4 days, $6 billion, Plasma ignites a DeFi money-grabbing battle

Bitfinex and Tether-backed stablecoin public chain Plasma is sweeping the entire DeFi market at an astonishing speed.

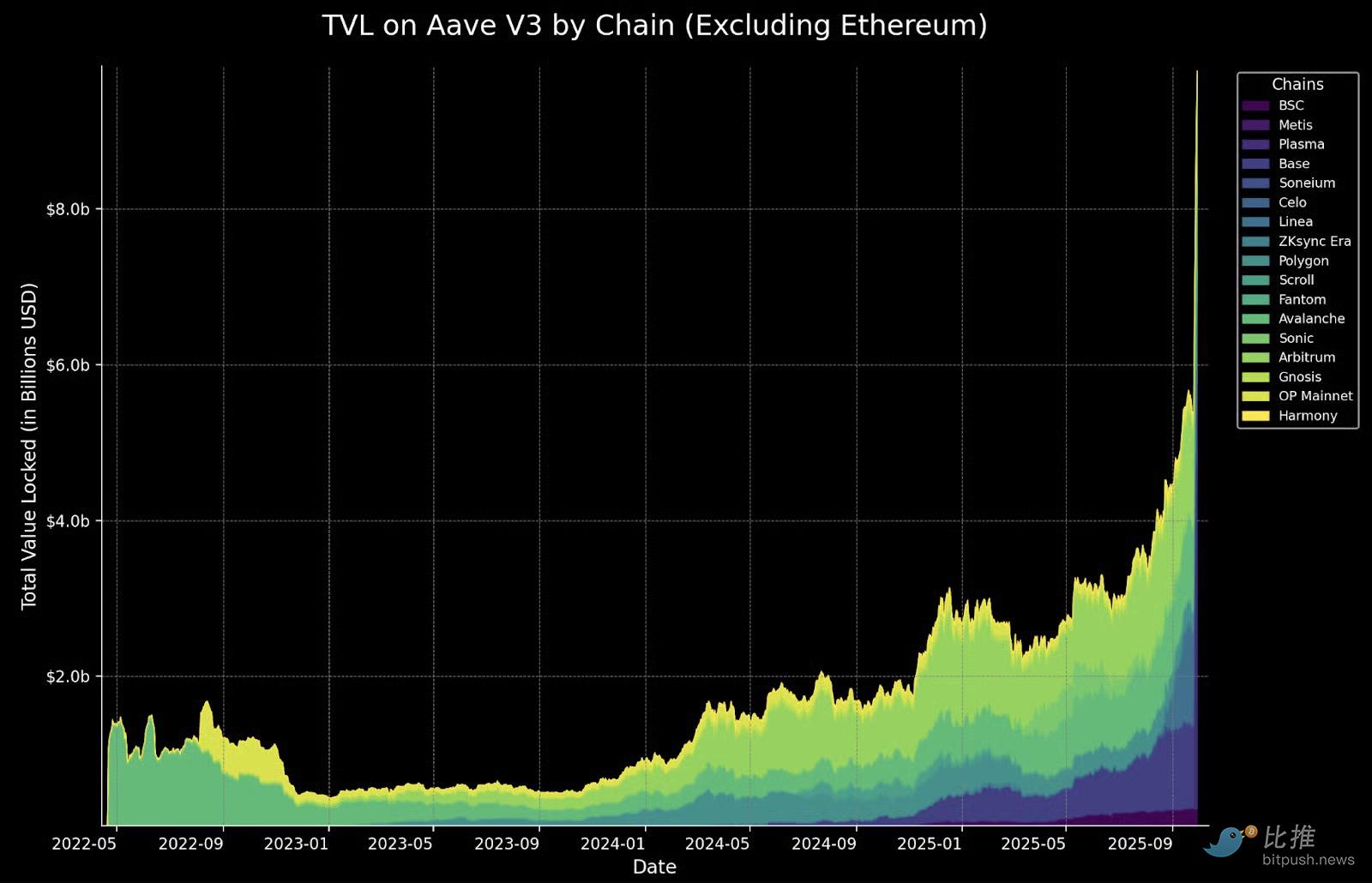

According to defillama data, since its mainnet launch on September 25, Plasma’s total value locked (TVL) has approached $6 billion, with an average daily increase of about $1.5 billion over four days. In just a few days, it has jumped to become the sixth largest stablecoin blockchain, second only to TRON.

The “Stablecoin Public Chain” Jointly Built by Bitfinex and Tether

Plasma is a brand new “stablecoin-driven public chain” led by the Bitfinex team and supported by the Tether (USDT) ecosystem. Its goal is to build a DeFi network with stablecoins as core assets, enabling users to earn considerable returns in a low-volatility environment.

Unlike Ethereum or Solana, which pursue high-performance generality, Plasma is positioned more as a “financial operating system,” mainly focusing on stablecoin deposit and lending, yield, and cross-protocol liquidity management.

Core design concepts include:

-

Native Stablecoin Asset Layer: Natively supports USDT and PlasmaUSD (pUSD) and other stablecoins;

-

Yield Aggregation Mechanism: Automatically allocates user deposits to DeFi protocols such as Aave and Veda to achieve high-yield integration;

-

Incentive Token XPL: Serves as the core of ecosystem governance and yield distribution, driving overall network liquidity growth.

According to insiders, part of the Plasma development team comes from within Bitfinex and Tether, and its tech stack is deeply connected to Bitfinex’s own Layer2 network.

The industry generally regards this as Tether’s strategic move to formally enter DeFi.

On its very first day online (September 25), Plasma’s TVL reached $2.32 billion, and in the following three days, it maintained an increase of over $1 billion per day. As of September 29, Plasma’s TVL ($5.544 billion) is approaching Tron ($6.11 billion), surpassing established public chains such as Base, Optimism, and Avalanche, becoming the new generation DeFi capital center.

Aave Becomes the Biggest Winner: Plasma Contributes Nearly Half of Non-ETH TVL

Plasma’s flagship product—the Savings Vault—attracted $2.7 billion in deposits in less than 24 hours after launch. This vault is jointly supported by Aave and Veda. After users deposit USDT, they can automatically receive yields from three parties (Plasma, Aave, and Veda).

DeFi lending giant Aave, as one of the first partner protocols in the Plasma ecosystem, is the biggest beneficiary of this surge.

According to Blockworks data, currently, Aave’s TVL on the Plasma network is as high as $4.54 billion, accounting for 46.5% of all its non-Ethereum deployments.

In other words, the amount of funds in Aave on the single Plasma chain is equivalent to the total of Arbitrum, Base, Linea, and Avalanche.

Aave founder Stani Kulechov also posted on X:

“Plasma is a prime example of how Aave works as a flywheel for liquidity.”

In the future, Plasma will also launch a “Basis-Trade Vault”, allowing users to earn additional returns from funding rates through risk-free perpetual contract arbitrage (delta-neutral strategy).

Aggressive XPL Incentive Mechanism: High Yields Attract Massive Stablecoin Inflows

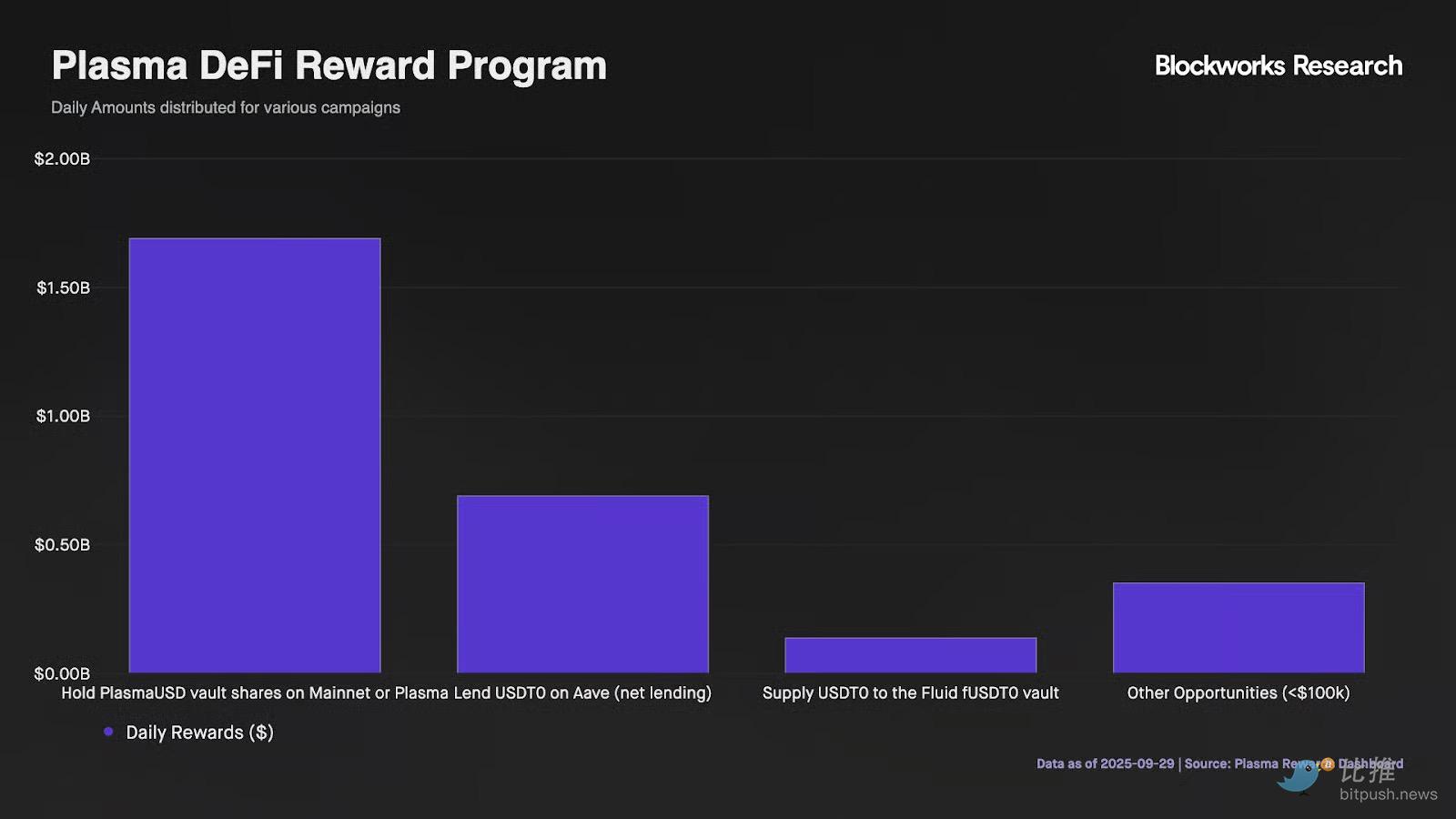

Plasma’s rapid growth is inseparable from its highly aggressive incentive mechanism.

Currently, the main yield channels in the ecosystem include:

-

PlasmaUSD Savings Vault: About 19.7% annualized yield (APY)

-

Aave USDT0 Lending Pool: About 6.3% APY

-

Fluid fUSDT0 Vault: About 12% APY

-

Small and Medium Position Rewards: Some annualized yields exceed 20%

It is estimated that Plasma’s current incentive distribution scale is about $2.8 million per day, with funds mainly coming from initial token distribution and partner protocol incentive pools.

This “high yield → stablecoin inflow → Aave amplifies returns → continuous reward distribution” flywheel mechanism has led to exponential capital inflows.

However, industry insiders also point out that the sustainability of continuous high subsidies will be the key test for whether Plasma can stabilize its ecosystem.

Stablecoin Ecosystem Resonance

The rise of Plasma has not only driven DeFi growth but also injected new momentum into the king of stablecoins, USDT.

So far, USDT circulation has reached $183 billion, with a market share as high as 69%, a record high.

Tether also plans to further expand the dominance of stablecoins in on-chain finance through Plasma and two upcoming stablecoin-exclusive chains—Stable and Tempo.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Best Cryptos to Invest In for 2026 – Top 7 List

200 Million XRP Shocks the XRP Army

A crypto trader loses $50 million USDT to address poisoning scam

Arthur Hayes Claims to Those Waiting for the Altcoin Season: “The Altcoin Season Never Ended Anyway”