Bitcoin Price Prediction: Fidelity & Bitwise Fuel Optimism as BTC Nears $120K

Bitcoin Price Prediction: Momentum Builds Near $120K

Bitcoin (BTC) is currently trading just under $119,000, after briefly touching $119,400 earlier in the day. The cryptocurrency has maintained strong momentum this week, consolidating above the $116,000 support zone. The psychological resistance level at $120K is now the key barrier for traders and investors.

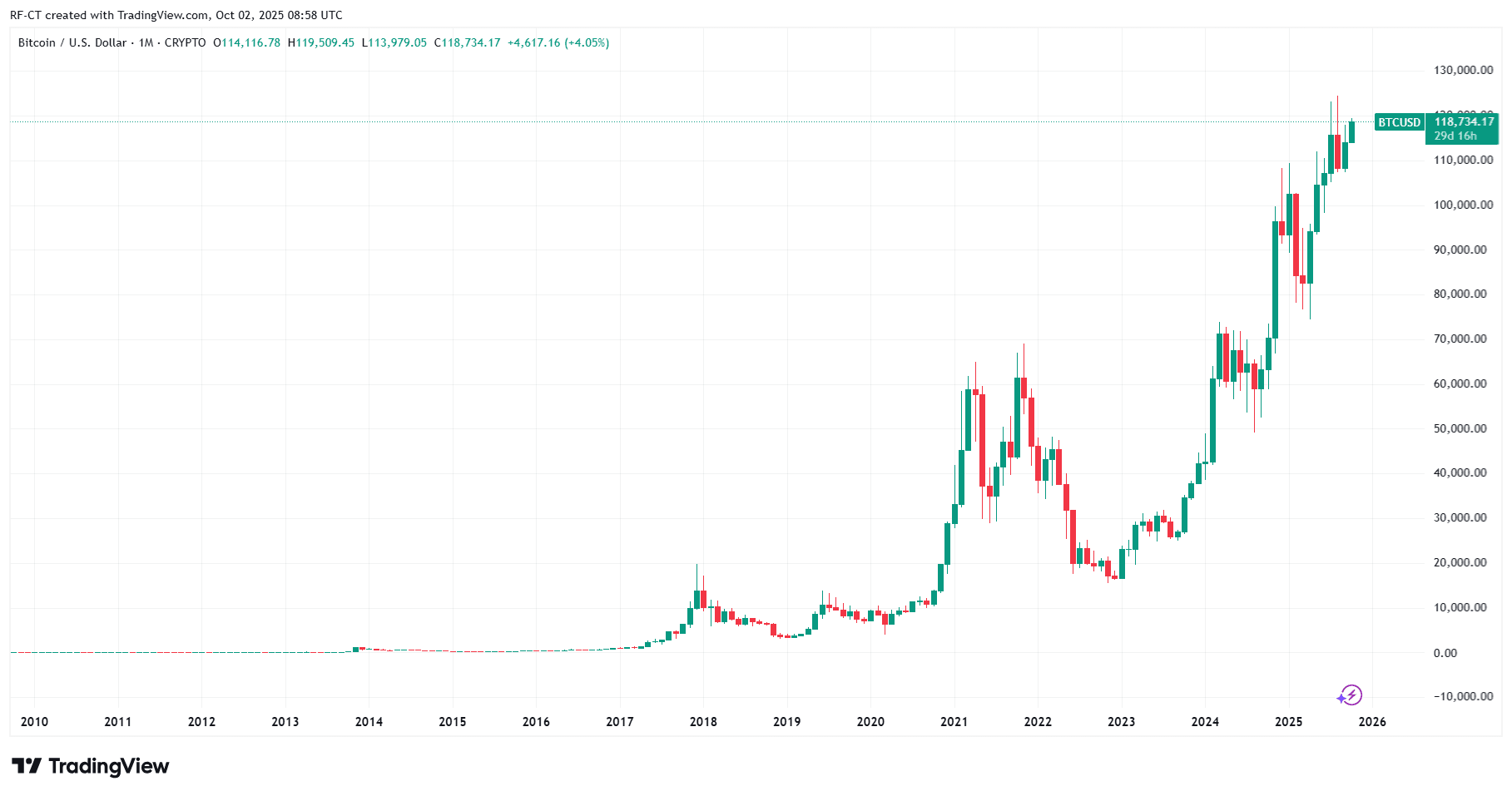

By TradingView - BTCUSD_2025-10-02 (All)

By TradingView - BTCUSD_2025-10-02 (All)

The latest Bitcoin price prediction suggests that if BTC manages to close decisively above $120K, a push toward $122K–$124K could follow. However, failure to hold $116K may drag the price back toward the $112K–$114K range.

Fidelity & Bitwise Buy $238.7 Million in Bitcoin

The big headline boosting market sentiment today is the news that Fidelity Investments and Bitwise collectively purchased $238.7 million worth of Bitcoin. Institutional buying at this scale strengthens confidence in BTC’s long-term potential , especially as these firms are key players in the ETF and asset management space.

This move highlights the ongoing institutional shift into Bitcoin, reinforcing BTC’s position as a digital store of value and making it increasingly attractive to traditional investors.

Technical Outlook: What to Watch Next

- Resistance: $120K remains the immediate resistance. A breakout could open the door to $124K.

- Support: $116K is the first key support, followed by the broader $112K–$114K range.

- Momentum: The RSI and moving averages remain supportive of further gains as long as BTC holds above $116K.

Traders should also keep an eye on spot ETF inflows, as renewed institutional demand has often correlated with upward momentum.

Bitcoin Price Prediction: Short-Term and Long-Term Outlook

- Short-Term: BTC is expected to test $120K multiple times in the coming hours . If broken, bullish momentum could extend quickly.

- Long-Term: Institutional adoption, combined with macroeconomic uncertainty and the upcoming halving cycle, continues to provide strong upside potential.

With Fidelity and Bitwise increasing their exposure, Bitcoin’s narrative as a long-term hedge against inflation and a key asset in diversified portfolios remains stronger than ever.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What’s going on with restaking?

A deep review of EigenLayer's journey in restaking: the pitfalls encountered and the achievements of EigenDA have all paved the way for the new direction of EigenCloud.

Is the 69 million FDV + JUP staking exclusive pool HumidiFi public sale worth participating in?

An overview of tokenomics and public offering regulations.

Why is the short seller who made $580,000 now more optimistic about ETH?

The truth behind Bitcoin's overnight 9% surge: Is December the turning point for the crypto market?

Bitcoin strongly rebounded by 6.8% on December 3 to $92,000, while Ethereum surged 8% to break through $3,000, with mid- and small-cap tokens seeing even larger gains. The market rally was driven by multiple factors, including expectations of a Federal Reserve rate cut, Ethereum’s technical upgrades, and policy shifts. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.