DeFi's Oracle Oversight Enables Whales to Gain $47.5M While Retail Investors Suffer $7M Losses

- Four whale addresses manipulated XPL's price on Hyperliquid, generating $47.5M profits via a 200% surge in minutes. - The attack exploited isolated oracles and no position limits, causing $7M in retail trader losses through liquidations. - Hyperliquid introduced price caps and external data feeds post-incident, but arbitrage gaps emerged between exchanges. - The event exposed systemic DeFi vulnerabilities in liquidity-thin tokens, urging stronger governance and circuit breakers. - Retail traders are advi

On August 27, 2025, four major whale wallets on Hyperliquid collectively earned $47.5 million by driving the price of

This coordinated manipulation exposed significant weaknesses in decentralized finance (DeFi) protocols that emphasize user growth over risk controls. Hyperliquid’s lack of circuit breakers enabled a $184,000 WETH trade to dramatically distort XPL’s spot price, a scenario less likely on centralized exchanges that use external pricing sources DeFi Market Manipulation: Analyzing the $XPL Hyperliquid Pump … [ 2 ]. While the platform’s decentralized design aims for greater transparency, it also left the system open to exploitation by large players with deep pockets. In response, Hyperliquid implemented new protections, including a 10x cap on mark prices relative to the 8-hour exponential moving average and the use of external market data to help prevent similar incidents DeFi Market Manipulation: Analyzing the $XPL Hyperliquid Pump … [ 2 ]. However, these changes unintentionally created arbitrage opportunities, as XPL prices began to diverge between Hyperliquid and Binance DeFi Market Manipulation: Analyzing the $XPL Hyperliquid Pump … [ 2 ].

Initially, speculation suggested that one of the whale wallets was linked to

The XPL incident is part of a larger pattern of whale-driven exploits in DeFi, following a $6.26 million attack on the JELLY

Hyperliquid’s reaction to the XPL manipulation has included both preventative and corrective steps. While the platform’s new safeguards are intended to stabilize prices, they have yet to fully restore user trust. This latest manipulation follows a previous exploit in March 2025, raising doubts about Hyperliquid’s ability to uphold market integrity Hyperliquid whales net $48M on 200% XPL rally, amid … [ 1 ]. Although Hyperliquid’s decentralized model is designed to remove counterparty risk, the XPL incident illustrates the difficulty of balancing openness with effective risk controls in highly leveraged environments Four Whales Accused of Manipulating XPL Price, Earning $47.5M … [ 3 ]. The platform’s future reputation and user confidence now depend on its ability to fix systemic flaws without hindering innovation XPL Futures on Hyperliquid See $130M Wiped Out … [ 4 ].

The XPL price manipulation stands as a warning for both DeFi platforms and individual traders. For platforms, it underscores the importance of proactive risk controls, such as external price feeds and liquidity protections, to guard against abuse. For traders, it highlights the need to understand market structure, liquidity conditions, and the dangers of using leverage with new or thinly traded assets XPL Futures on Hyperliquid See $130M Wiped Out … [ 4 ]. As the DeFi sector matures, the tension between decentralization and regulatory oversight will remain a key issue, especially in markets where a few large players can heavily influence price movements DeFi Market Manipulation: Analyzing the $XPL Hyperliquid Pump … [ 2 ].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vanguard Breaks Conservative Tradition, Opens to Crypto ETFs

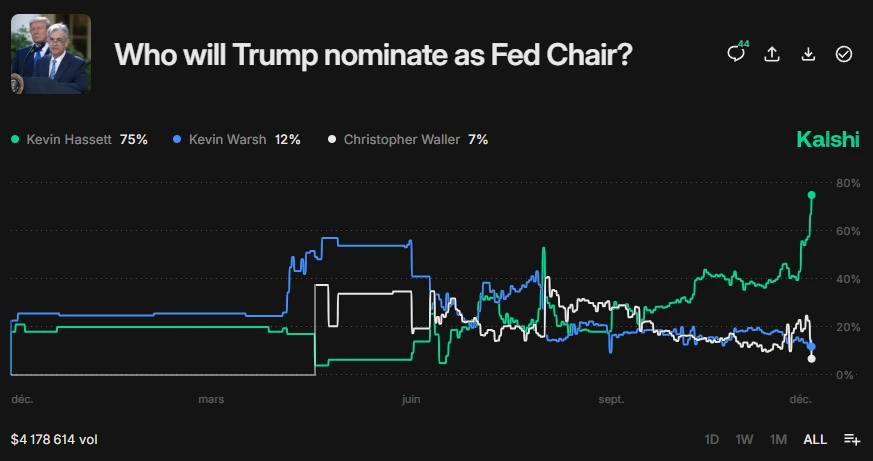

Trump’s Fed Chair Announcement Likely This Week: Is It the Needed Crypto Bullish Catalyst?

XRP Price News: Breakout or Breakdown?

Huione Pay Halts Withdrawals After Run on Banks, Users Fear Major Losses