4 US Jobs Reports That Could Sway Bitcoin Market Sentiment This Week

Bitcoin traders are watching US labor data closely this week. From JOLTS and ADP to jobless claims and Friday’s employment report, each release could shift expectations around Fed rate cuts, liquidity, and crypto sentiment. A cooling job market may spark risk-on flows into Bitcoin, while resilience could temper the rally.

US Jobs data form the bulk of economic events that could influence Bitcoin (BTC) and crypto market sentiment this week.

The labor market has progressively crept up as a critical macro signal for Bitcoin, with the potential to sidestep inflation and other data points on the calendar.

US Jobs Data That Could Move Bitcoin This Week

With the labor market presenting as a critical macro for Bitcoin, four related data points could influence market sentiment this week.

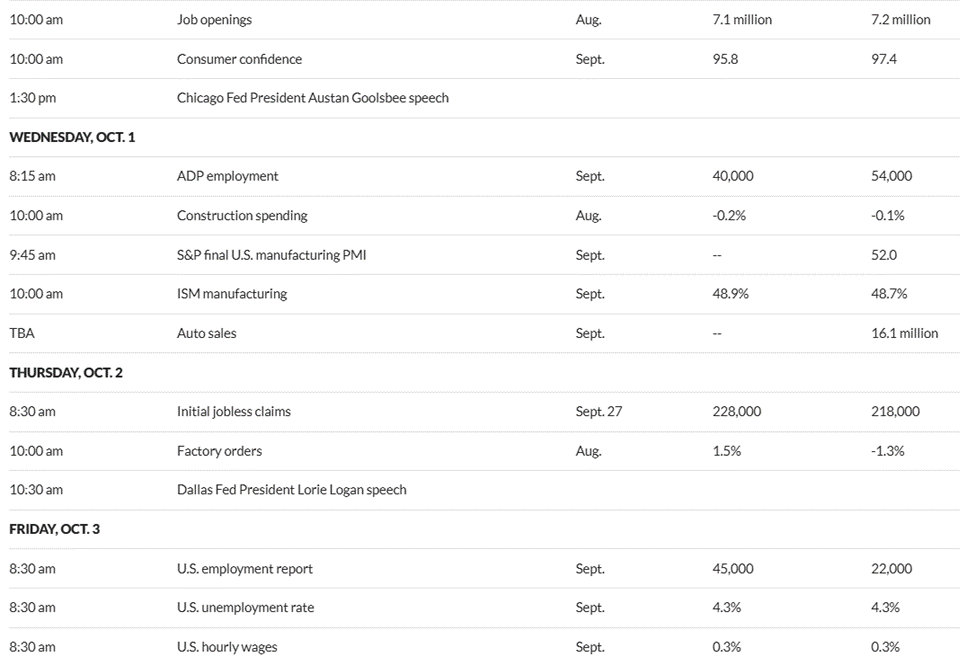

US Jobs Data with Bitcoin Implications this Week. Source:

US Jobs Data with Bitcoin Implications this Week. Source:

JOLTS

First in line for the top US jobs data to influence Bitcoin sentiment this week is the Job Openings and Labor Turnover Survey (JOLTS), released by the Bureau of Labor Statistics. This data point produces monthly and annual estimates of the nation’s job openings, hires, and separations.

This macroeconomic event is due on Tuesday, September 30. The previous JOLTS report indicated 7.2 million job openings in July, 7.4 million in June, and 7.8 million in May.

Based on this trend, economists surveyed by MarketWatch anticipate an extended decline to 7.1 million in August.

According to economists surveyed by MarketWatch, July data on US job openings, hires, and separations could come in at 7.4 million, just like in June.

Four successive months of declining JOLTS would signal a cooling labor market, easing wage pressures, and inflation.

Against this backdrop, the US Federal Reserve (Fed) may be inclined to cut interest rates further. This could boost liquidity and, by extension, the Bitcoin price as it would inspire risk-on sentiment.

However, if the trend reverses and JOLTS data comes in higher than expected, the perception of a trend reversal could temper rate-cut bets, potentially stalling the Bitcoin rally amid delayed easing.

ADP Employment

Another US jobs data to watch this week is the ADP employment report. This labor market data point is more comprehensive and widely regarded as the official measure. It is a private sector survey based on payroll data from its clients.

The ADP employment report, due on Wednesday, October 1, could show that US private sector jobs increased by 40,000 in September, compared to the 54,000 increase seen in August. Still, it would signify an extended drop after 104,000 in July.

Nevertheless, the expectation of a continued slump to 40,000 in September suggests a continued outlook of a slowdown in hiring.

Like the JOLTS data point, this signals cooling labor demand. Softer labor markets weaken the dollar and ease yields, boosting liquidity-sensitive assets like Bitcoin and crypto.

Traders often interpret weaker ADP prints as bullish for digital assets, anticipating risk-on flows and stronger demand for alternatives to traditional markets.

However, if the slowdown sparks recession fears, short-term volatility may hit crypto before liquidity expectations drive longer-term upside.

Initial Jobless Claims

Also, the initial jobless claims are on the watchlist, bringing forth a weekly jobs data point every Thursday. It determines the number of US citizens who filed for unemployment insurance for the first time.

In the week ending September 20, there were 218,000 initial jobless claims, with economists now anticipating more filings to 228,000 last week.

An uptick in jobless claims may signal economic weakness. This would increase the likelihood of the Fed adopting a more accommodative monetary stance.

Such a shift could lead to a weaker dollar, enhancing Bitcoin’s attractiveness as an alternative asset. However, if the rise in claims is viewed as a temporary fluctuation, the impact on Bitcoin may be limited.

Meanwhile, analysts say a resilient labor market, coupled with sticky inflation, could allow interest rates to remain elevated. However, signs of a cooling job sector could temper the Fed’s path.

Employment Report

Finally, Friday’s US employment and unemployment reports could also move the crypto market this week. Both data points are critical indicators of the economy’s health.

The employment report is forecasted to show 45,000 new jobs, up from 22,000 in the previous month, while the unemployment rate is expected to hold steady at 4.3% in September, similar to the August reading.

Such an outcome in the employment data would suggest hiring is improving slightly, showing resilience in the labor market. Meanwhile, the expectation of steady unemployment would point to more people looking for work than jobs created, pointing to underlying slack.

Markets often see this as neutral-to-dovish, where growth exists, but rising unemployment hints at softening conditions.

For Bitcoin and crypto, it could support rate-cut expectations (liquidity-friendly), offering a mildly bullish tilt despite the headline job gains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tom Lee is Bullish on Bitcoin, While His Firm Fundstrat Makes Bearish Statements – Company Issues Clarification

Dogecoin Might Add Extra Zero if This Crucial Support Gives Way

Zcash Founder Reveals Biggest Reason Why He’s Bearish on Bitcoin

Selling Bitcoin (BTC) in January May Be Bad Idea, Price History Warns