That man is back! This time he plans to raise 1 billion USD.

Just when everyone thought Andre Cronje had faded out of the crypto scene, the legendary figure known as the "Father of DeFi" has made a comeback.

This time, he returns with a brand new project—Flying Tulip, which today announced the completion of a $200 million funding round.

What’s even more special is that this project comes with a never-before-seen mechanism: users can destroy tokens and retrieve their principal at any time. This means participants have a "downside protection" for their risk, while the upside remains uncapped.

Who is Andre Cronje?

If you experienced the DeFi Summer of 2020, you’ve definitely heard his name.

Andre Cronje is the founder of Yearn Finance (YFI)—a legendary developer who sparked the DeFi boom with just code. YFI was once hailed as "the fairest token" because he didn’t reserve any allocation for himself at the time.

Andre Cronje is the founder of Yearn Finance (YFI)—a legendary developer who sparked the DeFi boom with just code. YFI was once hailed as "the fairest token" because he didn’t reserve any allocation for himself at the time.

But after several project booms, community disputes, and security incidents, Cronje faded from the public eye in 2022. Until today, when he returns with Flying Tulip.

What is Flying Tulip?

Editor’s note: "Flying Tulip" literally means "flying tulip." Tulips are the most famous symbol of financial bubbles in history (the 17th-century "Tulip Mania" was the earliest speculative bubble).

Cronje named the project Flying Tulip, which is both self-deprecating and a declaration: the crypto world may be like tulips, but this time, he wants to make it truly "fly." In other words, Flying Tulip aims to turn what once represented a "bubble" into something more stable, real, and vibrant through on-chain mechanisms.

According to the official documentation, Flying Tulip aims to build a fully on-chain financial platform, integrating many features familiar to crypto users—stablecoins, lending, spot trading, derivatives, options, insurance—all within one system.

Simply put, it wants to be an "all-in-one DeFi platform," allowing users to:

-

Deposit tokens to earn yield;

-

Borrow tokens for leverage;

-

Go long or short;

-

Even hedge risks through on-chain insurance.

And all of this is done within a unified account system, without the need to frequently switch between different platforms.

A "Refundable" Mechanism

The most eye-catching feature this time is Flying Tulip’s "Onchain Redemption Right".

Traditionally, once users participate in a public offering, their funds are locked regardless of price fluctuations.

But Flying Tulip offers a "programmable redemption" mechanism—

All participants can destroy their $FT tokens at any time and retrieve their principal (such as ETH).

The system will automatically return funds from a separate on-chain reserve pool.

This design is somewhat like an on-chain insurance mechanism, ensuring investors won’t "lose everything" while still retaining upside potential.

However, it’s important to note that the official team reminds users this is not a "guaranteed principal" or "deposit insurance"—the reserve pool is limited, and whether redemption rights can be exercised depends on whether there are sufficient funds in the pool.

Funds Are Not Locked: Using Yield to Fuel Growth

In his pitch materials to investors, Cronje mentioned that while this design may seem to make funds unusable, in reality, Flying Tulip plans to deploy these funds into on-chain yield strategies, such as Aave, Ethena, Spark, and other mainstream DeFi protocols.

Their goal is to achieve an annualized yield of about 4%.

With a planned fundraising cap of $1 billion, this would generate approximately $40 million in interest income per year.

This yield will be used for:

-

Paying protocol incentives;

-

Buying back $FT tokens;

-

Supporting ecosystem growth and marketing.

Cronje described it in investor materials as follows: "We use recurring yield to drive growth and incentives, use perpetual put options to protect investors’ downside, while retaining unlimited upside potential for the token—this forms a self-reinforcing growth flywheel."

No Team Allocation Reserved

Another major highlight is that the Flying Tulip team has no initial token allocation.

Their income comes entirely from the project’s real yield, which is used to buy back $FT tokens on the market and release them according to a public plan.

In other words, the team only gets rewarded if the protocol actually makes money and users actually use it.

This puts the team and investors in the same boat—the more popular the project, the more they earn.

Impressive Capital Backing, Targeting $1 Billion in Funding

Flying Tulip has already completed a $200 million private funding round, with investors including:

-

Brevan Howard Digital

-

CoinFund

-

DWF Labs

-

FalconX

-

Hypersphere

-

Nascent

-

Republic Digital

-

Susquehanna Crypto, etc.

Next, they will conduct fundraising across multiple chains, with a total target of up to $1 billion.

Summary

The emergence of Flying Tulip is reminiscent of the era in 2020 when "code changed finance."

The difference is, this time Andre Cronje aims not only to create innovative products, but to make DeFi more trustworthy and sustainable. After DeFi’s bear market reshuffle and trust collapse, Cronje’s return may not just be the comeback of a developer, but also a signal: a new DeFi cycle may be reignited.

Author: Bootly

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

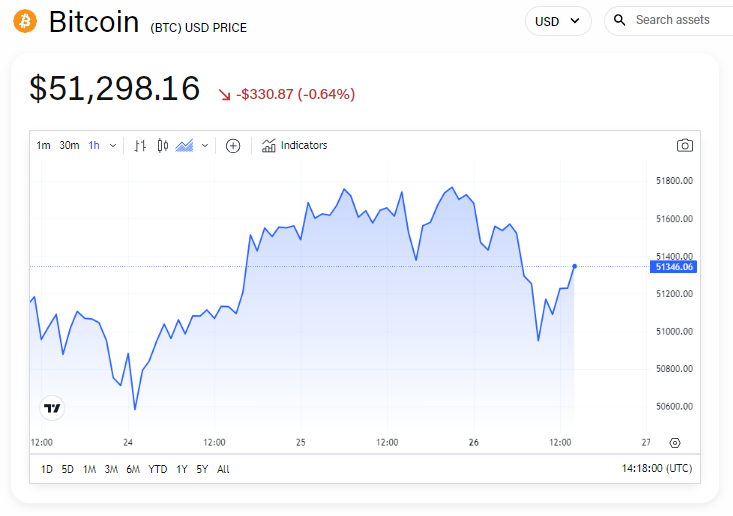

Tom Lee responds to X's debate with Fundstrat over differing bitcoin outlooks

Egrag Crypto: Selling XRP Now Makes No Sense. Here’s Why

What are Intent Based Architectures?

Bitcoin could face severe headwinds amid macroeconomic growth warnings, analyst says