Three Reasons ASTER Price Is Sliding Despite CZ’s Backing

Aster’s token has fallen sharply from recent highs, with analysts pointing to product doubts, investor exits, and unclear signals from CZ. Despite strong fundamentals, user trust and Hyperliquid competition raise questions about the exchange’s staying power.

Aster, a decentralized perpetuals exchange launched in early September, has experienced a 10% drop in the last 24 hours alone.

Despite strong early traction and backing from Binance founder Changpeng Zhao (CZ), cracks in sentiment are beginning to show.

Analyst Explains Why Aster Price is Dropping

As of this writing, Aster’s powering token, ASTER, was trading for $1.87, down 8% in the last 24 hours. The token is down over 20% from its local top of $2.43, established on September 24.

Aster (ASTER) Price Performance. Source:

TradingView

Aster (ASTER) Price Performance. Source:

TradingView

Against this backdrop, analysts have dissected what could be driving the price drop of the decentralized exchange (DEX) token.

Price Pressure and User Doubts

The sell-off comes amid growing skepticism around Aster’s platform performance. Investor Mike Ess revealed on X (Twitter) that he sold 60% of his Aster holdings, rotating into Bitcoin (BTC) and Plasma (XPL).

While he remains profitable, he said his decision was driven by gut instinct after Changpeng Zhao’s recent comments and dissatisfaction with Aster’s product.

“If you’ve used HYPE, then switched to Aster, you know exactly what I mean. It feels slower, less polished, and copy-paste… The more capital I have on it, the riskier it feels,” wrote Ess.

Other traders have echoed similar concerns. Clemente, another renowned voice on X, disclosed that he exited his Aster position entirely in favor of Hyperliquid’s HYPE token.

“Hyperliquid is clearly the leader in every metric other than crime and CEX distribution,” the analyst argued.

Mixed Signals From CZ

CZ’s involvement has been a double-edged sword. On September 28, the crypto executive framed Aster as a complementary project to the broader BNB Chain ecosystem despite rivaling the Binance exchange.

Few understand this.Aster competes with @Binance, but helps #BNB. https://t.co/CmTSvVKUGR

— CZ 🔶 BNB (@cz_binance) September 28, 2025

His venture firm, YZi Labs (formerly Binance Labs), holds a minority stake in Aster, which also boasts a team of former Binance employees.

However, traders like Ess interpreted CZ’s tone on a recent Spaces call as distancing, raising doubts about his level of engagement. For some, this perception was enough to spark de-risking.

“If CZ stops talking about it, HYPE wins hands down,” Ess warned.

Still, bullish voices remain. A user known as Cooker expressed conviction that Aster will make a long-term mark on the perp DEX market.

Still holding onto $ASTER, truly banking on CZ and their team to make their long term mark on the perp dex market Holding $XPL long term will prob be one of the best holds since $HYPE going into 2026Ofc still holding $HYPE, soon to be a year long hold from my original buy

— Cooker.hl | Kms.eth | Cooker (@CookerFlips) September 28, 2025

Meanwhile, others, like Crash, argued that Aster could outperform Solana and Ethereum in percentage terms over the next cycle.

Strong Fundamentals, Lingering Uncertainty

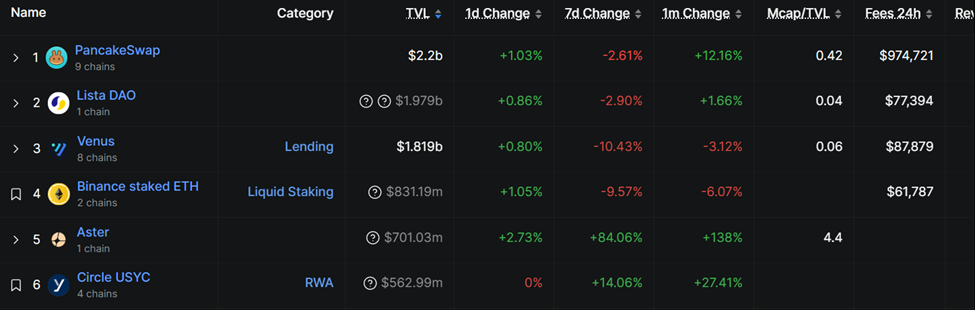

By several measures, Aster’s fundamentals remain solid. Since launch, the platform has generated over $82 million in fees, while total value locked (TVL) has ascended to $701 million on BNB Chain. For a project only weeks old, these numbers reflect significant adoption.

Aster on BNB Chain. Source:

DefiLlama

Aster on BNB Chain. Source:

DefiLlama

Yet the quick drawdown highlights the challenge of balancing early growth with user trust and product reliability.

Analysts warn that competition with Hyperliquid is intensifying, and without continued product improvement, momentum could fade.

Therefore, the Aster price’s trajectory remains contested, with supporters seeing it as a bold new player with CZ’s stamp of approval amid a fast-paced scaling ecosystem. On the other hand, skeptics say Aster may be unfinished and overhyped.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitwise CIO Just Said It Out Loud: XRP Was Better Received Than Ethereum

Tether-backed Northern Data sold bitcoin mining arm to companies run by Tether's own executives: FT

Tom Lee is Bullish on Bitcoin, While His Firm Fundstrat Makes Bearish Statements – Company Issues Clarification

Dogecoin Might Add Extra Zero if This Crucial Support Gives Way