- Stablecoin market cap tops $300 billion for the first time.

- USDT and USDC lead the surge in adoption.

- DeFi and remittances drive stablecoin utility.

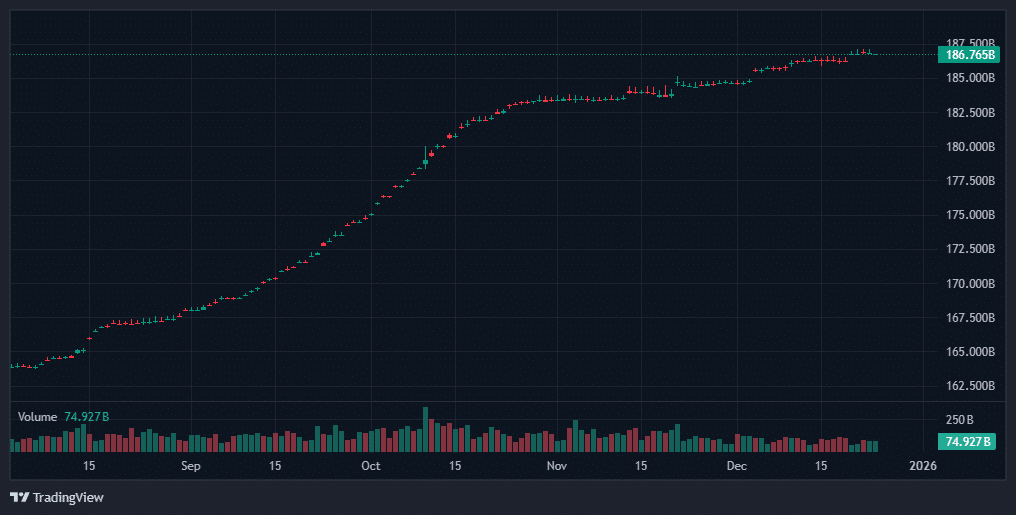

The global stablecoin market has officially crossed the $300 billion mark in total market capitalization. This major milestone underscores the increasing reliance on stable digital assets amid growing adoption in crypto trading, decentralized finance ( DeFi ), and cross-border payments.

Stablecoins, like Tether (USDT), USD Coin (USDC), and DAI, have become essential tools in the crypto ecosystem. Pegged to traditional fiat currencies—mostly the U.S. dollar—they provide a stable store of value and a trusted medium of exchange for crypto users. The latest surge in market cap reflects both fresh capital inflows and renewed interest from institutions and retail users alike.

USDT and USDC Dominate the Stablecoin Arena

Tether (USDT) continues to lead the stablecoin sector with a market cap exceeding $110 billion, followed closely by USD Coin (USDC), which has seen its own recent rebound thanks to integrations with payment platforms and growing usage in smart contract applications.

Other algorithmic and decentralized stablecoins, such as DAI and FRAX, have also contributed to the rise. With new launches and upgraded protocols, the stablecoin space is rapidly evolving to serve the needs of a broader user base.

Use Cases Expand Beyond Crypto Trading

Stablecoins are no longer just tools for hedging volatility on exchanges. Today, they’re central to decentralized finance, powering lending protocols, yield farming, and liquidity pools. Additionally, they’re playing an increasing role in global remittances, especially in emerging economies where access to stable banking infrastructure remains limited.

As regulatory clarity improves and blockchain scalability advances, experts expect stablecoin usage to continue climbing, potentially pushing the market cap even higher in the coming months.