Key Notes

- Spot Ethereum ETFs saw $248M in daily outflows, totaling $795M this week.

- Whales accumulated over 431,000 ETH worth $1,73B in just two days.

- Analysts note that steep corrections often clear excess leverage, resulting in gains.

Spot Ethereum ETFs have recorded another day of heavy withdrawals, extending a week-long trend that reflects heightened volatility. These funds saw cumulative net outflows of $248 million on Friday, bringing total outflows for the week to $795 million.

These five consecutive days of losses coincided with a sharp decline in ETH price .

At the time of writing, ETH is trading above the $4,000 zone. However, the cryptocurrency experienced a steep sell-off earlier in the week, plunging from near the $4,500 level on September 21 to as low as $3,850 on September 25.

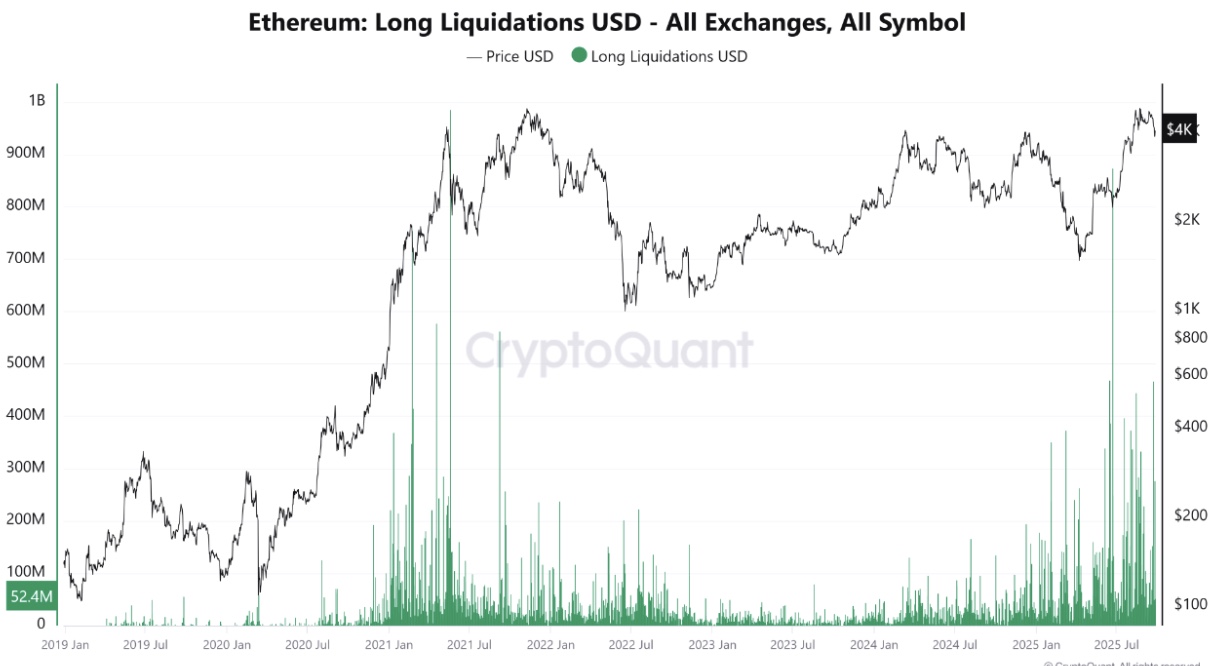

This drop also coincided with one of the largest derivatives market resets since 2024, according to data from CryptoQuant. Open interest across exchanges fell significantly, and hundreds of millions of dollars worth of long positions were liquidated.

Ethereum long liquidations across all exchanges | Source: CryptoQuant

Whales Accumulate, But Why No Surge?

Amid this price turbulence, large investors have been taking the opportunity to accumulate ETH. LookOnChain reported that 16 wallets collectively received 431,018 ETH, worth around $1.73 billion, from exchanges over the past two days.

Whales keep accumulating $ETH !

16 wallets have received 431,018 $ETH ($1.73B) from #Kraken , #GalaxyDigital , #BitGo , #FalconX and #OKX in the past 2 days. https://t.co/0DPxgZMGN7 pic.twitter.com/ksrmcF8Z81

— Lookonchain (@lookonchain) September 27, 2025

In total, investors have accumulated nearly 570,000 ETH in the past week. Still, the price has yet to show strong signs of recovery.

A CryptoQuant analyst explained that the paradox of “buying but falling” stems from the structure of the derivatives market. When long positions build up too heavily, the market becomes vulnerable to forced liquidations.

These liquidations trigger waves of sell pressure, often outpacing demand. Similar resets occurred in 2021, 2023, and earlier this year, each time clearing excess leverage.

As per the analyst, such steep falls often lead to healthier, more sustainable rallies despite the immediate bearish effects. Several analysts, including BitMine’s Tom Lee , have predicted a strong ETH price rally in the fourth quarter.

Whale Sell-off Fear Looms

However, not all investors are bullish. Earlier today, one major Ethereum whale appeared to be trimming their position. This investor , who had built a large stake at the bottom of $1,582 five months ago, deposited 1,000 ETH (around $4 million) into an exchange just hours ago.

If sold, the move would lock in a profit of $2.42 million. The remaining 5,000 ETH in the whale’s wallet still holds an unrealized gain of over $12 million.

next