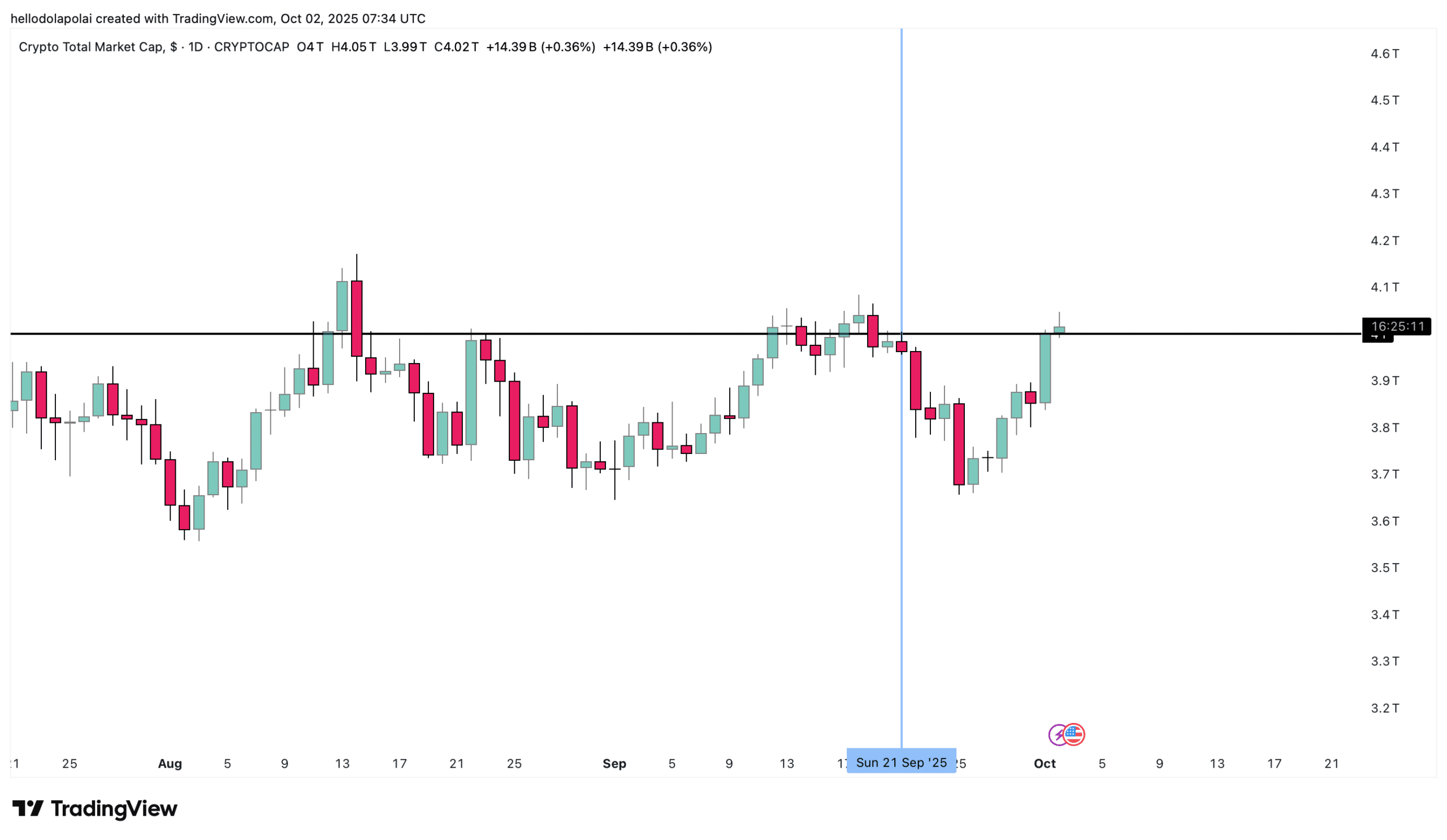

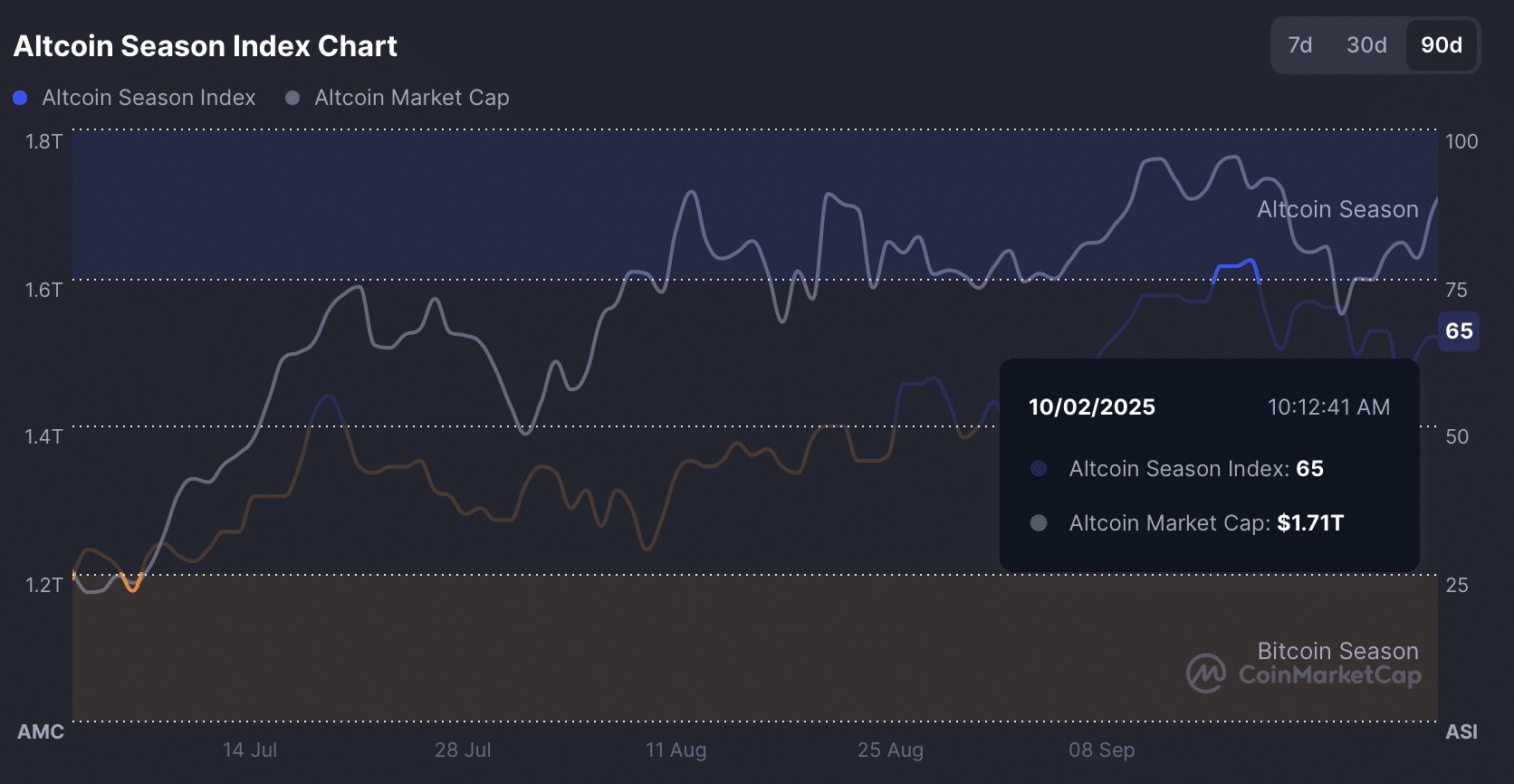

RLUSD minting added $1.8 million to Ripple’s RLUSD stablecoin, lifting its market valuation to $789 million and making it the eighth-largest stablecoin; this expansion—paired with a $4T crypto market cap and rising Altcoin Season Index—signals increased liquidity and potential upward pressure on altcoins and XRP.

-

RLUSD minting raised RLUSD’s supply by $1.8M, valuing it at $789M (8th-largest stablecoin).

-

Stablecoin supply growth often precedes higher trading activity and altcoin demand.

-

Market context: total crypto cap ~$4T, stablecoin cap ~$309B, Altcoin Season Index at 66.

RLUSD minting: RLUSD added $1.8M supply, raising its value to $789M—track market impact and XRP flows with COINOTAG insights.

What is RLUSD’s $1.8M minting and why does it matter?

RLUSD minting refers to Ripple Labs adding $1.8 million of supply to its RLUSD stablecoin, increasing its total valuation to about $789 million. This expansion matters because fresh stablecoin issuance can indicate incoming liquidity and higher buying capacity for spot markets.

How does RLUSD minting affect altcoins and XRP?

New stablecoins typically act as market liquidity reservoirs that traders use to buy altcoins and major tokens. With the overall crypto market cap near $4 trillion and the stablecoin market capitalisation around $309 billion, added RLUSD supply can support increased trading and price discovery.

Data points to watch: the Altcoin Season Index reading of 66 suggests growing altcoin demand (a 75+ reading confirms a broad altseason). The Fear & Greed Index at 51 shows neutral sentiment while investors accumulate selectively.

Stablecoin market as a signal: What should traders watch?

Stablecoin minting is often a short-term liquidity gauge. When issuers add supply, it implies capital is ready to flow into markets rather than sit idle.

Key metrics: total stablecoin cap (~$309B), 24H stablecoin trading volume (~$206B), and rank changes in stablecoin market share. Monitoring these helps assess whether RLUSD’s mint leads to sustained asset purchases.

Source: TradingView (plain text)

RLUSD’s $1.8M mint coincided with the crypto market reclaiming the $4 trillion threshold, a sign that investors are rotating capital back into crypto. Historically, such recoveries increase on-chain activity and exchange inflows.

How is the Altcoin Season Index shaping expectations?

The Altcoin Season Index at 66 signals rising altcoin breadth but not a full altseason. At 75+ the market typically shows widespread alt gains; current readings suggest pockets of strength with room to run.

Investors should balance position sizing and watch on-chain spot flows for confirmation.

Source: CoinMarketCap (plain text)

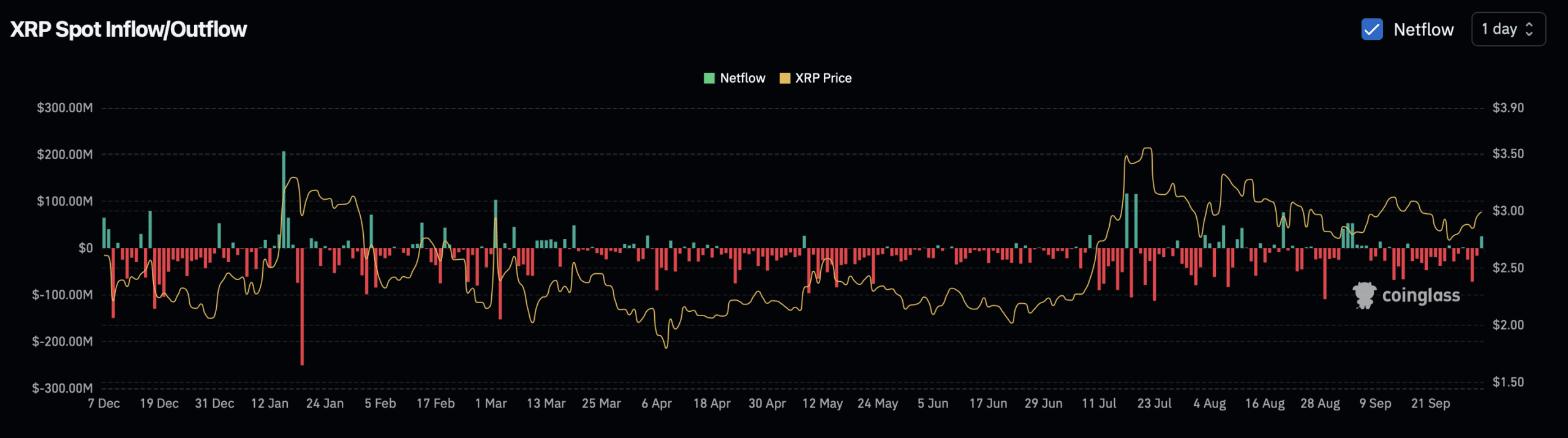

Are investors buying XRP now?

Netflow data shows mixed behavior. Between 28 September and 1 October, buyers accumulated roughly $110.9 million of XRP. A short-term reversal returned about $20.05 million in the 24-hour period ending 2 October, indicating renewed spot demand.

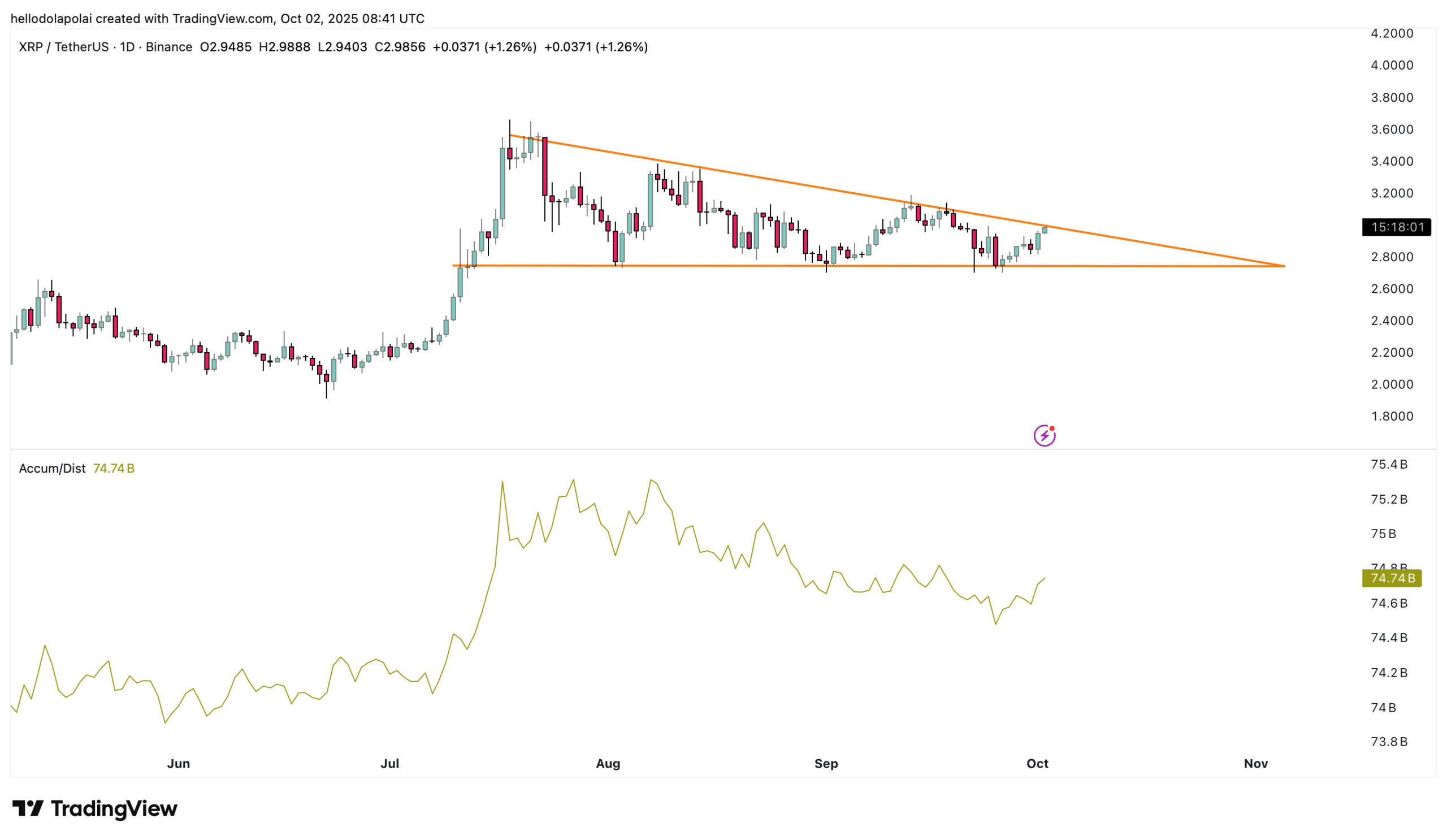

Technicals: XRP formed a bull-flag pattern on daily charts with a near-term measured target around $3.50. The Accumulation/Distribution indicator trending positive supports buying pressure; market volume near 74.75 billion XRP shows activity remains elevated.

Source: Coinglass (plain text)

Traders should combine on-chain netflow, stablecoin issuance, and technical patterns before acting. RLUSD’s mint is a liquidity event, not a directional certainty; watch spot flows into exchanges, orderbook depth, and major support/resistance levels.

Source: TradingView (plain text)

Frequently Asked Questions

How large is RLUSD after the $1.8M mint?

RLUSD’s market valuation is roughly $789 million after the $1.8 million mint, placing it among the top ten stablecoins by capitalization at publication time.

Can RLUSD minting trigger an altcoin rally?

RLUSD minting can add liquidity that fuels altcoin purchases, but a sustained rally requires broad stablecoin supply growth plus favorable on-chain flows and market sentiment.

What technical signs support an XRP breakout?

XRP’s daily bull-flag pattern, rising A/D indicator, and positive spot netflows suggest a higher-probability breakout, with a near-term target around $3.50 if volume confirms the move.

Key Takeaways

- RLUSD minting: A $1.8M addition lifted RLUSD to ~$789M, signaling added liquidity potential.

- Market context: Crypto cap near $4T, stablecoin cap ~$309B, Altcoin Season Index at 66 — room for further upside.

- Investor action: Watch spot netflows, orderbook depth and technical confirmations on XRP before trading.

Conclusion

RLUSD’s $1.8 million mint is a measurable liquidity event that raises the stablecoin’s profile and adds buying capacity for the market. Combined with broader metrics — a $4T crypto cap, rising Altcoin Season Index and positive XRP flows — the signal favors cautious optimism. Follow on-chain netflows and technical confirmations for trade decisions; COINOTAG will monitor developments and update as flows evolve.