- Cosmos struggles with losses across all Altcoin timeframes, yet its multi-chain ecosystem and staking rewards sustain long-term relevance.

- Hedera has 241% annual growth, which is due to adoption, strong governance, and enterprise-centric blockchain applications.

- Aptos is experiencing sharp losses, but scalability and developer activity gives it a footing to recover.

The Altcoin market showed opposite results when Cosmos, Hedera, and Aptos showed various trends over various periods. Their movements emphasized the changing momentum, sustainable strength, and new challenges. All of the tokens had their own distinctive features, and they became altcoins to keep an eye on in a fluctuating digital reality.

Cosmos (ATOM) Remains Feeble.

Cosmos was trading around $4.00 today with a day to day low of -0.55. It had a weekly performance of -12.36 and a monthly performance of -9.53. The six-month were at -16.07% and year-to-date at -37.34 and one-year at -20.16.

The numbers highlighted persistent selling pressure across most periods. Cosmos struggled to regain momentum despite its blockchain interoperability model attracting recognition. Price weakness signaled diminishing short-term demand and lower overall stability.

Despite these declines, Cosmos retained long-term relevance through its multi-chain ecosystem. The network connects independent blockchains, enabling seamless value transfer and communication. Its staking system also provides rewards that keep many participants engaged even during prolonged market downturns.

Hedera (HBAR) Maintains Long-Term Growth Potential

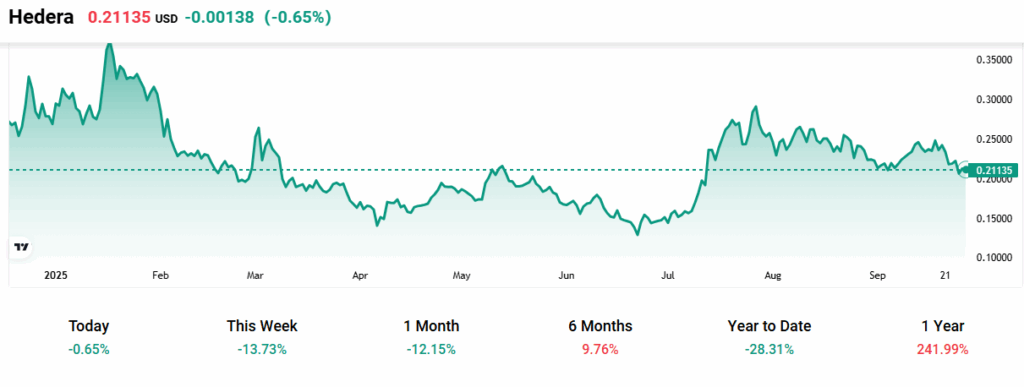

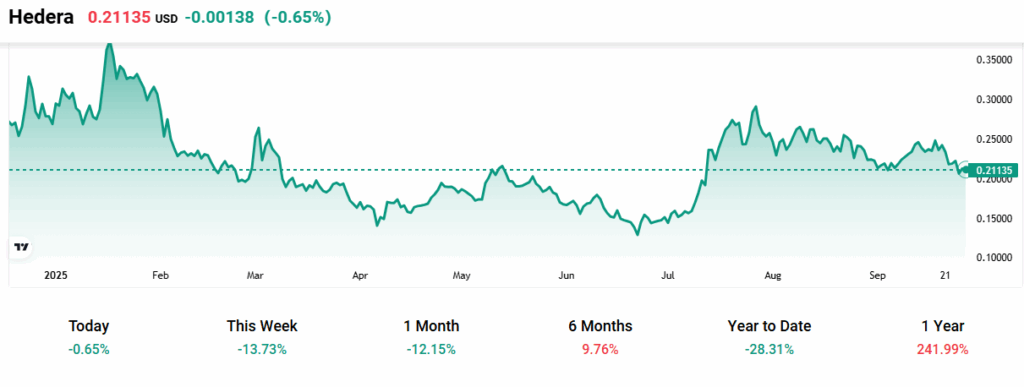

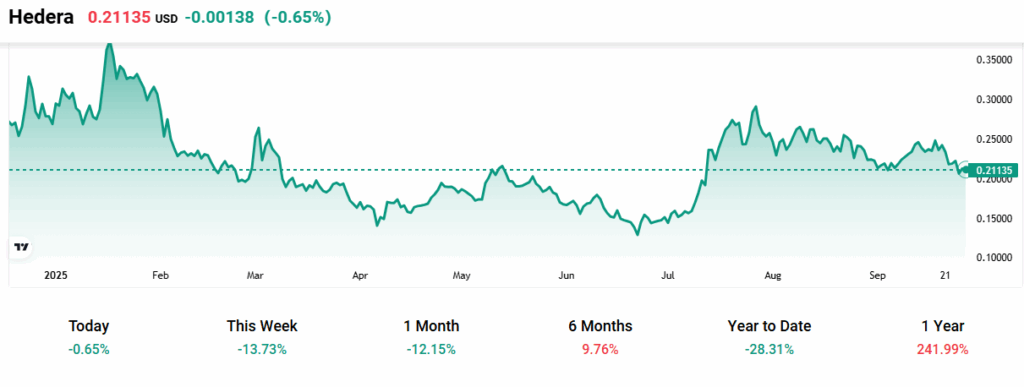

Hedera traded at $0.211, recording a small daily decline of -0.65%. Its weekly change showed -13.73%, and the monthly figure remained negative at -12.15%. However, Hedera posted a six-month gain of 9.76%, balancing its year-to-date loss of -28.31%.

Notably, Hedera’s one-year performance delivered an impressive gain of 241.99%. This growth highlighted significant network adoption and expanding utility in enterprise-focused use cases. The strong yearly trend contrasted sharply with short-term pullbacks observed over recent weeks.

Hedera’s governance model and consensus mechanism strengthened its long-term outlook. The platform supported energy-efficient transactions and positioned itself for large-scale adoption. Such fundamentals added credibility to its continued role as a competitive altcoin within the wider market.

Aptos (APT) Battles Heavy Declines

Aptos traded near $4.13 today, advancing by +4.29% in daily performance. Despite this rebound, the weekly change remained -9.43%, and the monthly figure dropped -3.05%. The six-month decline widened to -28.55%, while the year-to-date drop reached -52.64%.

Over the past year, Aptos recorded a sharp decline of -49.76%. The extended losses highlighted consistent selling activity and challenges in sustaining long-term momentum. Daily gains remained insufficient to offset the deeper downward trend.

Nevertheless, Aptos continued to build credibility with its technical framework and scalability features. Its architecture enabled high transaction throughput and strong developer activity. These fundamentals provided a foundation for recovery potential despite current bearish sentiment.

Summary

Cosmos struggled with persistent losses, Hedera showcased remarkable yearly growth, and Aptos attempted recovery amid long-term weakness. These contrasting results emphasized both opportunities and risks within the altcoin market. Together, they highlighted why monitoring Cosmos, Hedera, and Aptos remains essential in evaluating future blockchain trends.