PLUME drops by 209.03% within 24 hours during significant market downturn

- PLUME token plummeted 209.03% in 24 hours to $4.131 amid sharp correction after 2426.89% one-month gains. - Volatility spikes reflect speculative trading, profit-taking, and potential regulatory/liquidity pressures despite long-term bullish trends. - Technical indicators show bearish exhaustion with broken support levels, suggesting further downward pressure unless reversal occurs. - Proposed backtesting strategy aims to mechanically capture gains through overbought-to-oversold momentum shifts and suppor

On September 28, 2025, PLUME underwent a steep decline of 209.03% in just one day, dropping to $4.131. Although the token has fallen by 178.7% over the past week, it has still achieved impressive long-term growth, surging 2426.89% in the last month and 983.21% over the past year. This abrupt and substantial drop in the last 24 hours suggests a rapid correction after a period of strong upward momentum.

The recent price action highlights heightened market volatility, especially in the most recent trading sessions. Despite the severe 24-hour plunge, this follows a remarkable one-month rally of more than 2400%, underscoring intense speculation and rapid price swings. The sharp reversal may be the result of investors taking profits, regulatory uncertainties, or changes in market liquidity, though the project has not released any official comments.

Technical analysis points to a loss of bullish strength. Short-term signals have quickly shifted from overbought to oversold, breaking through important support areas. The current trend indicates possible bearish fatigue, and some long-term investors might be buying at these lower prices. Experts believe that unless a strong reversal pattern appears, downward momentum could persist.

Backtest Hypothesis

A backtesting approach was suggested to assess how a hypothetical trading system, using the same technical indicators as discussed earlier, would have performed. This strategy would issue sell alerts when short-term momentum shifts from overbought to oversold, and buy alerts when price revisits support levels with confirmed trading volume.

The backtest would model trades using these criteria over the past year to evaluate whether a systematic approach could have captured the recent gains and limited losses. Had this model been active, it might have closed long trades before the sharp 24-hour fall and possibly re-entered during the recovery. While the hypothesis has yet to be validated with actual trading data, it is based on the same analytical tools referenced in this report.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Best Crypto Presale to Buy in December: DeepSnitch AI’s Clear Utility And 100X Stands Out, US Senate Appoints New CFTC Chair

The Role of Stablecoins in Building Modern Financial Systems

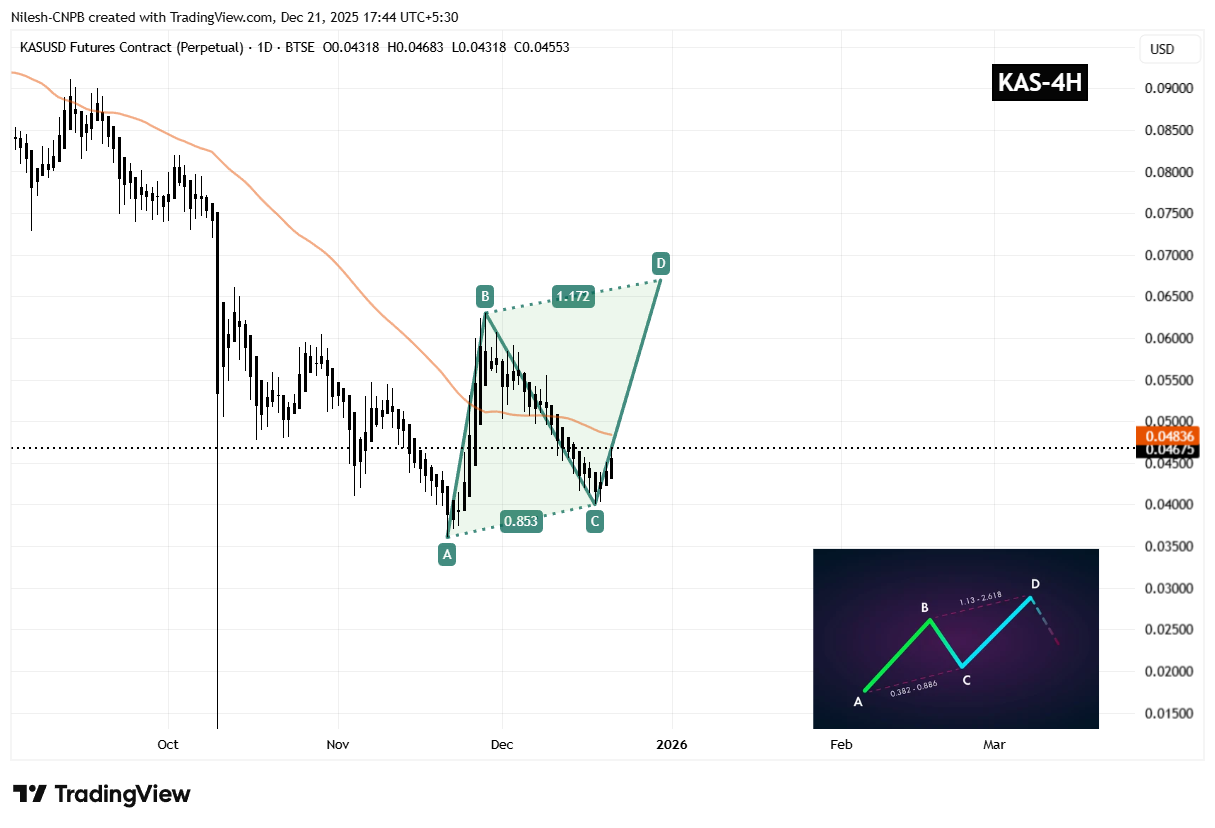

Kaspa (KAS) To Climb Higher — Key Emerging Pattern Formation Suggest So!