- Solana has been trading steadily above 200 and staked its ground at 204 with no indication of intraday resistance.

- Cardano was not able to move out of range and the gains diminished as the price moved between $0.775 and 0.795.

- Avalanche was picking up steam, with recurring Binance volume surges taking AVAX near the $25 mark.

The performances of layer 1 blockchains were different as markets shifted to the variety of primary platforms. Solana remained stable between 200 and 200 with narrow ranges and Cardano remained range-bound with diminishing momentum, and Avalanche was gaining traction with Binance volumes going up in a sharp fashion. The change in focus highlighted the dynamic changes, with AVAX approaching the mark of 25.

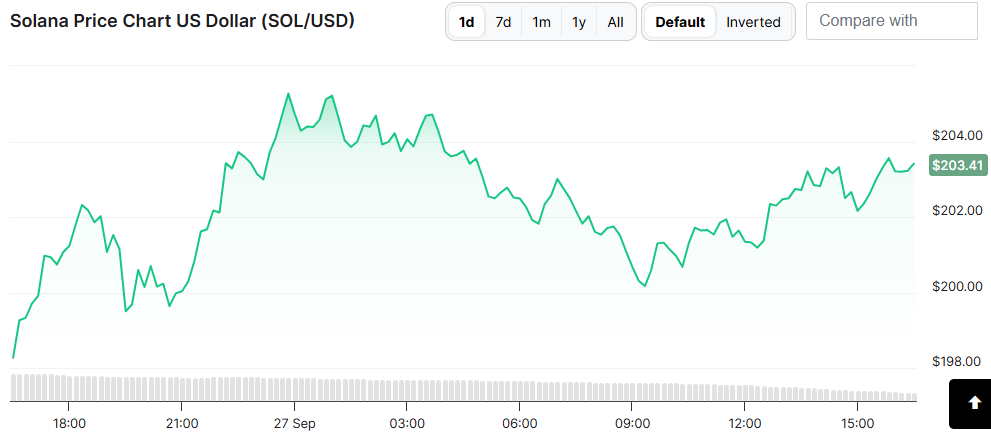

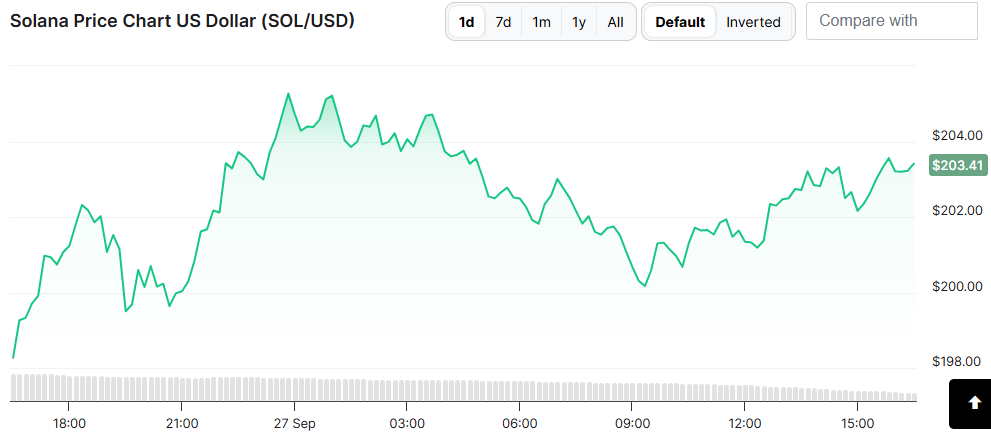

Solana Holds Above 200 Having Narrow Swings.

The defined band was met with strong support around 200 and resistance around 204 on the 27 th day Solana traded in a defined band. The session was closed at 203.41 which is slightly above the previous levels which is a control in the market. The range was stable as traders had to work all day.

Prices shot up in early trading, and soon dropped out of the single digits, rising to over 202. The bullishness was taken through the late evening with Solana reaching shortly above $204. This peak induced selling which brought about a gradual pullback.

By late morning, Solana corrected toward $200, showing typical resistance behavior near the upper threshold. However, demand returned during afternoon trading, supporting a bounce back above $202. The level around $200 acted as a psychological barrier.

Cardano Stays Range-Bound As Gains Fade Quickly

Cardano recorded restrained price movement as it traded between $0.775 and $0.795. The closing price stood at $0.785, marking little change from the session start. The activity highlighted limited strength within this band.

Early trading brought a brief push upward, with Cardano climbing close to $0.795. However, selling soon emerged, and the price retraced into sideways trading. Momentum weakened as the session progressed.

By morning, Cardano slipped under $0.780, creating the session’s lowest point. The price then recovered slowly during afternoon hours, supported by buyers defending the $0.775 level. Yet the earlier highs remained untouched.

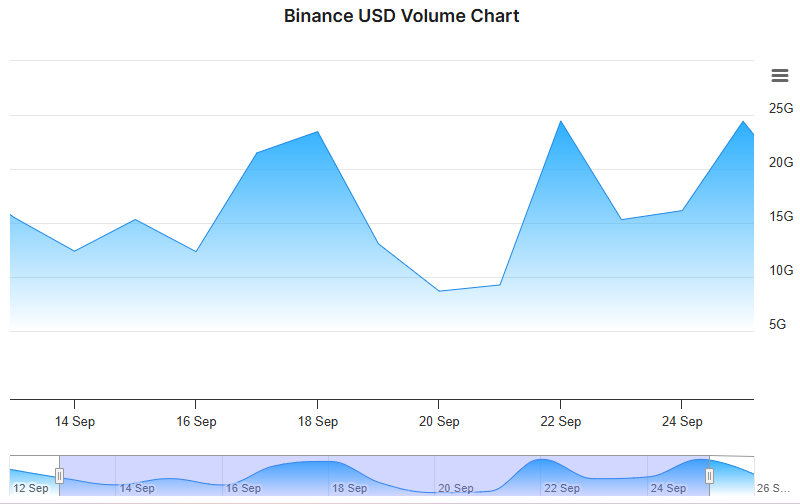

Avalanche Gains Attention As Binance Volume Climbs

Avalanche drew market focus as Binance trading volume fluctuated sharply between September 12 and September 26. Volume ranged from 10G to 25G, reflecting heightened activity across major sessions. The swings underlined speculative entry and exit patterns.

A notable surge occurred around September 17–18, when trading climbed near 25G before dropping steeply toward 10G. Another spike formed on September 22, again approaching the higher level. These shifts revealed repeated bursts of heavy participation.

Despite the corrections, volume quickly recovered after each drop. By September 25–26, trading returned close to 25G. Such resilience indicated consistent demand, positioning Avalanche toward stronger liquidity and upward pressure on its price levels.

Market Context

Layer 1 blockchains continue to compete for market share as capital rotates between leading platforms. Solana displayed narrow intraday moves with $200 acting as clear support. Cardano held in a tighter band, unable to extend beyond resistance.

Avalanche benefitted from the overall rotation as speculative activity lifted its relevance on major exchanges. The repeated recovery in Binance volumes highlighted sustained activity. Such trends keep AVAX in focus as it approaches the $25 mark.

The broader market environment shows a redistribution of trading attention across major assets. This shift suggests short-term opportunities may arise from rapid volume changes. Avalanche now holds a stronger position compared to its peers.