Bitcoin Surges to $118.5K Amid Rate-Cut Speculations

- Bitcoin hits $118.5K, fueled by rate-cut predictions.

- Institutional inflows drive Bitcoin’s price surge.

- Short liquidations heighten, influencing market movement.

Bitcoin’s price surge past $118,500 is driven by upcoming US rate cut expectations and institutional interest, with entities like BlackRock and Japan’s Metaplanet active in the market. This aligns with historical patterns of liquidity-driven rallies.

Bitcoin surged past $118,500, influenced by Federal Reserve rate-cut prospects and short liquidations. Institutional interest from spot ETF providers like BlackRock and Fidelity has bolstered market confidence, anticipating potential new records. Speculations about monetary policy have also influenced the crypto market dynamics significantly.

Bitcoin’s surge past $118,500 marks a milestone, reflecting intensified investor engagement driven by Federal Reserve rate-cut expectations and spot ETF inflows. Short position liquidations have further accelerated Bitcoin’s price movement, positioning it near an all-time high. Major entities such as the Federal Reserve and spot BTC ETF providers are pivotal. With the Fed’s monetary policy in focus, Tom Lee of Fundstrat remarked, “Bitcoin is responding to global liquidity, which is currently moving up,” in a CNBC article. Institutional buyers like Japan’s Metaplanet have shown increasing interest with significant Bitcoin purchases.

The surge in Bitcoin price has intensified institutional demand, amplifying trading volumes and drawing interest from global markets. Institutional interest and liquidity factors play significant roles in the crypto market. These elements collectively bolster Bitcoin’s positioning and strengthen investor sentiment amidst a burgeoning market landscape.

Financial implications involve Bitcoin’s robust performance, which is significant for institutional traders eyeing long-term gains. Politically, the Federal Reserve’s potential rate cut may influence monetary policies globally, impacting investor strategies and market dynamics. Such developments could shape financial narratives considerably. Potential impacts include enhanced investor confidence and regulatory shifts. Regulatory emphasis may shift toward accommodating crypto demand, influenced by significant liquidity inflows. Technologically, opportunities arise within derivatives and ETFs, adhering to evolving market trends and capital inflows, accommodated by innovative solutions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Best Crypto to Buy Now? Hedera Price Prediction, New Crypto Coins

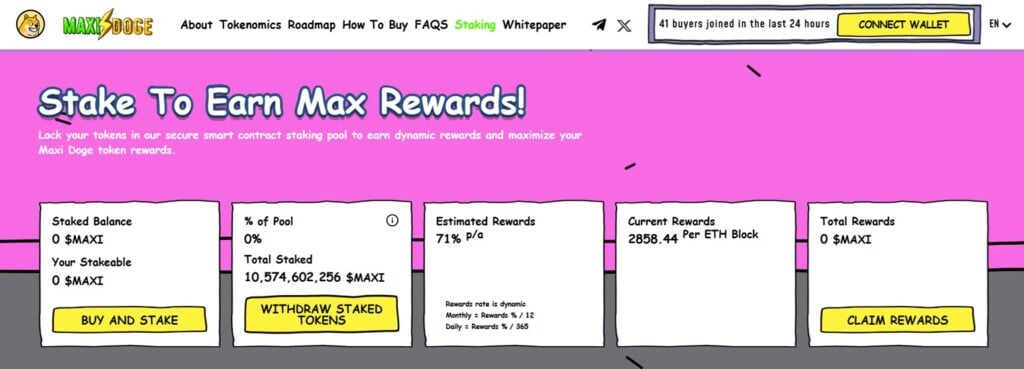

Best Crypto Presales: Dog-Themed Token Set to Surge in the Next Market Cycle

Whale Inflows Dampen XRP ETF Optimism As Selling Pressure Persists

Following Yesterday’s Move, Controversial Figure Arthur Hayes Purchased a Different Altcoin Today