U.S. Treasury and IRS issue guidance: Strategy may not need to pay CAMT on unrealized bitcoin gains

Foresight News reported that Strategy founder Michael Saylor stated that, due to the interim guidance issued by the U.S. Department of the Treasury and the Internal Revenue Service (IRS), Strategy is expected not to be subject to the Corporate Alternative Minimum Tax (CAMT) arising from unrealized gains on its bitcoin holdings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Foundation sets strict 128-bit encryption rules for 2026

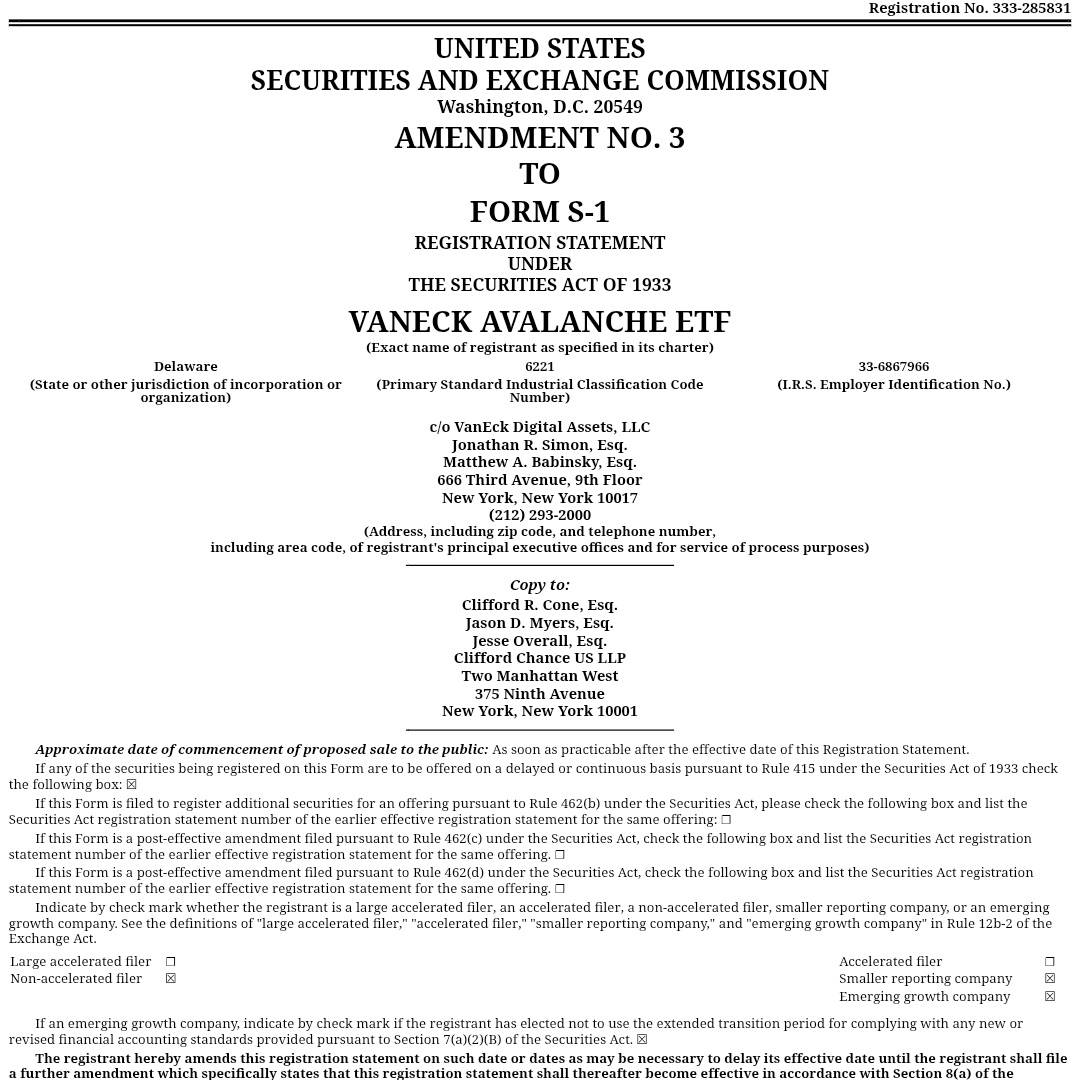

VanEck updates Avalanche ETF application to include staking rewards

VanEck submits spot AVAX ETF application to US SEC

Pi Network updates DEX and AMM features and launches holiday event