Can LDO’s 7% Rally Survive Lido’s Shrinking Staking share?

LDO’s price momentum looks strong with bullish inflows and technical signals, but Lido’s falling staking market share poses a key risk.

LDO, the native token of leading Ethereum staking protocol Lido, has emerged as today’s top gainer, climbing 7% in the past 24 hours on strong trading activity.

Positive readings from its on-chain and chart data reinforce the bullish momentum, hinting at the likelihood of sustained gains in the near term. However, there is a catch.

Traders Double Down on LDO

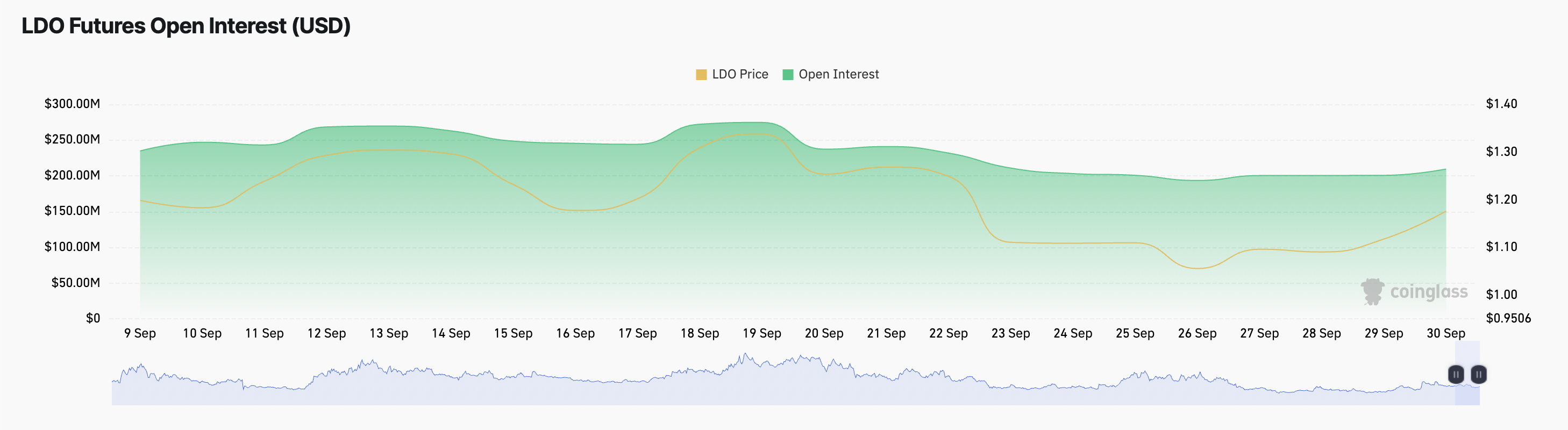

Futures open interest tied to the LDO token has climbed with the price over the past day, reflecting increased inflows and bullish market positioning. According to Coinglass, this currently stands at $210 million, up 5% in the past 24 hours.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

LDO Futures Open Interest. Source:

Coinglass

LDO Futures Open Interest. Source:

Coinglass

Open interest tracks the total number of outstanding futures and options contracts that have not yet been settled. When it rises alongside an asset’s price like this, it signals that new money is flowing into the market and traders are actively opening fresh positions.

This trend signals that LDO buyers are increasingly committing new capital in anticipation of further upside. If this trend holds, it could provide the token with additional support, further strengthening the rally.

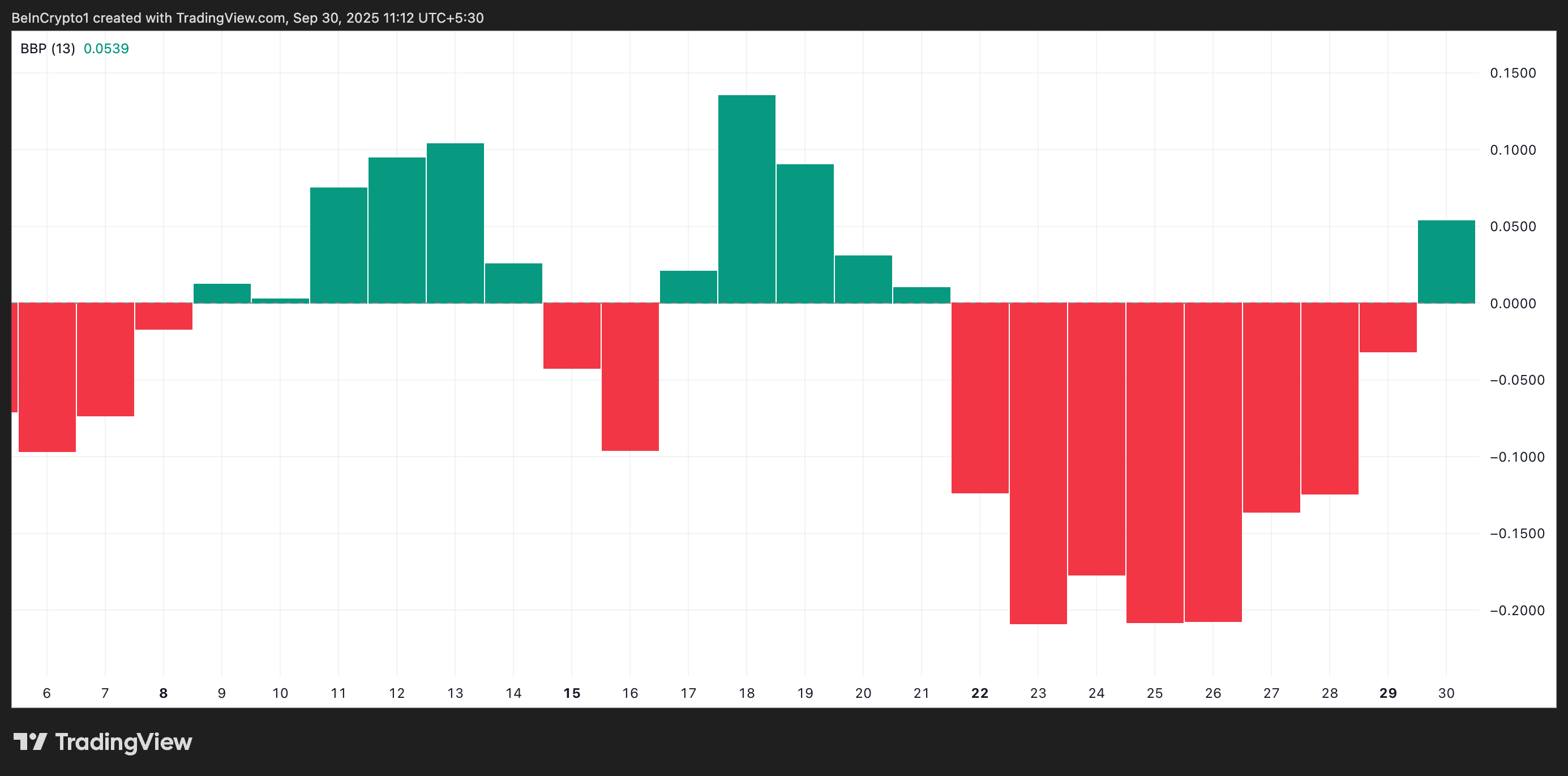

Moreover, on the daily chart, readings from the LDO’s Elder-Ray Index show that it has flipped back above the zero line to return a positive value for the first time since September 21.

LDO Elder-Ray Index. Source:

TradingView

LDO Elder-Ray Index. Source:

TradingView

The Elder-Ray Index measures the balance between buying and selling pressure in the market by tracking the difference between bullish power (buyers) and bearish power (sellers). A reading above zero indicates that bulls are in control, while a drop below zero signals bear dominance.

For LDO, the index flipping back into positive territory highlights a decisive shift in momentum. It suggests that after nine days of sellers holding the upper hand, buyers have regained strength and are now driving price action.

LDO Rally Faces Reality Check

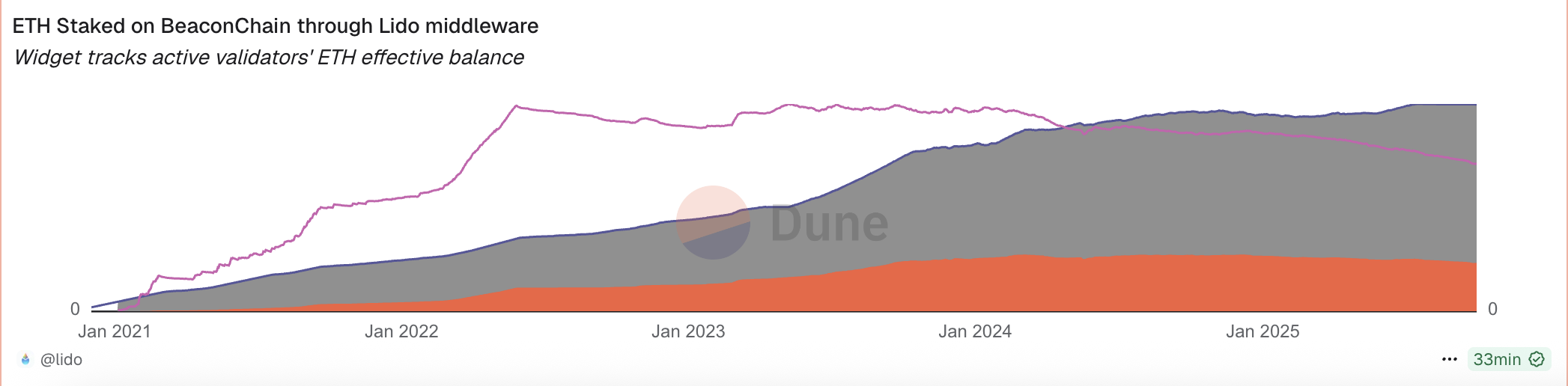

Despite the price optimism, Lido’s network data paints a concerning picture. Staking activity on the protocol has been declining, with its market share now at a three-year low of 23.4%.

Lido Staking Marketshare. Source:

Dune Analytics

Lido Staking Marketshare. Source:

Dune Analytics

This drop may be partly attributed to Ether’s recent lackluster price performance, which has dampened investor enthusiasm for locking up assets in staking contracts.

If the broader market continues to show restrained activity, this weakness could persist, lowering ETH staking volume on Lido. In turn, the shrinking network activity may lower how far LDO’s rally could potentially climb in the short term.

LDO Bulls Bet Big, But Lido’s Fundamentals Say Caution

If the current buy-side pressure persists, the token could extend its rally to breach the resistance at $1.24. A successful breakout above this level could open the door for a spike toward $1.41.

LDO Price Analysis. Source:

TradingView

LDO Price Analysis. Source:

TradingView

However, without a turnaround in Lido’s staking activity, investor sentiment may weaken, causing the rally to run out of steam soon. In this case, its price could fall under $1.22.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Next "Black Swan": "Tariff Refund Mega Deal", Wall Street and Individual Investors Are Placing Bets

Individual investors are participating in this game through emerging prediction markets such as Kalshi and Polymarket.

Since the U.S. legislation in July, stablecoin usage has surged by 70%!

After the "Genius Act" was passed in the United States, stablecoin payment volumes surged, with August transactions exceeding 10 billion USD. Nearly two-thirds of this amount came from inter-company transfers, making it the main driving force.

BlackRock Shifts $500 Million Funds to Polygon Network

In Brief BlackRock transfers $500 million to Polygon, enhancing blockchain integration in finance. The move shows increased trust in blockchain-based financial structures. It indicates a trend towards decentralization and long-term structural change in finance.

XRP Eyes $27 Target After Breakout Confirms Multi-Year Bullish Pattern