"Crypto Mom's NFT Parody: Breaking Regulatory Deadlock Through Wit"

- SEC commissioner Hester Pierce announced her exit in June 2026 and entry into NFT creation with satirical crypto/TradFi characters. - Her NFT collection critiques regulatory ambiguity, featuring "CryptoMom," "Terrified TradFi," and "HyperTyper" to mock industry polarization. - During her tenure, she advocated for crypto-friendly frameworks, including NFT safe harbors and international collaboration, as SEC shifts toward clearer digital asset guidelines. - The agency's pivot from enforcement to clarity ha

Hester Pierce, a commissioner at the U.S. Securities and Exchange Commission (SEC) often referred to as “Crypto Mom,” has outlined her intentions to become an NFT creator after her SEC term ends. During her remarks at the Coin Centre event on September 26, 2025, Pierce shared that she would not pursue a third term at the SEC, with her current term ending in June 2026. Her time at the SEC has been characterized by her push for clearer regulations in the cryptocurrency space, including initiating a “Crypto Task Force” to shape digital asset policies Hester Pierce Hints Future NFT Plans After Leaving The SEC [ 1 ].

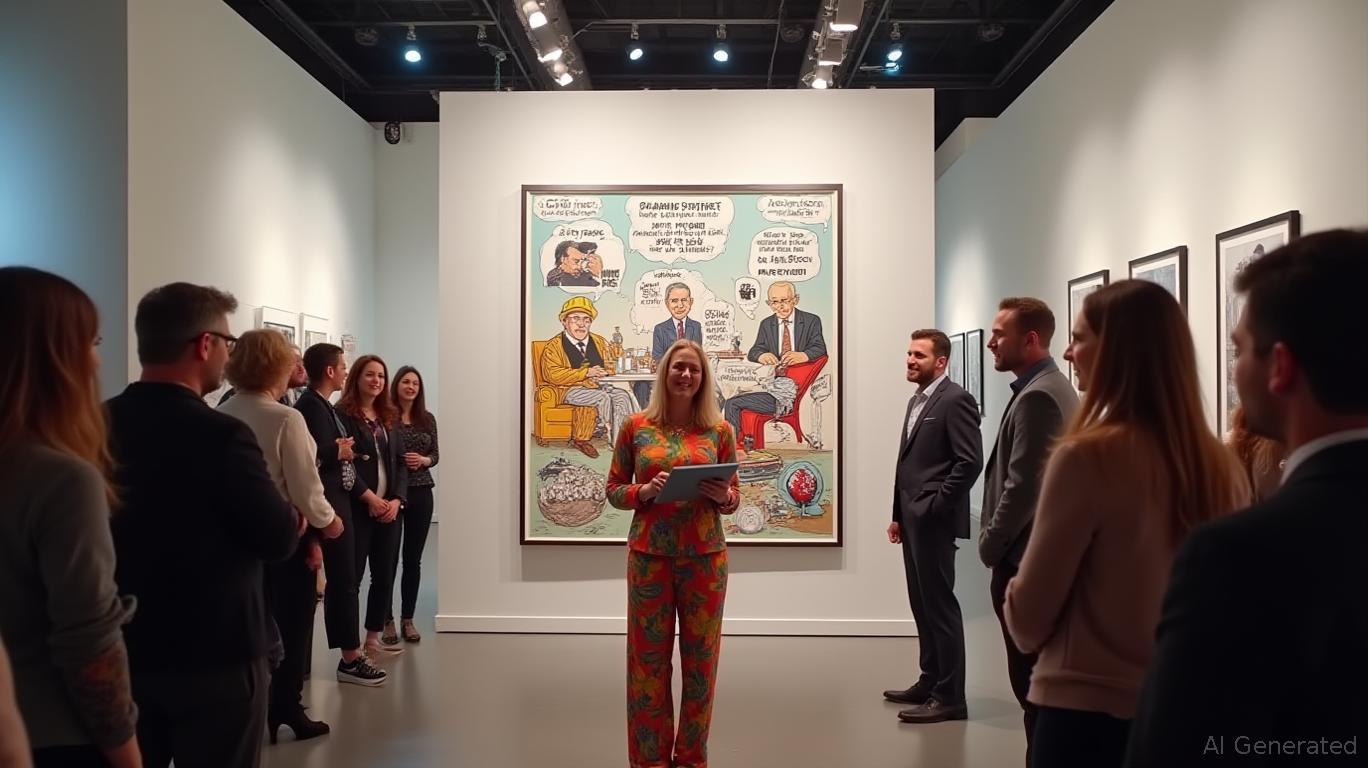

Pierce’s NFT initiative will introduce a humorous series of characters inspired by personalities from both the crypto and traditional finance (TradFi) worlds. The debut NFT, “CryptoMom,” portrays her as a middle-aged woman with glasses, struggling with the intricacies of blockchain regulation. The next, “Terrified TradFi,” lampoons financial industry veterans who cling to old securities laws and resist crypto progress. The third, “HyperTyper,” pokes fun at crypto supporters who swing between enthusiastic promotion and exasperation over market manipulation Hester Pierce Hints Future NFT Plans After Leaving The SEC [ 1 ]. These figures are designed to satirize regulatory confusion and the divisive nature of industry debates Hester Peirce Shares Future NFT Plans After Her SEC Tenure [ 2 ].

This NFT project highlights Pierce’s ongoing commitment to the digital asset sector. While at the SEC, she advocated for a regulatory model based on principles, supported safe harbor provisions for NFTs, and encouraged global cooperation to balance innovation with investor protection Hester Pierce Hints Future NFT Plans After Leaving The SEC [ 1 ]. Her exit comes as the SEC, under new leadership, shifts from a focus on enforcement to providing more transparent digital asset guidelines. This includes pausing some enforcement actions against crypto companies and working on new rules to enable ETF approvals Hester Peirce Shares Future NFT Plans After Her SEC Tenure [ 2 ].

The SEC’s changing approach to crypto has sparked a range of opinions. Detractors of former Chair Gary Gensler argue that his strict enforcement led to confusion, while proponents of the new direction point to progress in balancing innovation and investor safety. Pierce admitted to being disappointed at not convincing her peers during her time at the SEC, but she remains hopeful for the industry’s future. “The government now aims for regulatory clarity instead of uncertainty,” she remarked, encouraging innovators to develop secure and valuable technologies Hester Peirce Shares Future NFT Plans After Her SEC Tenure [ 2 ].

Though playful in tone, Pierce’s NFT venture is part of her broader effort to challenge regulatory stagnation. At the Coin Centre event, she joked about her lack of tech skills and dismissed the idea of taking up beekeeping after leaving the SEC. Nevertheless, she stressed her commitment to ensuring the SEC builds a strong digital asset framework before she moves on Hester Pierce Hints Future NFT Plans After Leaving The SEC [ 1 ]. This focus aligns with ongoing Senate debates about digital asset market structure and clarifying the regulatory responsibilities of financial agencies Hester Peirce Shares Future NFT Plans After Her SEC Tenure [ 2 ].

The SEC’s move toward greater transparency has already impacted the market. The agency’s recognition that most NFTs do not qualify as securities has encouraged more creators to participate in the space Hester Pierce Hints Future NFT Plans After Leaving The SEC [ 1 ]. Meanwhile, the Crypto Task Force established under Pierce continues to refine regulations for tokenized assets and decentralized finance (DeFi) initiatives Hester Peirce Shares Future NFT Plans After Her SEC Tenure [ 2 ]. Experts believe these regulatory shifts could speed up crypto ETF approvals and lower legal risks for startups, making the industry more competitive Hester Peirce Shares Future NFT Plans After Her SEC Tenure [ 2 ].

Pierce’s unconventional NFT series captures her unique position as both a regulator and a crypto advocate. By satirizing the extremes of regulatory and market behavior, she hopes to spark conversations about the need for balanced rules. Her exit from the SEC may mark a turning point for U.S. digital asset regulation, with her legacy linked to the agency’s transition from strict enforcement to more collaborative engagement Hester Pierce Hints Future NFT Plans After Leaving The SEC [ 1 ]. As the crypto sector adapts to these changes, Pierce’s post-SEC activities—whether through NFTs or policy work—will continue to influence the industry’s direction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH Increases by 2.44% as Significant Insider Selling and Purchase Indicators Emerge

- DASH rose 2.44% in 24 hours to $50.1, showing a 31.63% annual gain despite a 11.79% seven-day drop. - High-ranking insiders sold millions via 10b5-1 plans, including $9. 3M by Stanley Tang and $6.19M by Andy Fang. - Alfred Lin’s $100.2M purchase signaled confidence, contrasting with other sales and suggesting undervaluation. - Market reacted positively short-term, but analysts expect macroeconomic and business fundamentals to support DASH ahead.

BCH Rises 36.52% Over the Past Year as Network Enhancements and Improved Mining Efficiency Drive Growth

- Bitcoin Cash (BCH) rose 36.52% in a year due to network upgrades and improved mining efficiency. - Growing merchant adoption boosts real-world use cases, enhancing BCH’s practical appeal. - Analysts predict continued momentum from stable updates and adoption efforts amid crypto volatility. - Recent stability, with no major forks, strengthens investor confidence in BCH’s scalability.

Why is COAI experiencing a downturn towards the end of 2025

- COAI token and index collapsed in late 2025 due to deteriorating market fundamentals, governance failures, and regulatory uncertainty. - C3 AI's Q3 2025 revenue growth (26% YoY) was overshadowed by Q1 2026 revenue decline (20% YoY) and leadership instability, eroding investor trust. - Token centralization (87.9% in ten wallets) and lack of transparent governance exacerbated liquidity crises and manipulation risks. - The CLARITY Act's ambiguity and jurisdictional loopholes deepened uncertainty, deterring

BCH Surges 35.88% Over the Past Year as Institutions Embrace It and Network Improvements Roll Out

- Bitcoin Cash (BCH) rose 35.88% in a year amid growing institutional adoption and network upgrades. - Recent protocol upgrades improved scalability and security, boosting transaction speeds by 20%. - Regulatory clarity and increased fintech adoption have enhanced BCH’s legitimacy and investor confidence. - Sustained developer activity in open-source projects highlights ongoing efforts to optimize smart contracts and interoperability.