Delphinus Lab’s ZK technology connects real-world assets with blockchain, building confidence in decentralized networks

- Delphinus Lab invests in Solar Mine, a RWA project tokenizing real-world assets via ZKWASM's zero-knowledge framework. - ZKWASM enables verifiable off-chain computations, enhancing transparency and scalability for decentralized asset management. - The collaboration bridges blockchain with physical assets, unlocking use cases like fractional ownership and cross-border trade settlements. - Toobit's ZKWASM token listing and modular architecture support institutional adoption through multi-chain interoperabi

Delphinus Lab has revealed a strategic investment in Solar Mine, an RWA (Real-World Assets) initiative, signifying a major advancement in the expansion of its zero-knowledge (ZK) ecosystem. This decision is in line with the lab’s ongoing mission to merge ZK technology with practical, real-world uses, thereby boosting the scalability and reliability of decentralized platforms. Solar Mine, which aims to connect tangible assets with blockchain technology, plans to utilize Delphinus Lab’s ZKWASM (Zero-Knowledge WebAssembly) platform to facilitate verifiable off-chain computations. This partnership highlights the increasing collaboration between ZK infrastructure and RWA projects, both of which seek to digitize assets like real estate, commodities, and infrastructure on the blockchain.

Created by Delphinus Lab, ZKWASM is a virtual machine designed for zero-knowledge proofs that supports the execution of WebAssembly (WASM) code. This innovation enables developers to operate WASM-based applications in a trustless setting, allowing on-chain verification of computations without sacrificing speed or privacy. By merging Solar Mine’s RWA protocols with ZKWASM, the ecosystem can provide transparent and verifiable asset oversight, a key requirement for institutional involvement. ZKWASM’s modular design also allows it to interact with various blockchains, supporting a range of applications such as decentralized finance (DeFi), gaming, and AI-powered analytics The ZKWASM Tokenomics Cycle – Delphinus Lab [ 1 ].

This investment comes after the introduction of Delphinus Lab’s ZKWASM tokenomics cycle, which is designed to establish a sustainable ecosystem through an integrated token model. The cycle brings together developers, users, and prover nodes: developers produce ZKWASM proofs that are validated in the Proof Market, while users participate in dApps and games to earn points that recirculate within the system. This structure encourages both liquidity and user activity, with staking, launchpad, and dApp hubs already in operation GitHub - DelphinusLab/zkWasm [ 2 ]. The ZKWASM token, overseen by the ZKWASM Foundation, is guided by the community, with Delphinus Lab concentrating on research and infrastructure growth.

Recently, Toobit, a digital asset exchange, has added the ZKWASM token for spot trading, increasing the token’s availability. The platform emphasized ZKWASM’s role as a core infrastructure for scalable Web3 solutions, with backing from prominent investors such as HashKey Capital and SevenX Toobit lists Delphinus Lab (ZKWASM) for spot trading [ 3 ]. This listing reflects a broader industry shift, as ZK-based projects are gaining momentum for their ability to lower computational expenses and improve privacy. Experts suggest that combining RWA with ZK technology could open up new possibilities, including fractional asset ownership and international trade settlements, by merging blockchain transparency with the complexities of the physical world ZKWASMHUB [ 4 ].

Delphinus Lab’s ecosystem is growing through new partnerships and developer resources. The ZKWASM Hub, a cloud-based platform for deploying and sharing ZKWASM apps, provides automated proof generation and batching, supported by a permissionless pool of proving nodes ZKWASMHUB [ 4 ]. Furthermore, the lab’s GitHub offers open-source tools for compiling C, C++, Rust, and AssemblyScript into WASM bytecode, making it easier for Web2 developers to transition to ZK technologies GitHub - DelphinusLab/zkWasm [ 2 ]. These efforts position ZKWASM as a connector between conventional and decentralized systems, helping to solve scalability issues in Web3 adoption.

The investment in Solar Mine demonstrates Delphinus Lab’s commitment to embedding ZK technology in real-world contexts where trust and verification are essential. By integrating ZKWASM’s computational assurances with RWA’s asset digitization, the project has the potential to transform the management, exchange, and governance of both physical and digital assets. As ZK ecosystems evolve, such collaborations are likely to encourage greater institutional involvement, especially in fields like supply chain, energy, and real estate, where transparency and fraud prevention are vital The ZKWASM Tokenomics Cycle – Delphinus Lab [ 1 ].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC OG Insider Whale Holds $730M Long Across BTC, ETH, and SOL with $41M Unrealized Losses

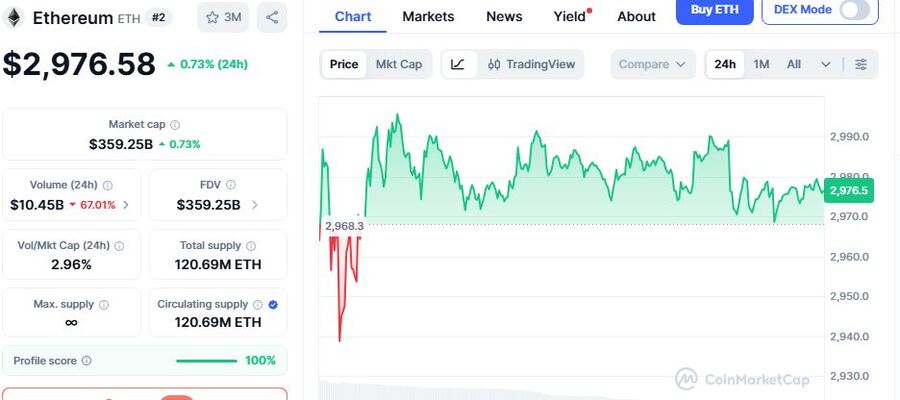

Ethereum New Wallet Addresses on Spike As ETH Consolidates at $2,977, Suggesting Looming Market Momentum

Digital Renminbi Fraud Traps: How Scammers Push Wallet Schemes and How to Protect Your Funds