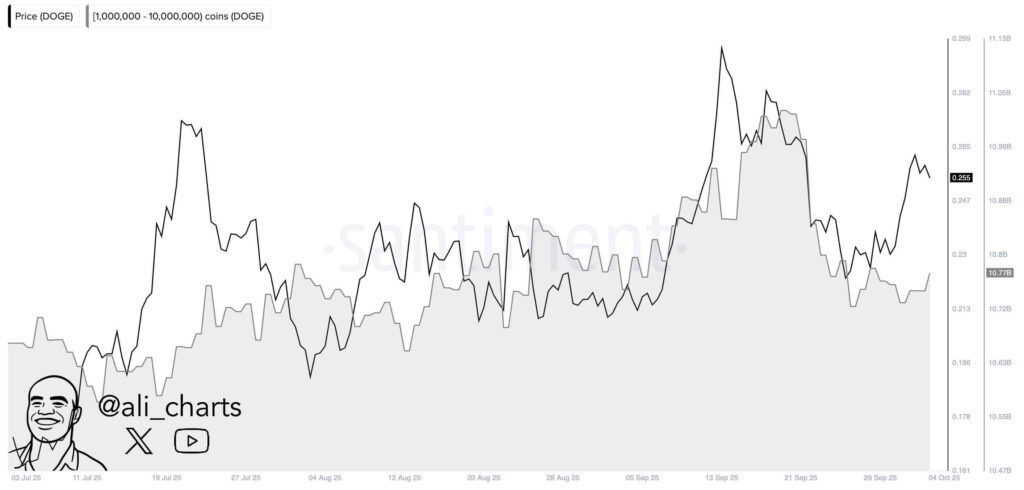

Dogecoin accumulation resumed as mid‑tier wallets added 30M DOGE in 24 hours, pushing cohort balances to ~10.77B. This whale-led buying supports price near $0.255 and focuses attention on a $0.27–$0.30 breakout zone with trendline retest and ascending triangle signals.

-

30M DOGE added by mid‑tier wallets in 24 hours

-

Analysts note a trendline retest and an ascending triangle as key breakout signals.

-

Price stability above $0.25 keeps focus on the $0.27–$0.30 resistance belt; a drop below $0.23 would threaten momentum.

Dogecoin accumulation surges as whales add 30M DOGE; price eyes $0.27–$0.30 resistance—read COINOTAG’s expert breakdown and trader guidance now.

What is the latest Dogecoin accumulation by whales?

Dogecoin accumulation refers to concentrated buying by wallet cohorts; mid‑tier wallets (1–10M DOGE) added ~30 million DOGE in 24 hours, lifting combined holdings to approximately 10.77 billion DOGE. This fresh inflow coincides with technical setups that increase the probability of a near‑term breakout.

How did whale balances and price move through July–October?

Early July saw quiet accumulation while price hovered near $0.17–$0.18. Balances peaked above 11.13B during a mid‑July spike to $0.29 before retracing. Consolidation between August and early September kept balances near 10.7–10.9B with price in a $0.21–$0.24 range. Recent activity resumed accumulation and pushed price to ~ $0.255.

Source: Ali on X

Source: Ali on X

Why do analysts see a potential breakout for DOGE?

Multiple chart patterns are converging. Analysts highlight a trendline retest and an ascending triangle that together increase breakout odds. Repeated accumulation from wallets controlling 1–10M DOGE provides support underneath price, reducing the likelihood of an immediate collapse.

What targets and risk levels do chart watchers cite?

Some analysts map higher targets, including range extensions toward $0.50 on aggressive breakouts. Nearer‑term attention centers on $0.27–$0.30 as the immediate resistance belt. Conversely, a sustained decline under $0.23 would reopen downside toward $0.20 and invalidate bullish structure.

| Mid‑tier wallet balance | ~10.77B DOGE | 10.7B–11.1B historically |

| Spot price | $0.255 | $0.23 (support) — $0.27–$0.30 (resistance) |

| Technical setups | Trendline retest, ascending triangle | Breakout target up to $0.50 (model dependent) |

How should traders interpret this accumulation?

Front‑load the most important signals: growing mid‑tier accumulation, converging technical patterns, and price holding above $0.25. Use defined risk: consider entries on confirmed breakout and retest, and set stops below $0.23 to limit downside exposure.

Frequently Asked Questions

How much DOGE did mid‑tier wallets add in the recent accumulation?

Mid‑tier wallets (1–10M DOGE) added around 30 million DOGE within a 24‑hour period, pushing their combined holdings to roughly 10.77 billion DOGE and signaling renewed buying interest.

What technical patterns are supporting the bullish case?

Analysts point to a trendline retest and an ascending triangle across higher timeframes. These setups, when paired with sustained accumulation, raise the probability of a bullish breakout toward the $0.27–$0.30 zone.

Key Takeaways

- Whale accumulation resumed: 30M DOGE added by mid‑tier wallets, balances at ~10.77B.

- Converging technicals: Trendline retest and ascending triangle increase breakout odds.

- Manage risk: Watch $0.27–$0.30 for breakout confirmation and use stops below $0.23.

Conclusion

This COINOTAG analysis shows renewed Dogecoin accumulation from mid‑tier wallets combined with technical setups that place the $0.27–$0.30 belt in focus. Traders should prioritize confirmed breakout signals and strict risk controls as the market evolves. Monitor whale balances and price structure closely for actionable entries.