitalization rose 8% week-on-week to $4.18 trillion, suggesting that capital is consolidating around Bitcoin rather than spreading across altcoins.

Low Ethereum network fees — currently around 0.26 Gwei, placing them in the 10th percentile range — signal limited on-chain activity, a further indication that retail traders have not yet reentered the market in force. Analysts interpret this as a sign that the rally’s current strength is underpinned by institutional accumulation through ETFs, not short-term speculation.

Volatility and macro catalysts could set the stage

Option markets are also flashing signals of a potential breakout. Traders are reportedly positioning for a larger, more directional move into year-end, as implied volatility lingers near multi-month lows. With a cluster of Federal Reserve and global macro events on the October calendar, analysts expect volatility to return in the coming weeks, potentially accelerating Bitcoin’s trend.

The broader takeaway from this report is that Bitcoin’s current trajectory appears more deliberate and structurally sound than in previous cycles. If institutional inflows continue to deepen while volatility remains suppressed

However, previous 10x Research had cautioned that a significant share of inflows into U.S. spot Bitcoin ETFs may be short-term in nature, driven by tactical positioning rather than long-term accumulation. Even so, the balance of evidence suggests Bitcoin’s current rally may mark the early stages of a structurally reinforced bull phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Three Financial Giants Predict Why Crypto Faces Its Hardest Test Yet in 2026

Ethereum Nears $3,000 as Bitmine Expands Holdings to 4 Million ETH

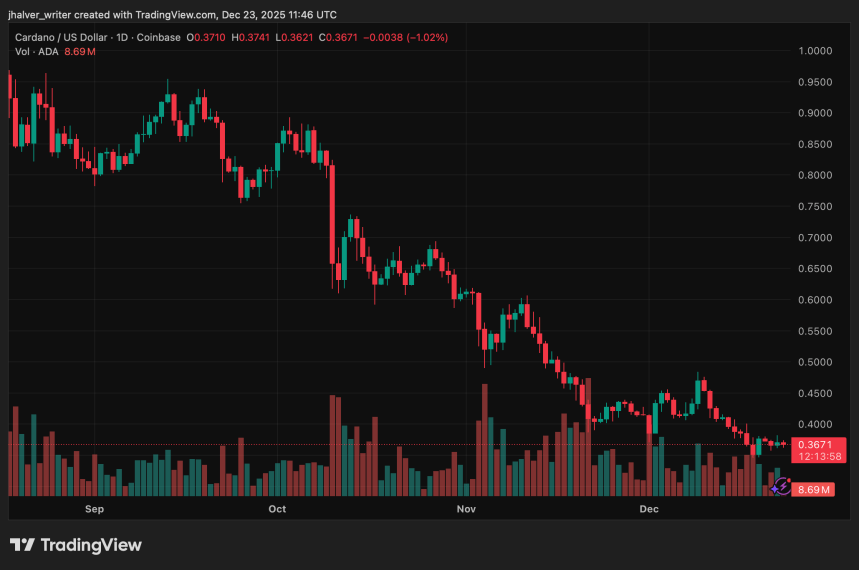

Founder Signals Long-Term Opportunity in Cardano DEXes as Price Consolidation Persists

AI Crypto Coins: ETHZilla Liquidates $74M Worth of ETH, DeepSnitch AI’s $875K Presale Takes Hold of the AI Sector