Bitcoin Derivatives Stay Active as $110K Resistance Shapes Market Sentiment

Bitcoin derivatives activity remained intense over the weekend, with futures and options showing strong liquidity but mixed sentiment. On Saturday, Bitcoin traded at $109,449, with the $110,000 mark acting as a key zone for both bullish bets and protective hedges. Market signals now point to caution as technicals lean bearish, while futures and options flows reveal deep positioning.

In brief

- Futures OI hits $77.45B, with CME and Binance leading positions while smaller exchanges show mixed performance.

- Options skew shows 60.66% calls, but short-term flows lean bearish with puts gaining momentum on key strikes.

- Traders eye December calls at $140K and $200K, showing longer-term bullish appetite despite near-term caution.

- Bitcoin trades at $109,479, under pressure from ETF slowdown, profit-taking, and fragile support near cycle lows.

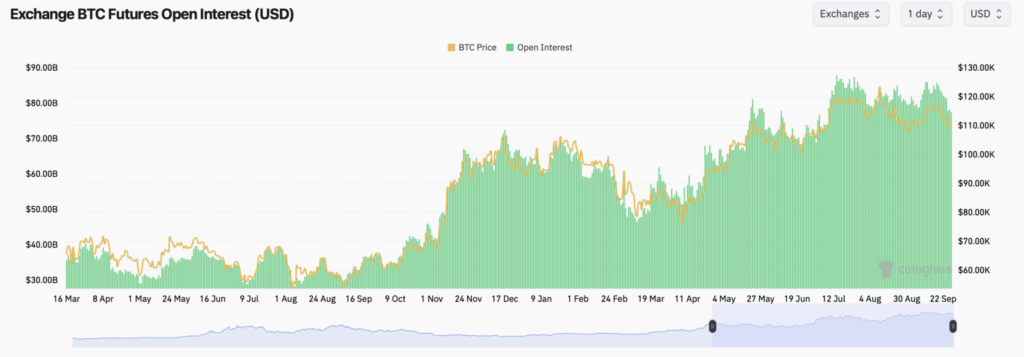

Futures Market: $77.45 Billion in Open Interest

Futures activity stayed strong, with total open interest (OI) reaching 707.59K BTC ($77.45 billion). CME leads with 138.82K BTC ($15.19 billion), followed by Binance at 123.30K BTC ($13.50 billion). Bybit holds 84.39K BTC ($9.23 billion), while OKX and Gate posted 37.78K BTC ($4.13 billion) and 78.24K BTC ($8.56 billion), respectively.

Smaller exchanges posted mixed results on the day. Bitget rose 0.45% to 52.33K BTC ($5.72 billion), while KuCoin fell 2.88% to 6.12K BTC ($669.49 million). MEXC gained 4.87% to 26.42K BTC ($2.89 billion), but BingX dropped sharply—down 42.96% to 9.15K BTC ($1.00 billion).

Calls Still Dominate Bitcoin Market, But Puts Gain Short-Term Flow

On the options side, calls hold 60.66% of OI (199,102.16 BTC) compared to 39.34% in puts (129,149.11 BTC). However, recent volume leaned slightly toward puts. In the last 24 hours on Deribit, puts accounted for 16,247.21 BTC (50.87%), versus 15,694.48 BTC in calls (49.13%)—a sign of hedging activity.

Contracts near the current trading level dominated short-term flows. The Sept. 28 $110,000 put traded 1,311.9 BTC, while the Oct. 10 $100,000 put added 853.3 BTC. On the bullish side, the Oct. 31 $116,000 call saw 812.5 Bitcoin in trades.

Further out, December expiries highlight traders’ appetite for higher prices. The December 26 $140,000 call leads with 9,804.5 BTC in OI, followed by the $200,000 call at 8,527.2 BTC. Strong interest also sits at the $120,000 and $150,000 strikes.

The current “max pain” range clusters between $110,000 and $116,000, marking a key zone where both bulls and bears face pressure.

Market sentiment has turned cautious despite heavy positioning:

- For now, 15 indicators flash bullish signals, while 18 lean bearish, tilting sentiment to the downside.

- The Fear & Greed Index stands at 37, reflecting a market mood of “Fear.”

- Bitcoin is trading close to its cycle low of $107,304, signaling fragile support.

- The asset sits 11.92% below its cycle high and just 1.93% above the cycle low.

At the time of writing, Bitcoin trades at $109,479, as profit-taking and an ETF outflow slowed the market , keeping price action just under the key $110K level.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

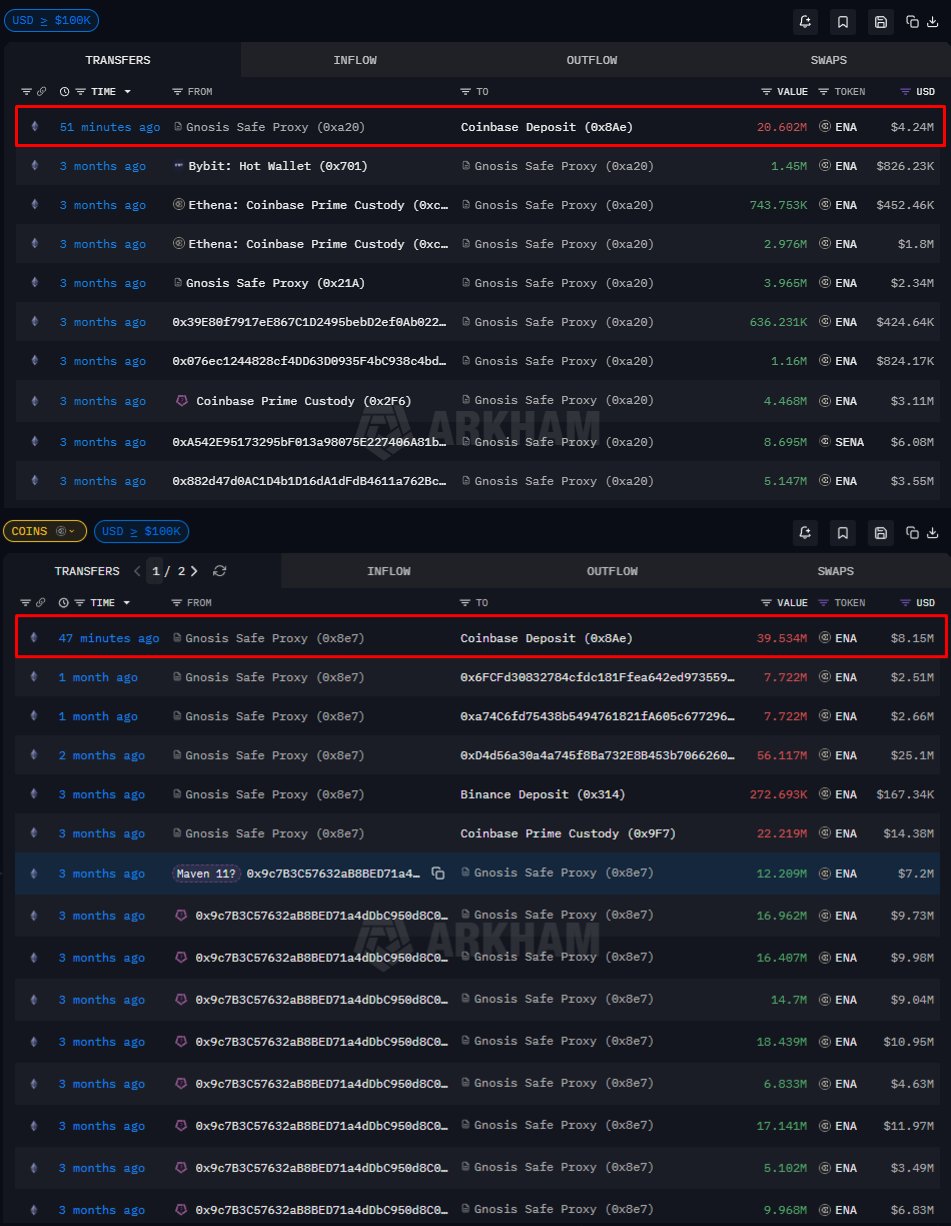

Can Ethena hold $0.20 after 101M ENA flood exchanges?

Galaxy Digital, Which Manages Billions of Dollars, Reveals Its Bitcoin, Ethereum, and Solana Predictions for 2026

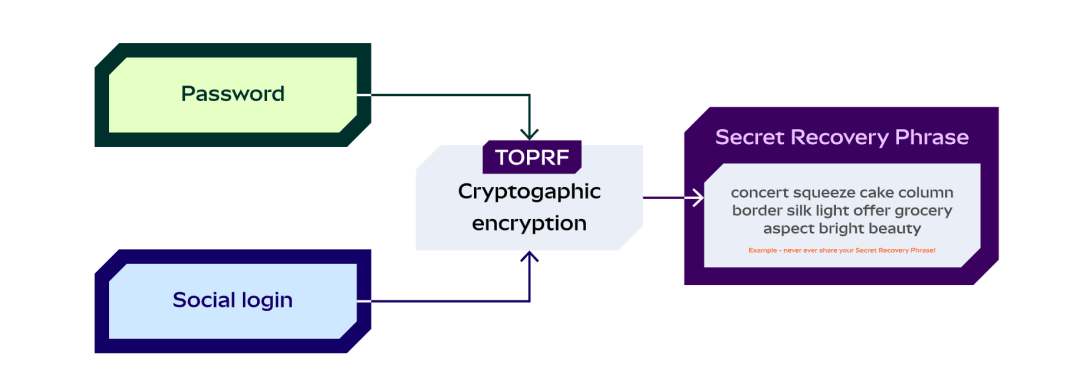

A Brief History of Blockchain Wallets and the 2025 Market Landscape

Tom Lee responds to X's debate with Fundstrat over differing bitcoin outlooks