Is Pump.fun Enabling a New Generation of Racists?

Pump.fun’s rapid coin-launch model has enabled racist tokens to trend on DEXs, spotlighting crypto’s struggle with regulation and ethics.

The emergence of multiple trending tokens launched via Pump.fun that contain racial slurs has generated widespread concern across the crypto community regarding the proliferation of discriminatory and highly offensive meme coins.

These incidents have restarted the debate over the lack of regulation in the meme coin space. The ease with which tokens can be created on launchpads inevitably facilitates the dissemination of malicious content.

Escalation of Offensive Meme Coins

A concerning trend emerging in the meme coin industry is the proliferation of racist tokens.

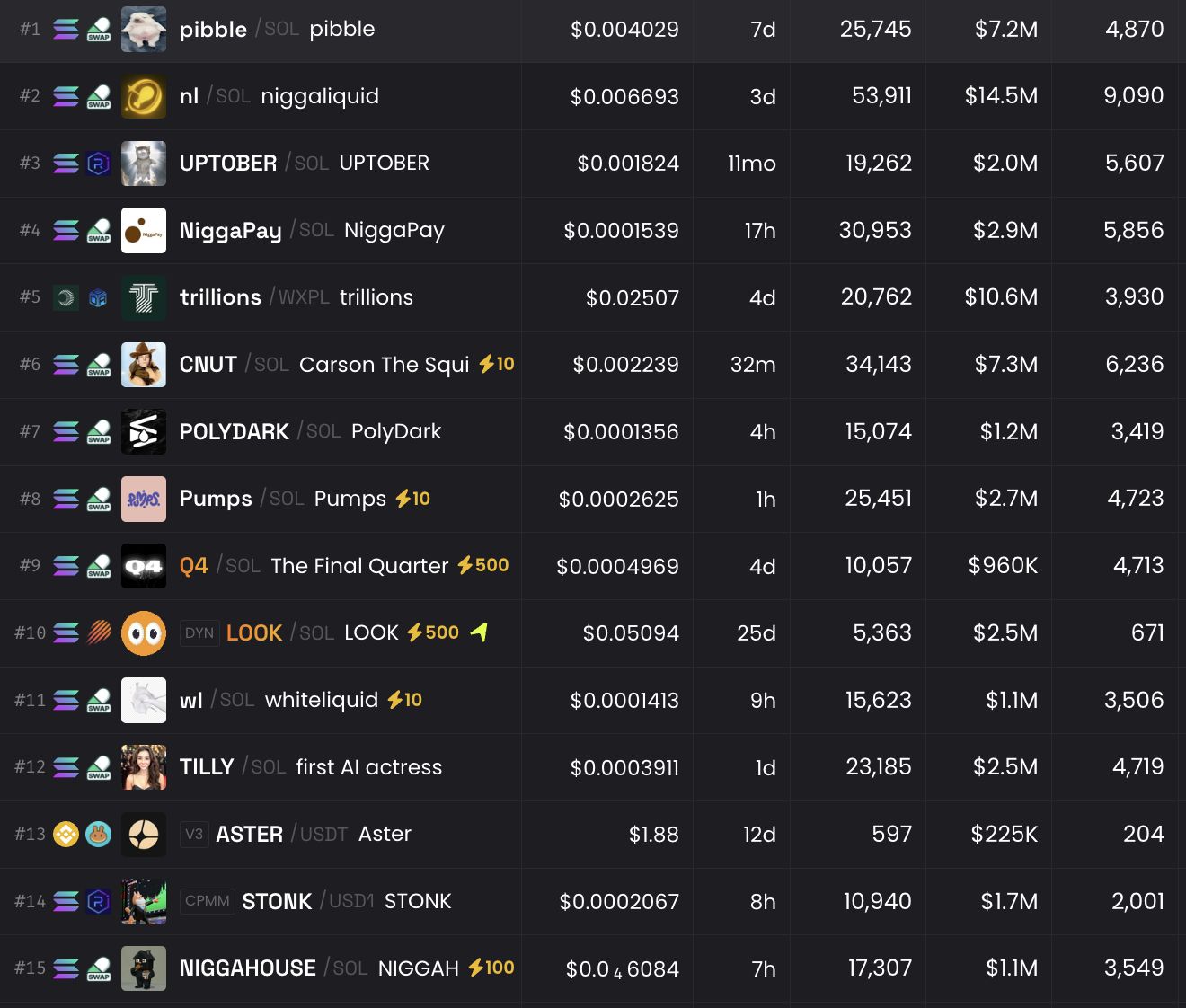

Of the top 15 trending tokens on DEXScreener, four have names that contain racial slurs or allude to skin color. The tokens were all launched on the popular Solana platform, Pump.fun.

Pump.fun has come under scrutiny for the launch of racist meme coins. Source:

DEX Screener.

Pump.fun has come under scrutiny for the launch of racist meme coins. Source:

DEX Screener.

The news comes a day after Pump.fun enthusiasts reportedly vandalized the Hollywood sign in Los Angeles, hanging up a banner with the launchpad’s signature pill logo.

Crypto enthusiasts from Pumpfun vandalized the Hollywood sign.1) Whaat

— 0xMarioNawfal (@RoundtableSpace) September 28, 2025

While racist meme coins are not new to the crypto sector, their recent status as trending tokens on decentralized exchanges (DEXs) illustrates the escalating scale of the problem.

Ease of Creation and Malicious Content

Commonly described as a “meme coin factory,” Pump.fun is a decentralized platform that has transformed the creation of meme coins. The launchpad makes the process exceptionally simple, fast, and affordable.

This extreme ease of use has drastically lowered the barrier to entry for launching hateful or racist meme coins. The increased frequency of these offensive tokens represents the democratization of malicious content.

A prime example came earlier this year when an American rapper announced a “Swasticoin” on X.

In a separate incident, a “Hitler Musk” token swiftly appeared on Pump.fun immediately following Elon Musk’s salute during Donald Trump’s presidential inauguration. The gesture was widely interpreted as a reference to Nazi-fascism.

Despite some attempts by industry leaders to condemn the creation of these controversial tokens, the recent incidents clearly demonstrate that the issue remains persistent.

The Regulatory Challenge of DEXs

Leading figures in the cryptocurrency sector addressed the proliferation of meme coins with offensive themes.

Ethereum co-founder Vitalik Buterin previously criticized the rise of these tokens. In the March 2024 blog post, he specifically condemned “openly super-racist” meme coins on the Solana blockchain and other tokens linked to totalitarian regimes.

The Solana Foundation has also acknowledged the issue. Austin Federa, the foundation’s head of strategy, proposed that implementing filtering mechanisms within crypto applications could be a viable solution for restricting the visibility of these controversial assets.

Yet, curbing this activity on a DEX is inherently difficult because there is no central authority to vet or police token names before launch.

Consequently, a regulatory and ethical vacuum continues to enable the creation and viral spread of these controversial tokens.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Abrupt 50% Decline in SOL Value: Was This a Market Adjustment or a Total Crash?

- Solana (SOL) faced a 50% price drop in November 2025, sparking debates over whether it signaled a temporary correction or deeper collapse. - Fundamentals showed mixed signals: falling TVL and validator counts, but strong institutional inflows ($101.7M net ETF inflows) and rising DEX activity. - Retail panic ($19B liquidations) and bearish technical indicators (broken $140 support) contrasted with institutional confidence in Solana's infrastructure. - Analysts highlighted the critical $80B market cap supp

Internet Computer's Value Rises: On-Chain Growth and Ecosystem Enhancements Drive Sustainable Gains

The Emergence of a Governed Clean Energy Market and Its Influence on Institutional Investors

- CleanTrade secures CFTC SEF approval, enabling transparent clean energy trading akin to traditional markets. - Platform facilitates $16B in transactions by centralizing VPPAs/PPAs/RECs, reducing counterparty risks for institutional investors. - Global clean energy investment ($2.2T) now outpaces fossil fuels ($1.1T), driven by cost-competitive solar and policy support. - Clean energy markets show growing independence from oil prices while maintaining crisis resilience seen during pandemic recovery. - CFT

Bitcoin Faces Regulatory Turning Point in November 2025: Institutional Integration and Compliance Obstacles

- In November 2025, Bitcoin faces regulatory crossroads as U.S. SEC approves spot ETFs and EU MiCA harmonizes crypto rules, accelerating institutional adoption. - 68% of institutional investors now allocate to Bitcoin ETPs, driven by GENIUS Act clarity and infrastructure advances, signaling strategic asset-class integration. - Compliance challenges persist due to fragmented enforcement, with MiCA passporting inconsistencies and U.S. stablecoin audit requirements complicating cross-border operations. - Futu