Bit Digital Selects Figment as Primary Ethereum Staking Provider

Contents

Toggle- Quick Breakdown

- Why Bit Digital partnered with Figment

- Compliance, security, and institutional standards

Quick Breakdown

- Bit Digital, with $532.5M in ETH, has staked over 86% of its holdings.

- Figment, managing $17B in assets, will serve as its primary staking provider.

- Partnership strengthens institutional-grade, non-custodial ETH staking with strict compliance.

Bit Digital (Nasdaq: BTBT), one of the largest publicly traded Ethereum-native treasuries, has appointed Figment as its primary staking provider to strengthen its institutional ETH strategy. The company holds more than $532.5 million in ETH and has already staked over 86% of its holdings as part of its long-term treasury approach.

🚀 @BitDigital_BTBT has selected Figment, as its primary staking provider to bolster its Ethereum strategy.

Bit Digital has actively adopted staking in its strategy and under this partnership, Bit Digital leverages Figment’s institutional-grade staking solutions to optimize ETH… pic.twitter.com/VA3zrj2EwT

— Figment (@Figment_io) September 30, 2025

Why Bit Digital partnered with Figment

The decision reflects Bit Digital’s focus on scale, security, and compliance in staking operations. Figment, which manages $17 billion in Assets Under Stake for over 1,000 institutional clients, offers audited, institutional-grade infrastructure with global coverage. The company is backed by investors including Thoma Bravo, Morgan Stanley’s Counterpoint Global, Franklin Templeton, and Fidelity’s Avon Ventures, reinforcing its position as one of the leading staking providers worldwide.

Bit Digital emphasized Figment’s non-custodial design, which allows institutions to retain full control of assets while benefiting from enterprise-grade staking infrastructure. This approach separates custody and staking responsibilities, reduces counterparty risks, and ensures compliance with fiduciary obligations.

Compliance, security, and institutional standards

As a Nasdaq-listed firm operating under SEC oversight, Bit Digital requires providers that meet stringent compliance frameworks. Figment brings a robust security backbone with SOC 2 Type II and ISO 27001 certifications, and exclusively operates OFAC-compliant relays to mitigate regulatory risks.

Sam Tabar, CEO of Bit Digital, said the partnership supports the company’s vision to “build the largest institutional ETH treasury while delivering secure, scalable yields.” Figment CEO and Co-Founder Lorien Gabel added that the collaboration was designed to balance performance with risk management, ensuring a stronger ETH yield on a per-share basis.

In parallel, Bit Digital has announced a $100 million convertible senior note offering, with an additional $15 million over-allotment option. The proceeds will be used to expand ETH holdings and support broader corporate initiatives, including acquisitions and digital asset investments. The organisation currently holds 120,000 ETH, ranking seventh among Ether treasury companies tracked by Strategic Ether Reserve.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Expert to XRP Holders: This Will Be One of the Biggest Fakeouts in History If This Happens

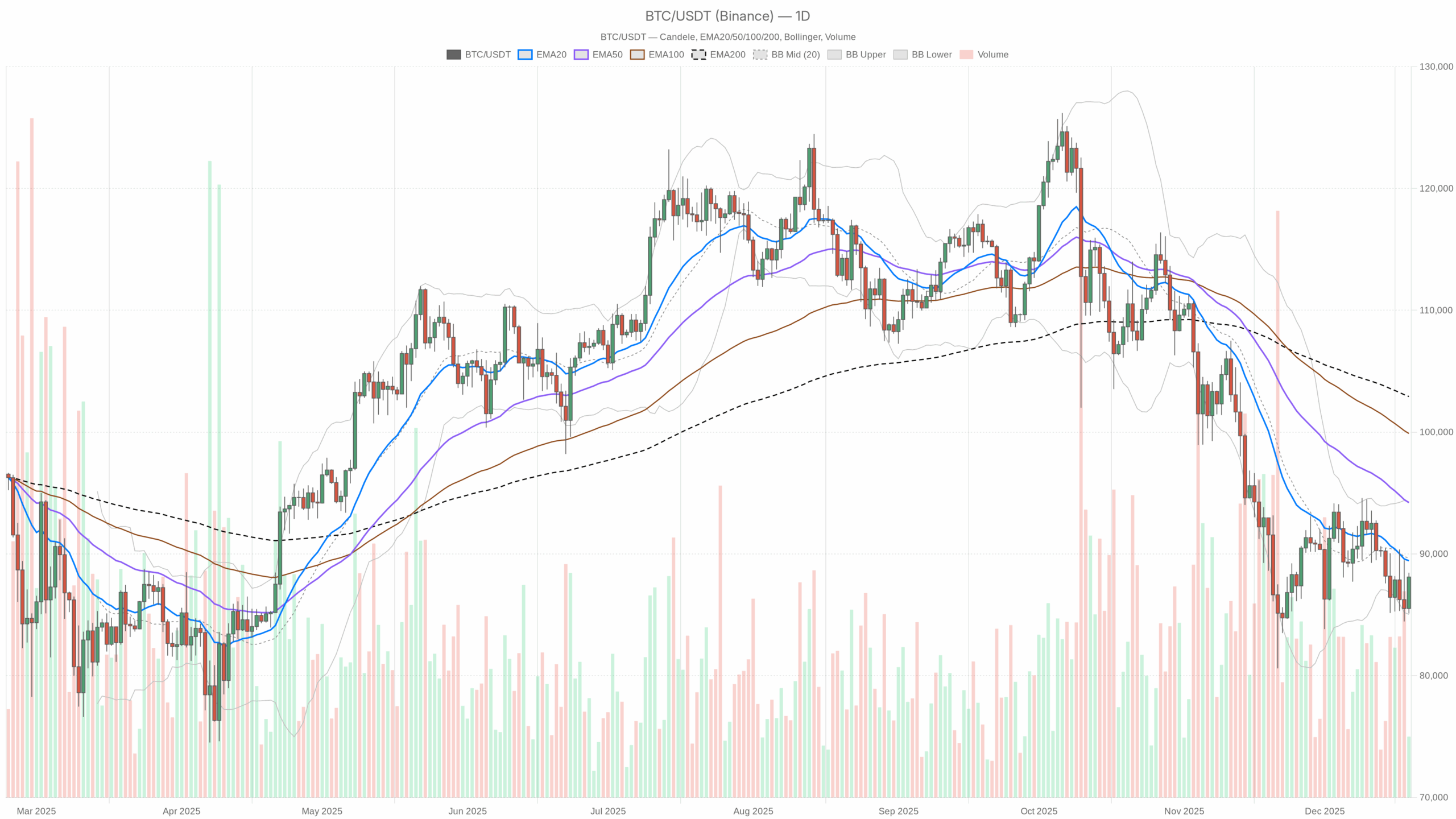

BTC price outlook: short-term bounce inside a larger downtrend

Best Solana Wallets as Visa Chooses Solana and USDC for US Bank Settlements

Senators Set January Markup for Crypto Market Structure Bill