Memecoins lose their mojo as retail flocks to tokens touting utility

Quick Take The memecoin sector is being overlooked during the recent altcoin positioning surge, as traders increasingly gravitate toward projects with perceived fundamental value. The following is excerpted from The Block’s Data and Insights newsletter.

The GMCI memecoin index has remained relatively stagnant at around 220 over the past several months, representing a significant decline from its peak of 600 reached during the height of last year's speculative fervor when tokens like Fartcoin, BONK, and WIF captured the majority of retail trading attention.

This performance contrasts sharply with broader altcoin indexes, particularly the top 30 tokens, which have established new all-time highs since November, suggesting a clear divergence in investor preferences.

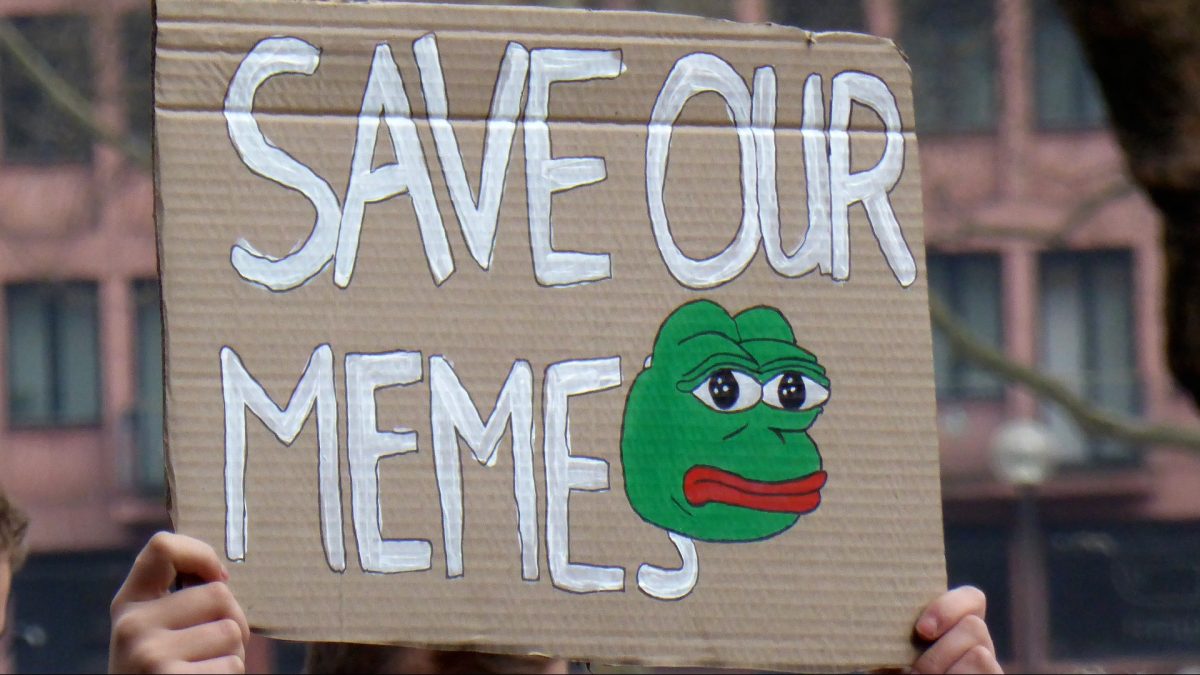

Even established memecoin names such as Dogecoin, Pepe, and Shiba Inu have failed to recapture their previous momentum, indicating the sector's struggles extend beyond newer, more speculative tokens.

The memecoin sector is being overlooked during the recent altcoin positioning surge, as traders increasingly gravitate toward projects with perceived fundamental value rather than purely speculative assets.

Recent project launches such as ASTER and XPL have demonstrated strong market reception, with investors showing preference for tokens associated with actual utility or development roadmaps. This suggests a shift in retail investor behavior, where participants are becoming more discerning about their investments, focusing on a project's ability to drive revenue — a revenue metric, if you will.

While memecoins served as a gateway for new retail participants entering crypto markets last year, the current environment appears to favor projects with clearer value propositions. We're seeing investors increasingly participate in token launches where the project is building tangible products, such as stablecoins, real-world asset tokenization, or DeFi.

This is an excerpt from The Block's Data Insights newsletter . Dig into the numbers making up the industry's most thought-provoking trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Timeless Strategies for Investing in Today's Market

- R.W. McNeel and Warren Buffett share timeless value investing principles emphasizing emotional discipline, long-term vision, and intrinsic value. - Both stress faith in the U.S. economy, with Buffett's Berkshire Hathaway exemplifying this through long-term investments in American icons like Apple and Coca-Cola . - Retained earnings and margin of safety strategies, demonstrated by Apple's reinvestment and Berkshire's share buybacks, highlight compounding's role in mitigating market volatility. - Modern be

Investing for Tomorrow: Preparing the Workforce and Advancing Tech Education in the Digital Age

- AI, cybersecurity, and data analytics are reshaping industries, driving 29% growth in cybersecurity roles and 56% wage premiums for AI skills. - Educational institutions like CCBC and Cengage Work are bridging skill gaps through AI-powered training and industry partnerships. - Government-industry collaborations aim to train 500 AI researchers by 2025, emphasizing workforce readiness as a shared responsibility. - ROI metrics for tech education now include operational efficiency gains and strategic alignme

FARTCOIN Trades at $0.347 as 9.6% Daily Gain Meets Strong $0.38–$0.40 Resistance

Aster Holds Near $1.06 as Tightening Channel Highlights Key Resistance