The Next Big Airdrops? 3 Perp DEXs Traders Can’t Stop Farming

Perpetual DEXs are the hottest arena for airdrop farming in 2025. Lighter leads with zero-fee trading and $50 OTC points, Paradex attracts traders with deep liquidity and a community-focused token model, while Pacifica emerges as a Solana-based dark horse. Each offers unique risk-reward dynamics for ambitious farmers.

Perpetual DEXs (decentralized exchanges for perpetual futures) have become the latest battleground for traders looking to farm lucrative token airdrops.

The appeal is simple: traders can accumulate points by providing liquidity or executing trades. Those points later translate into tokens, sometimes worth significant sums on the secondary market.

The Top 3 Perp DEXs Airdrop Farmers Should Probably Watch

In 2025, this strategy has evolved into a key play for retail traders who want to replicate the early success stories of exchanges like dYdX and Hyperliquid (HYPE).

However, not all perp DEXs are created equal. While some boast venture capital (VC) backing and billion-dollar volumes, others remain in beta with points already changing hands in OTC markets.

With zero-fee trading models, competitive liquidity, and point systems that convert into tokens at TGE (Token Generation Events), exchanges like Lighter, Paradex, and Pacifica are attracting unprecedented attention.

Lighter

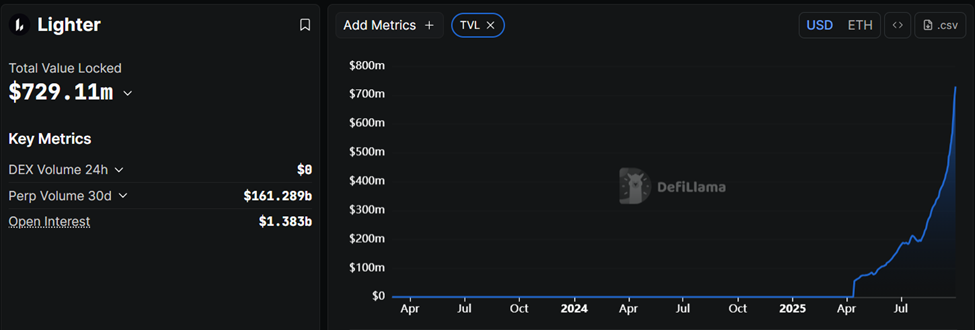

Lighter has quickly emerged as one of the hottest platforms for airdrop farming. Surpassing Hyperliquid to rank as the #2 perp exchange by volume, it now reports daily turnover exceeding $7 billion and an open interest of almost $1.4 billion.

Lighter TVL and Open Interest. Source:

DefiLlama

Lighter TVL and Open Interest. Source:

DefiLlama

Backed by a16z (Andreessen Horowitz) and Lightspeed, and founded by Vladimir Novakovski, a former HFT at Citadel, Lighter is positioning itself as a serious contender.

Traders farm Lighter Points, which are already valued at around $50 per point on the OTC market, with token distribution expected at the end of December 2025. Points are earned by trading perpetual futures, joining competitions, and referrals.

What sets Lighter apart is its zero-fee trading model, which allows genuine strategies like funding arbitrage between platforms. Its point system also rewards liquidity provision in low open interest (OI) pairs, creating extra incentives for risk-tolerant traders.

Meanwhile, Lighter offers a User Pool for non-traders, where deposits can earn points passively, albeit with operator fees ranging between 5% and 30%. Still, the platform cautions that users bear losses, making it less appealing to beginners.

Nonetheless, Lighter is among the top destinations for high-volume farmers, thanks to its unique scoring system and institutional-grade backers.

Paradex

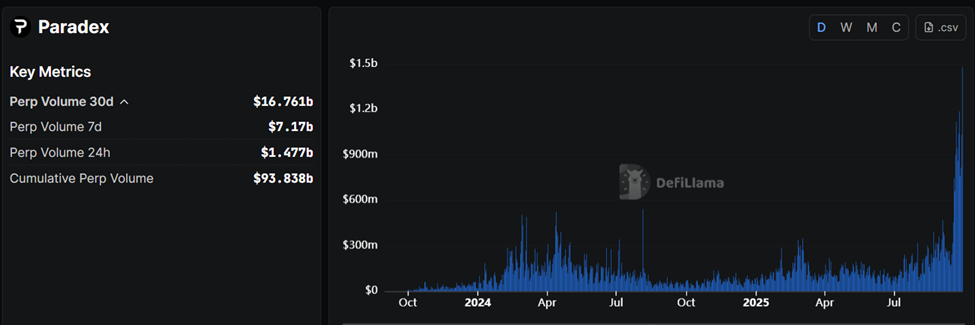

Paradex has established itself as another heavyweight in the perp DEX airdrops space, approaching the $100 billion mark in lifetime trading volume in September 2025.

The Paradex Perp Volume. Source:

DefiLlama

The Paradex Perp Volume. Source:

DefiLlama

Backed by Paradigm, Jump, Dragonfly, and DCG, it has the kind of VC pedigree that attracts attention. The exchange distributes 4 million XP every Friday, with Season 2 of its program underway.

OTC markets for Paradex XP (experience points) are already active, signaling strong demand ahead of its token generation.

Importantly, 57.6% of its token supply is allocated to the community, with a large 20% Genesis Allocation set aside for early farmers. This makes it one of the most community-focused token models on the market.

“What stands out to me is their token model. A massive 57.6% of DIME is allocated to the community, with 20% reserved for Genesis Allocation,” wrote Pranjal Bora, an airdrop farmer and on-chain researcher.

Meanwhile, Paradex’s adoption of Zero Fee Perps has been a major draw, leveling the playing field with rivals like Lighter. However, the platform recently extended Season 2 by six months, sparking complaints of point dilution and transparency issues.

Paradex is good, like really good, but they just extended Season 2 up to 6 months, and man… it’s not looking greatAfter Hyperliquid, it’s my favorite place to trade. But no amount of slick features can outshine community FUD.Here’s the issue:Instead of taking a snapshot of… pic.twitter.com/7zPSCEuLiB

— 〽️ax | DeFi Chronicles (@DeFiChronicles) August 1, 2025

Traders remain split, with some viewing it as an opportunity to accumulate more XP, while others worry about delayed timelines.

Despite this, Paradex remains one of the strongest contenders, especially for traders who want exposure to a platform with deep liquidity and clear institutional backing.

Pacifica

Pacifica is the dark horse on the list. Built on Solana by a former FTX team, the exchange is still in closed beta, yet it already ranks among the top 10 exchanges by trading volume.

🚨JUST IN: @pacifica_fi, a new entrant in Solana’s perpetual DEX market, which is still in closed beta, has surpassed Jupiter in 24H trading volume to become the largest perp DEX on the network pic.twitter.com/zL4PLoywH1

— SolanaFloor (@SolanaFloor) September 29, 2025

Its points system is live, valued at around $0.80 in OTC markets. Pacifica’s farming is straightforward, such that users earn points through perpetual trading, community engagement (such as bug reports), and liquidity provision when LPs launch.

The platform has also introduced discounted trading fees during promotional windows, encouraging new users to accumulate points more cheaply.

With a smaller, community-driven approach, Pacifica is still considered high-risk. However, its growing adoption and early market interest suggest it could deliver outsized rewards for those willing to position before its mainnet launch.

Pacifica Perp Volume. Source:

DefiLlama

Pacifica Perp Volume. Source:

DefiLlama

Multiple factors beyond trading activity fuel the race for perp DEX dominance in 2025. Among them is the promise of airdrop rewards that could rival early Blur and dYdX windfalls.

For traders, the decision comes down to risk tolerance:

- Lighter offers high-volume opportunities with a strong zero-fee system.

- Paradex provides transparency on allocations but faces questions over timing.

- Pacifica represents a speculative bet with early momentum.

Nevertheless, while perp DEX airdrop farming has become the latest gold rush in DeFi, users should conduct their own research.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why MicroStrategy’s Collapse Could Be the Next Black Swan for Crypto in 2026

Most Bullish Memecoins: Top 5 Picks Lead With Sentiment Levels Above 60+%