Ethereum's growing institutional holdings are prompting individual investors to turn toward meme coin presales

- Ethereum’s exchange supply hits 9-year low at 14.8M ETH, driven by institutional accumulation, ETFs, and cold storage withdrawals. - Corporate treasuries and ETFs now control 10% of ETH supply, staking 12M ETH ($51.7B) while prices remain rangebound below $4,500. - Retail investors shift to meme-to-earn presales like MAGAX, seeking high-risk returns as Ethereum’s supply crunch limits short-term gains. - Market duality emerges: institutional stability in Ethereum contrasts with retail speculation in micro

Ethereum holdings on major exchanges have dropped to their lowest point in nearly a decade, reflecting a move toward institutional accumulation and longer-term investment approaches. By late September 2025, exchange reserves had decreased to 14.8 million ETH—a 50% reduction over two years and the smallest amount since 2016 Ethereum Supply on Exchanges Hits 9-Year Low as Institutions Accumulate [ 1 ]. This decline is largely attributed to corporate treasuries, ETFs, and significant transfers to cold storage or staking platforms Ethereum Exchange Supply Hits 9-Year Low Amid Institutional Surge [ 2 ]. Ongoing net outflows have further reduced exchange liquidity, with the 30-day average of net ETH withdrawals reaching its highest level in two years Ethereum Exchange Balances Hit 9-Year Low — What It Means for Investors Moving to Meme Presales [ 3 ]. Experts link this trend to lower selling pressure and a growing preference for self-custody, as investors focus more on yield-generating strategies than on speculative trades Ethereum Price Today: ETH Struggles Below $4K Amid Supply [ 4 ].

Interest from institutions has climbed sharply, with corporate treasuries and ETFs now holding a combined 10% of Ethereum’s total supply. Since April 2025, organizations like BitMine and StrategicEthReserve have accumulated 5.26 million ETH, valued at $21.7 billion, while U.S. spot ETH ETFs possess 6.75 million ETH, accounting for 5.6% of the circulating supply Ethereum Supply on Exchanges Hits 9-Year Low as Institutions Accumulate [ 1 ]. Most of these assets are staked, further limiting available liquidity. The narrative of Ethereum’s “Wall Street makeover” has gained momentum as institutional trust in its financial utility grows Ethereum Exchange Supply Hits 9-Year Low Amid Institutional Surge [ 2 ]. Despite this accumulation, Ethereum’s price has not seen immediate gains, instead experiencing volatility and dropping over 11% in a single week to below $4,100 Ethereum Supply on Exchanges Hits 9-Year Low as Institutions Accumulate [ 1 ].

The ongoing reduction in exchange-held ETH points to a fundamental change in market structure. With fewer tokens available for trading, analysts believe that persistent institutional buying could lead to a supply squeeze, potentially boosting prices in the future Ethereum Supply on Exchanges Hits 9-Year Low as Institutions Accumulate [ 1 ]. On-chain data, such as the exchange supply ratio at 0.14, highlights the limited ETH presence on trading platforms Ethereum Exchange Supply Hits 9-Year Low Amid Institutional Surge [ 2 ]. Meanwhile, Ethereum’s Liveliness metric, which tracks long-term holder activity, has shown mixed results, with some selling pressure balancing out bullish inflows Ethereum Supply at 9-Year Low, But Bears Still Win; … [ 5 ]. This has kept ETH trading within a range, moving between $4,000 and $4,500 Ethereum Supply at 9-Year Low, But Bears Still Win; … [ 5 ].

Traders are watching closely to see if Ethereum can break through key resistance levels, such as $4,580, to confirm a bullish trend. A successful move above this level could set the stage for a rally toward $5,000 by the end of the year, provided institutional buying and retail optimism persist. On the other hand, a drop below $4,100 could trigger a fall toward $3,910, increasing short-term volatility.

Ethereum’s nine-year low in exchange reserves marks a significant milestone in its development as a financial instrument, while also highlighting the rising appetite for high-risk, high-reward opportunities in the crypto space. As institutions tighten supply and ETFs consolidate their holdings, retail investors are increasingly seeking alternatives in hopes of replicating Ethereum’s early growth. This balance between institutional stability and retail speculation is shaping the current market cycle, presenting distinct options for capital deployment in an ever-changing environment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

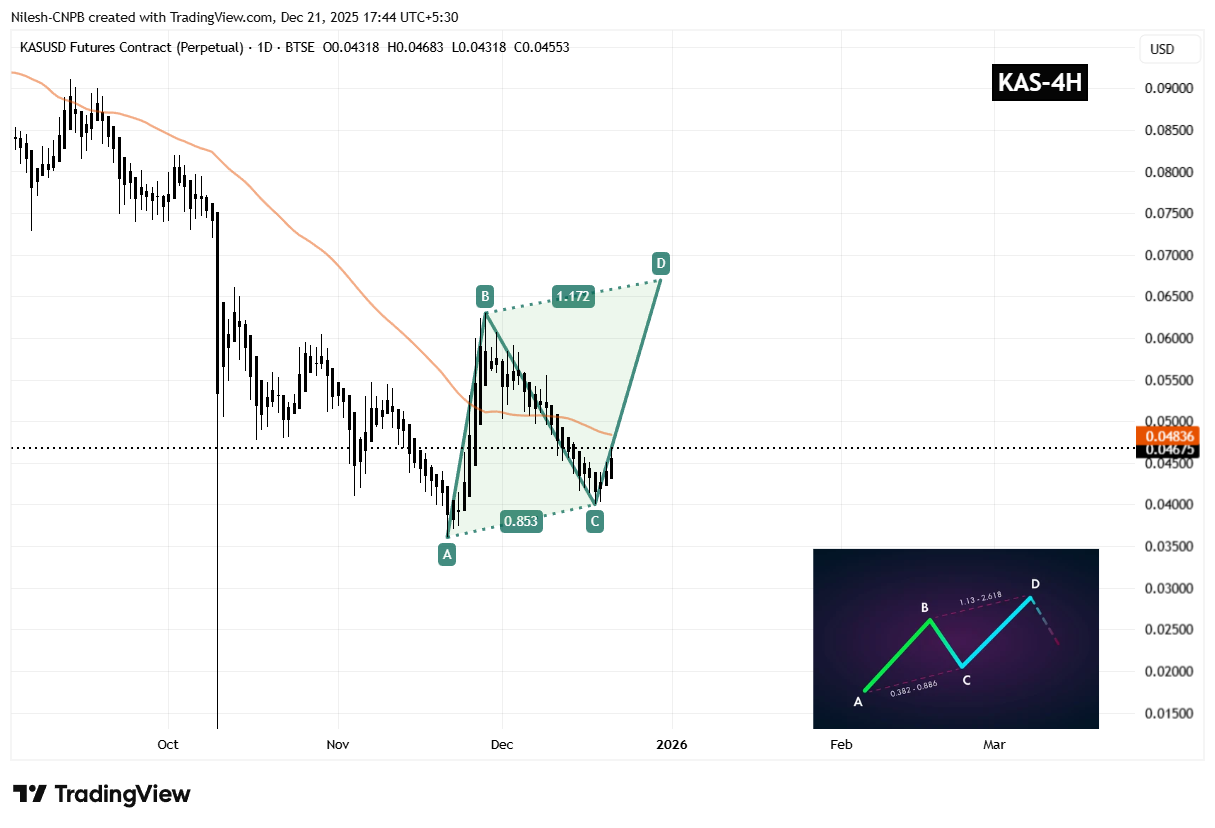

Kaspa (KAS) To Climb Higher — Key Emerging Pattern Formation Suggest So!

Best Crypto to Buy Now December 2025: DeepSnitch AI’s 100X Narrative Captures the Interest of Mantle and Toncoin Investors