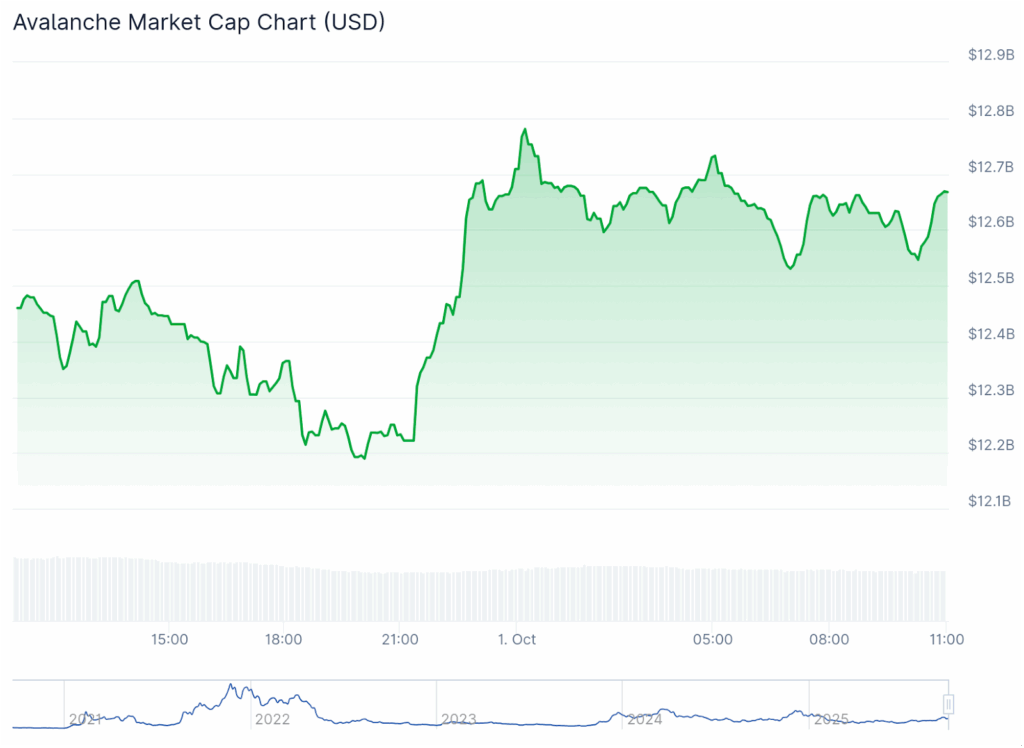

Avalanche trading volume surged to about $34 billion in September 2025, a yearly high that coincided with AVAX price trading near $29.92 and market cap oscillating around $12.2–12.9 billion, signaling elevated DEX liquidity and renewed investor interest in short-term AVAX markets.

-

Avalanche DEX volume reached ~$34B in September 2025, the highest monthly figure this year.

-

AVAX trades near $29.92 with support at $27–$25 and resistance at $35 and $40–$42.

-

Avalanche market cap moved between $12.1B–$12.9B intraday, showing sharp volatility and renewed accumulation.

Avalanche trading volume spike: AVAX DEX volume hit $34B in Sept 2025 — read concise analysis of price levels, market cap moves and trader signals. Learn what to watch next.

What is the Avalanche trading volume surge?

Avalanche trading volume refers to total DEX activity on the Avalanche network; in September 2025 that monthly DEX volume rose to roughly $33–34 billion, the highest level recorded this year. The surge coincided with AVAX price activity near $29.92 and increased market-cap volatility, indicating higher short-term liquidity and trader participation.

How did AVAX DEX volume reach $34B in September 2025?

Data compiled from on‑chain DEX records and market aggregators show a steady climb from mid‑year, with July and August surpassing $20B and September nearly doubling those monthly averages. Market analyst Marc Shawn Brown observed the yearly ATH in social comments, noting heightened trading pairs and increased swap frequency.

Monthly trading volumes: what changed through 2025?

Monthly DEX volume began the year near $15B in January, dipped through April to around $10B, then recovered variably. July and August posted more than $20B each, and September delivered the largest increase at roughly $33–34B.

This pattern shows a late‑cycle pickup in trading activity, with higher swap counts and larger single‑day volumes compared with early 2025 averages.

$AVAX monthly DEX Volume just hit a yearly ATH. pic.twitter.com/1BHWYbCxJj

— Marc Shawn Brown (@MarcShawnBrown) October 1, 2025

January began with around $15 billion in trading volume. February and March fell to $13 billion and $12 billion respectively, with April at the year’s low near $10 billion. May recovered to $14 billion, June dipped to near $11 billion, and momentum shifted in July and August before September’s major surge.

How is AVAX price reacting to higher DEX liquidity?

The AVAX four‑hour chart shows price trading near $29.92 with clear support at $27–$25 and a deeper base near $23–$22. Resistance zones sit at $35 and the $40–$42 range.

Support levels around $25–$27 have repeatedly acted as rebound points, while intraday swings reflect profit‑taking and short‑term accumulation in the $12.2–12.9 billion market‑cap band.

Source: CW Via X

Source: CW Via X

Market capitalization movements: why they matter

Avalanche market cap swung between approximately $12.1 billion and $12.9 billion in intraday trading, showing both profit‑taking and renewed buying. Holding above $12.5 billion supports short‑term upside, while failing $12.2 billion would increase downside risk.

Source: CoinGecko

Source: CoinGecko

Frequently Asked Questions

What caused September 2025 DEX volume to spike for Avalanche?

Higher on‑chain activity, increased swap pairs and a cluster of large transactions drove September’s DEX volumes. Market commentary and on‑chain metrics point to renewed trader participation and elevated liquidity demand across AVAX pairs.

How should traders interpret the current AVAX support and resistance?

Traders should view $27–$25 as immediate support for short‑term longs and $35 as the first clear resistance for breakouts. A sustained move above $40 would indicate broader market confidence; conversely, losing $23–$22 increases downside risk.

Key Takeaways

- Volume spike: September DEX volume reached about $34B — the largest monthly total in 2025.

- Price context: AVAX trades near $29.92 with supports at $27–$25 and resistance at $35 and $40–$42.

- Market cap insight: Intraday swings between $12.1B–$12.9B reflect profit‑taking and renewed accumulation; watch $12.2B as a key threshold.

Conclusion

September’s Avalanche trading volume surge to approximately $34 billion underscores stronger DEX liquidity and active participation in AVAX markets. Traders should monitor support at $27–$25, resistance at $35, and market‑cap behavior around $12.2–12.9 billion. For ongoing coverage and detailed data, COINOTAG will continue tracking on‑chain metrics and price developments.