Ethereum Reaches $4,500 Amid Institutional Interest

- Ethereum breaks $4,500, signaling renewed market confidence.

- Institutional demand and whale activity drive growth.

- Macro trends support positive market outlook.

Ethereum has surged past $4,500, buoyed by macroeconomic trends and increased institutional interest, although it saw a 0.75% daily dip. Whale activities indicating accumulation add solidity to this upward move, highlighting a bullish phase for ETH.

Points Cover In This Article:

ToggleIn recent trading, Ethereum (ETH) surpassed the $4,500 mark, marking a key resurgence in value. Institutional interest, whale accumulation, and macroeconomic trends have contributed to this price movement.

This event highlights the increased importance of macroeconomic dynamics and institutional involvement in cryptocurrency markets. The price action reflects broader confidence and sustained accumulation, as researchers from Coinbase noted:

“Rising expectations of a rate cut and Gold printing fresh highs as the US Dollar weakens reduces cash-yield competition for risk assets, which should benefit crypto,” said Colin Basco, a researcher at Coinbase.

Despite a small 0.75% daily decline, ETH’s rally was fueled by rising institutional activity . Capital inflows into Ethereum-based ETFs and DeFi platforms have encouraged its ascendancy to this strong price point.

Institutional Interest and Whale Accumulation

Leading researchers from Coinbase have noted that the expectation of further rate cuts enhances Ethereum’s standing. Whale accumulation of 840,000 ETH in recent weeks indicates sustained long-term faith.

Impact on Cryptocurrency Market

This price surge positively influenced related assets, with Bitcoin and major altcoins rallying. However, Ethereum outperformed others, consolidating its status as a central component of the crypto ecosystem.

Historical Context and Future Outlook

Previous monetary policy shifts have similarly spurred crypto rallies. Historical data corroborates the idea that risk-on assets benefit amid dovish fiscal outlooks.

Market participants continue to monitor these movements, weighing their implications for Ethereum’s long-term trajectory. These developments could lead to further capital inflows and sustain a bullish macro outlook.

Intervals of dovish interest rate environments have historically symbolized bullish phases for Ethereum. As economic conditions evolve, Ethereum’s trading dynamics could experience further shifts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

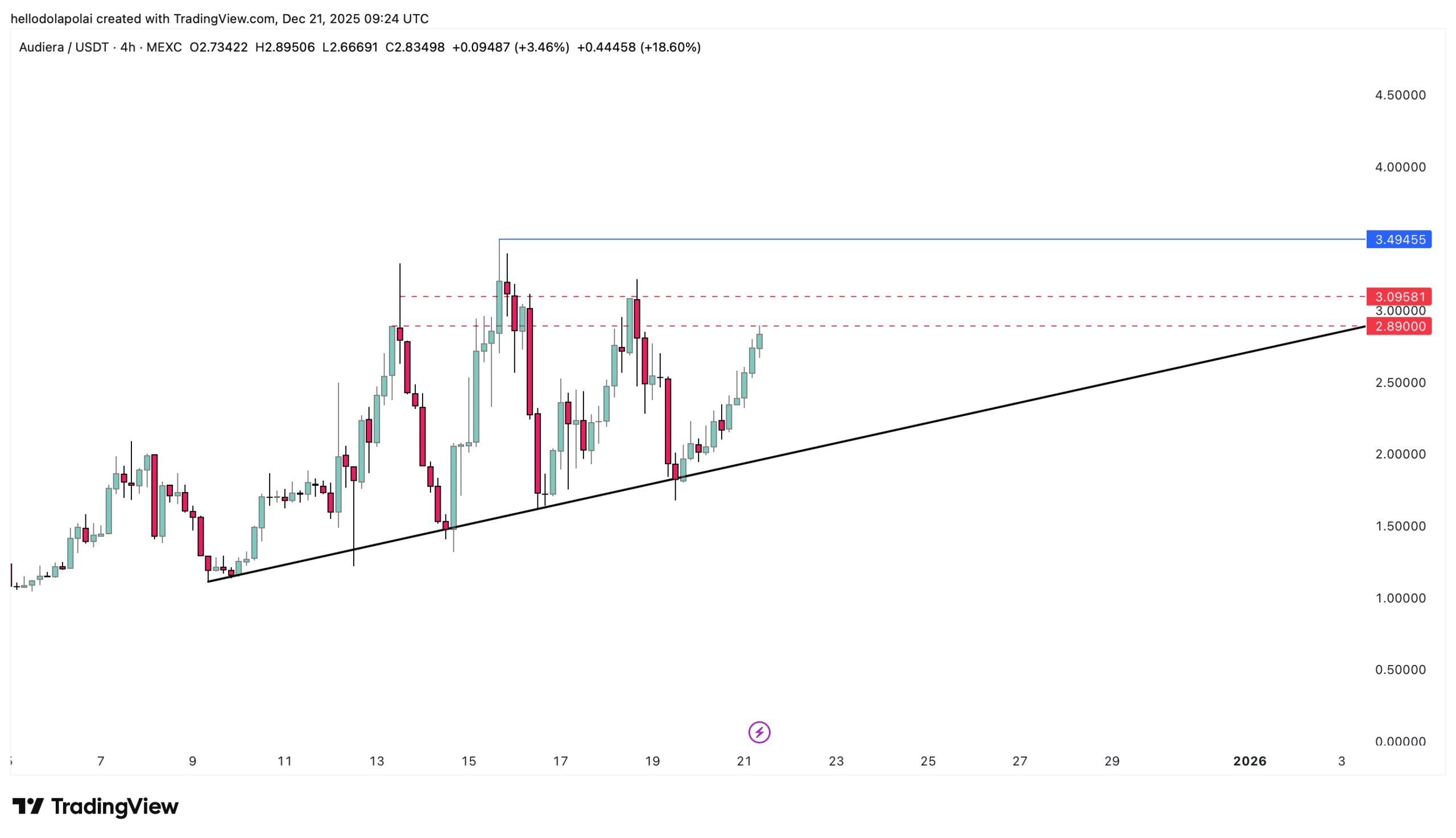

BEAT heats up, rallies 30%! A key level stands before Audiera’s ATH

Trending news

MoreDTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

Bitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low