Powell is about to step down. Who will be the next "money-printing chief"?

From "Estée Lauder's son-in-law" to "Trump loyalist," how might the crypto stance of potential successors impact the market?

Author: Bernard, ChainCatcher

Powell "Countdown," Trump Lays Out Plans in Advance

In May 2026, Federal Reserve Chairman Jerome Powell's term will officially end. However, the Trump administration's preparations have already begun—Trump and Treasury Secretary Bessent are seeking to gain substantial control over monetary policy by securing key voting rights on the Federal Reserve Board (FRB) before the first half of 2026. Currently, the Trump camp has secured three seats by having Stephen Miran replace Adriana Kugler, and Board member Lisa Cook faces pressure to resign due to allegations of mortgage fraud, leaving them just one seat short of a majority on the seven-member board.

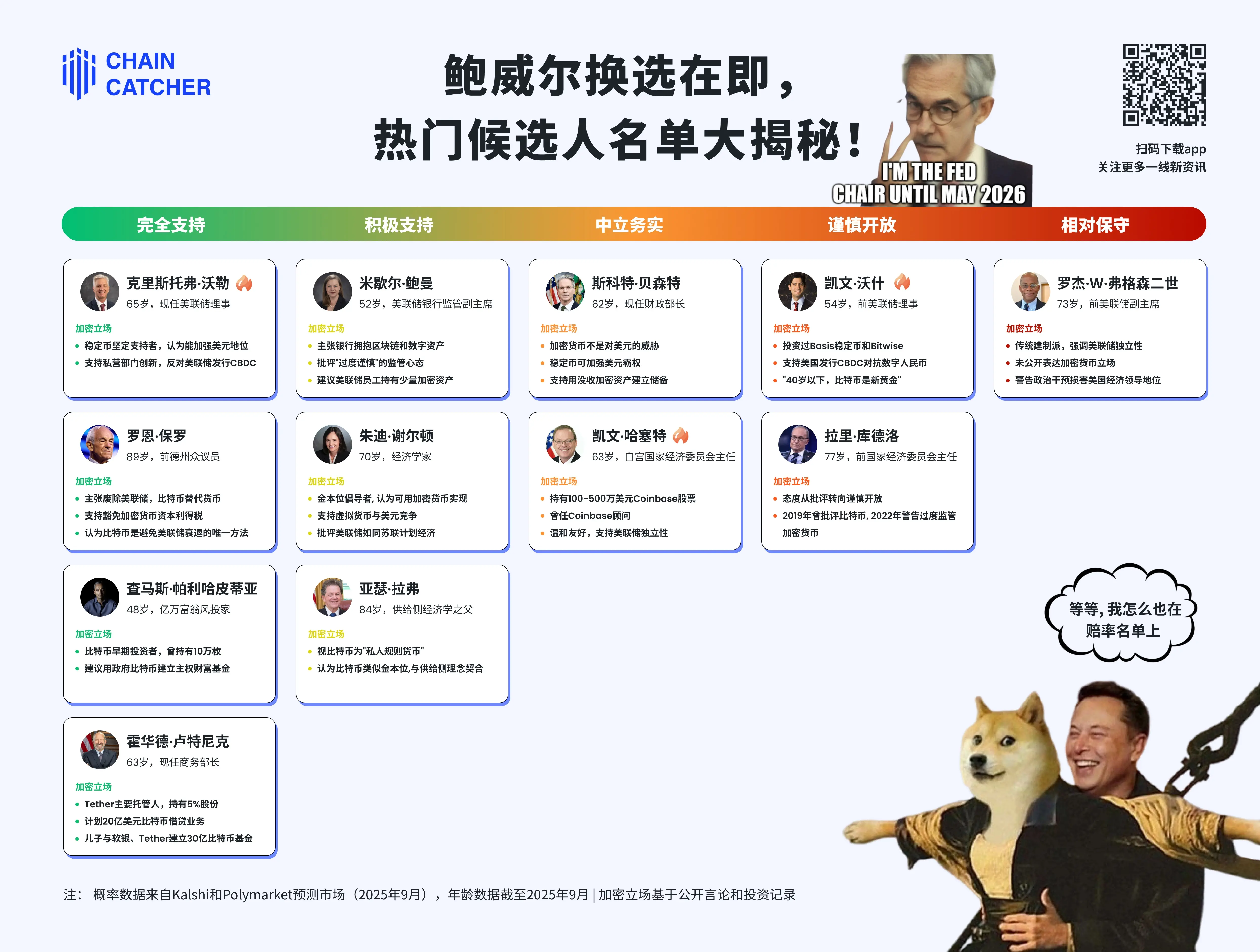

From the introduction of the "shadow chairman" concept to the quiet maneuvering for board seats, this battle for control over the Federal Reserve is reshaping the future landscape of cryptocurrency. According to prediction platforms Polymarket and Kalshi, several candidates with open attitudes toward cryptocurrency are vying for this crucial position, and the market's expectations for the next Fed chair are clearly diverging: Kevin Hassett, Kevin Warsh, and Christopher Waller have emerged as the three leading candidates, with significantly higher odds; other candidates such as Bowman and Bessent have odds ≤1%. Notably, Elon Musk also appears on Polymarket's odds list, currently ranking last.

The Three Leading Candidates Emerge

On September 5, Trump confirmed in an Oval Office interview that Kevin Hassett (Director of the White House National Economic Council), Kevin Warsh (former Fed Governor), and Christopher Waller (current Fed Governor) are his "top three" final candidates to replace Powell.

1. Kevin Hassett: Prediction Market Frontrunner

On prediction markets, current White House National Economic Council Director Kevin Hassett leads with a 29% probability on Kalshi and 8% on Polymarket. This 63-year-old economist holds a pivotal position in the Trump camp. He served as Chairman of the Council of Economic Advisers from 2017 to 2019 and was one of the main architects of the "Tax Cuts and Jobs Act" during Trump's first term, also providing economic policy advice for Trump's 2024 presidential campaign.

Regarding his stance on crypto, according to financial disclosure documents filed in June this year, Hassett holds between $1 million and $5 million worth of Coinbase stock, received as compensation for his advisory work with Coinbase. His total assets are at least $7.6 million, including speaking fees from institutions such as Goldman Sachs and Citi.

On monetary policy, Hassett is a typical dove. He has repeatedly criticized Powell's decision to maintain high interest rates, arguing that the Fed should be more proactive in cutting rates to support economic growth. In August this year, Trump repeatedly praised Hassett on CNBC's "Squawk Box," considering "the Kevins" (Hassett and Warsh) as his top choices for Fed chair.

2. Kevin Warsh: "The Estée Lauder Son-in-law"

Kevin Warsh ranks second with a 19% probability on Kalshi and 13% on Polymarket, and his background is a perfect blend of Wall Street and Washington. In 2006, at just 35, Warsh was appointed to the Fed Board by then-President Bush, becoming the youngest governor in Fed history. During the 2008 financial crisis, he played a key liaison role between the Fed and Wall Street, coordinating the sale of Bear Stearns to JPMorgan and participating in the decision-making process regarding Lehman Brothers' collapse.

Warsh's personal background is also notable. His wife, Jane Lauder, is the heiress to the Estée Lauder cosmetics empire, with a net worth exceeding $2 billion. His father-in-law, Ronald Lauder, is not only a longtime friend and former donor of Trump but also the person who first proposed the idea of the US purchasing Greenland during Trump's first term. Warsh's deep political and business connections give him unique influence in Washington.

On cryptocurrency, Warsh takes a pragmatic but cautious stance. He has invested as an angel in algorithmic stablecoin project Basis and crypto index fund manager Bitwise. In a 2021 CNBC interview, Warsh said: "In the current environment of major shifts in monetary policy, it makes sense for bitcoin to be part of a portfolio; it's gaining new life as an alternative currency. If you're under 40, bitcoin is your new gold." He also noted that part of bitcoin's rise comes from a "bid shift" away from gold, but pointed out that bitcoin's price volatility severely undermines its role as a reliable unit of account or effective means of payment. Additionally, in a 2022 Wall Street Journal op-ed, Warsh supported the US issuing a central bank digital currency (CBDC) to counter China's digital yuan, a stance that drew criticism from the crypto community for potentially threatening decentralization.

3. Christopher Waller: A Staunch Supporter of Stablecoins

Current Fed Governor Christopher Waller ranks third with a 17% probability on Kalshi and 14% on Polymarket. He may be the most crypto-friendly current Fed official. Waller has served as a Fed Governor since 2020 and was previously Director of Research at the St. Louis Fed, making him an authoritative expert in monetary economics.

Waller's support for stablecoins is particularly noteworthy. At the Wyoming Blockchain Symposium this August, he described the transformation of payment systems as a "technology-driven revolution" and clearly stated that "stablecoins have the potential to maintain and expand the international role of the dollar." He believes stablecoins, with their 24/7 availability, near-instant settlement, and unrestricted circulation, have become especially useful financial tools, particularly in inflationary economies or regions with limited banking services.

Waller argues that stablecoins actually strengthen, rather than weaken, the dollar's global status. In his "A Very Stable Conference" speech this February, he likened stablecoins to "synthetic dollars," complementing bitcoin's "digital gold" status. He also praised the recently passed GENIUS Act, calling it a major milestone in US digital asset regulation and a foundation for the responsible expansion of stablecoins. Waller insists that innovation should primarily come from the private sector and opposes the Fed issuing a CBDC.

Other Potential Candidates

4. Michelle Bowman: The Reformer Rising from Within

Although she has only a 1% probability on prediction markets, current Fed Vice Chair for Supervision Michelle Bowman should not be overlooked. Appointed directly to the Fed Board by Trump in 2018, she was promoted this May to Vice Chair for Supervision, giving her a key voice in formulating stablecoin regulations.

Bowman has shown an open attitude toward cryptocurrency. In a speech this August, she advocated that banks should support the digital asset wave and that the Fed should provide rules for the industry that do not hinder its development. She specifically emphasized that "regulators must recognize the unique characteristics of these new assets and distinguish them from traditional financial instruments or banking products." She even suggested that Fed employees should be allowed to hold small amounts of crypto assets to "gain a working understanding of the underlying functions."

Bowman believes tokenization can make ownership transfers faster, reduce costs, and mitigate "well-known risks," and that stablecoins "will become a fixture in the financial system." She criticized the "overly cautious mindset" and advocated for a "pragmatic, transparent, and tailored" regulatory framework. At the September 2024 FOMC meeting, she voted against a sharp 50-basis-point rate cut, supporting a milder 25-basis-point cut, an independence that won Trump's appreciation.

5. Scott Bessent: The current Treasury Secretary, Bessent made it clear in a speech this July that "cryptocurrency is not a threat to the dollar, and stablecoins can actually strengthen dollar hegemony." While he explicitly stated he would not use Treasury funds to buy bitcoin, he supports building reserves from government-seized crypto assets, currently worth about $15-20 billion.

6. Judy Shelton: Economist, Shelton's views may be the most disruptive. A staunch advocate of the gold standard, Shelton has long criticized the Fed's excessive power, even comparing it to the Soviet Union's centrally planned economy, and believes the Fed's 2% inflation target is a disguised expropriation of public wealth. Shelton sees a convergence between the gold standard and cryptocurrency, once stating, "I like the idea of a gold standard currency, and it could even be implemented in a crypto way."

7. Roger W. Ferguson Jr.: Former Fed Vice Chair, representing the voice of the traditional financial establishment. Ferguson led the Fed's initial response during the 9/11 attacks, ensuring the normal operation of the US financial system. Ferguson has not made a clear public stance on cryptocurrency but emphasizes the importance of maintaining Fed independence and warns that political interference could undermine US economic leadership.

8. Arthur Laffer: Father of supply-side economics, creator of the famous "Laffer Curve," and one of the architects of Reaganomics. Laffer sees bitcoin as "private rules-based money," akin to the gold standard, capable of driving global monetary progress and aligning with supply-side principles (reducing government intervention, promoting growth).

9. Larry Kudlow: Former Director of the White House National Economic Council, with a relatively cautious but gradually opening attitude toward crypto. In 2019, Kudlow was considered by the crypto community as "the best argument for why we need bitcoin" due to his criticism of bitcoin. But by 2022, on Fox Business, he began warning that "radical progressives will try to regulate digital currencies," opposing excessive regulation of crypto.

10. Ron Paul: Former Texas Congressman, highly respected among libertarians and the bitcoin community. Starting from a critical stance toward the Fed, Paul has become a staunch supporter of bitcoin. He claims the only way to avoid Fed-induced recessions is to let people use alternative currencies like bitcoin and to exempt crypto from capital gains tax.

11. Chamath Palihapitiya: Billionaire, venture capitalist, and one of Silicon Valley's most influential bitcoin advocates. Palihapitiya once held a large amount of bitcoin; although he later regretted selling $3-4 billion worth, he remains a strong supporter of crypto. He has proposed that the government could use its bitcoin holdings to launch a US sovereign wealth fund, raising $50-100 billion through lending rather than selling bitcoin.

12. Howard Lutnick: Current Secretary of Commerce and CEO of Cantor Fitzgerald. Lutnick's company is a major custodian for Tether (USDT issuer), holding tens of billions of dollars in US Treasuries to back USDT. His son, Brandon Lutnick, also partnered with SoftBank, Tether, and Bitfinex this year to establish a $3 billion bitcoin investment fund.

Although these candidates have low odds of winning on prediction markets, their varying attitudes toward crypto reflect the diversity of US policymakers' understanding of digital assets. From Bessent's vision of a "crypto superpower," to Paul's monetary freedom philosophy, from Lutnick's business practices to Laffer's economic theory, each perspective provides unique insights into the Fed's possible future crypto policy direction. With personnel changes, policy loosening, and softening attitudes, the Fed—once a source of anxiety for the crypto market—is re-engaging in dialogue with the industry.

Market Expectations: Is the Era of Massive Liquidity About to Begin?

Mike Novogratz, CEO of Galaxy Digital, stated in an interview with Kyle Chasse: "The next Fed chair could be the biggest bull market catalyst for bitcoin and the entire crypto space." Novogratz predicts that if Trump appoints an "extremely dovish" Fed chair who slashes rates when they shouldn't, bitcoin could reach $200,000. BitMEX founder Arthur Hayes, in his latest article "Four, Seven," even forecasts a "sky-high" bitcoin price of $3.4 million—if the Trump administration implements yield curve control (YCC) by controlling the Fed, potentially creating up to $15.2 trillion in credit. Based on the historical correlation that "for every $1 of credit created, bitcoin rises by $0.19," bitcoin could reach $3.4 million.

However, Novogratz also warns that this scenario "would be really bad for America." He believes that while such aggressive monetary policy would benefit crypto, the cost would be the loss of Fed independence and severe damage to the US economy. Hayes also believes the Fed would be forced to buy massive amounts of long-term Treasuries to lower rates, regional banks would get more lending capacity to support small and medium-sized businesses, and the liquidity injection would far exceed that of the 2020 pandemic period. This "Quantitative Easing 4.0 for the Poor" policy would shift credit creation power from Wall Street to Main Street's small and medium-sized banks.

Conclusion: Waiting for the Other Shoe to Drop

As Novogratz said, the "political situation" makes predicting the bitcoin cycle top unprecedentedly difficult. Personnel changes at the Fed have never been just a bureaucratic process, but a catalyst for reshaping the entire crypto landscape. From the SEC's softening stance to the FDIC relaxing restrictions, from the approval of bitcoin ETFs to the advancement of stablecoin legislation, every regulatory loosening is paving the way for the coming monetary policy upheaval.

Polymarket data shows a 44% probability that Trump will not announce the next Fed chair this year, meaning the market may have to wait several more months for clarity. But judging from the backgrounds of the current frontrunners, whoever ultimately takes over, they generally show a more open attitude toward financial innovation. This shift is no accident; an irreversible trend has formed: when BlackRock manages the largest bitcoin ETF, Fed governors openly support stablecoins, and the Treasury Secretary says "crypto is not a threat to the dollar"—the highest halls of traditional finance have opened their doors to digital assets, and a more crypto-friendly regulatory era may be imminent. For the crypto industry, regardless of who ultimately takes over, it must be prepared for the possible arrival of the "era of massive liquidity."

Click to learn about ChainCatcher job openings

Recommended Reading:

Regulatory Breakthrough, Institutional Entry: A Review of a Decade of Cryptocurrency's Penetration into Wall Street

Pantera Capital In-depth Analysis: The Value Creation Logic of Digital Asset Treasuries (DATs)

Backroom: Information Tokenization, a Solution to Data Redundancy in the AI Era? | CryptoSeed

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Telegram, the world's largest social platform, launches major update: Your graphics card can now mine TON

Telegram’s ambition for privacy-focused AI

A well-known crypto KOL is embroiled in a "fraudulent donation scandal," accused of forging Hong Kong fire donation receipts, sparking a public outcry.

Using charity for false publicity is not unprecedented in the history of public figures.

An overview of two new projects in the Polkadot ecosystem and what they will bring to Polkadot Hub

HIC: Continue to bring truly valuable new projects to Polkadot in a sluggish market!