While SHIB Burns, BlockDAG Builds: Crypto's Execution Era Arrives

- Shiba Inu (SHIB) and Pi Network (PI) face bearish trends in late 2025 due to structural weaknesses and regulatory uncertainty, while BlockDAG (BDAG) gains traction with $410M presale funding and 312,000+ holders. - SHIB's 42.2% YTD decline highlights failed token burn efficacy against 589 trillion supply, while PI's delayed mainnet utility fuels forecasts of $0.2077 price drop by September. - BlockDAG's execution-focused growth includes 19,594 ASIC miners deployed, 3M app users, and testnet upgrades with

Shiba Inu (SHIB) and Pi Network (PI) have both exhibited signs of decline toward the end of 2025, with experts pointing to underlying structural issues and a prevailing bearish mood. In contrast, BlockDAG (BDAG) has positioned itself as a promising high-growth project, amassing a community of over 312,000 holders.

BlockDAG, a cutting-edge Layer 1 blockchain, is gaining momentum thanks to its strong focus on implementation. The initiative has delivered 19,000 X-Series miners to users in over 130 nations, and welcomed 3 million users through its X1 mobile platform. Analysts credit its achievements to tangible infrastructure, including a testnet debut set for September 25 and a hybrid consensus mechanism combining DAG and Proof-of-Work. With more than 312,000 holders and daily investments averaging $1 million, BlockDAG’s adoption rates surpass those of many established competitors. The upcoming testnet will feature advanced vesting strategies and EIP-4337 smart account support, positioning BlockDAG as a scalable infrastructure solution.

Unlike the speculative stories surrounding SHIB and PI, BlockDAG’s progress is rooted in measurable user adoption. The project sees over 1,000 new members joining each day, and its hardware rollout—19,594 ASIC miners sold before mainnet launch—reflects strong institutional trust. The anticipated $1 price target, bolstered by partnerships with Seattle sports teams and gamified features like Buyer Battles, has gained traction among investors. These collaborations bring blockchain technology into live entertainment, introducing NFTs and fan tokens to broaden its practical uses. By prioritizing real infrastructure over hype, BlockDAG distinguishes itself from projects that depend on token burns or delayed milestones.

Investor attitudes toward these projects are notably different. SHIB’s price remains limited, with forecasts suggesting it will trade between $0.0000135 and $0.000015 through the fourth quarter of 2025. PI’s optimistic models predict it could reach $1.50 by 2028, which is still below the hopes of early supporters. In contrast, BlockDAG is expected to achieve returns exceeding 50 times the initial investment, with post-listing estimates pointing to a $1 valuation. This stark difference highlights a growing trend in the crypto space, where institutional investors are increasingly drawn to projects with clear utility and strong execution rather than pure speculation.

As the 2025 crypto market cycle unfolds, BlockDAG’s blend of hardware integration, active community, and readiness for testnet launch makes it a leading candidate. Meanwhile, SHIB and PI must overcome significant challenges to regain their momentum unless they address their fundamental issues. The market’s reaction to BlockDAG’s testnet release and exchange listings will play a crucial role in determining if it secures its place as the top cryptocurrency to watch in the coming year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

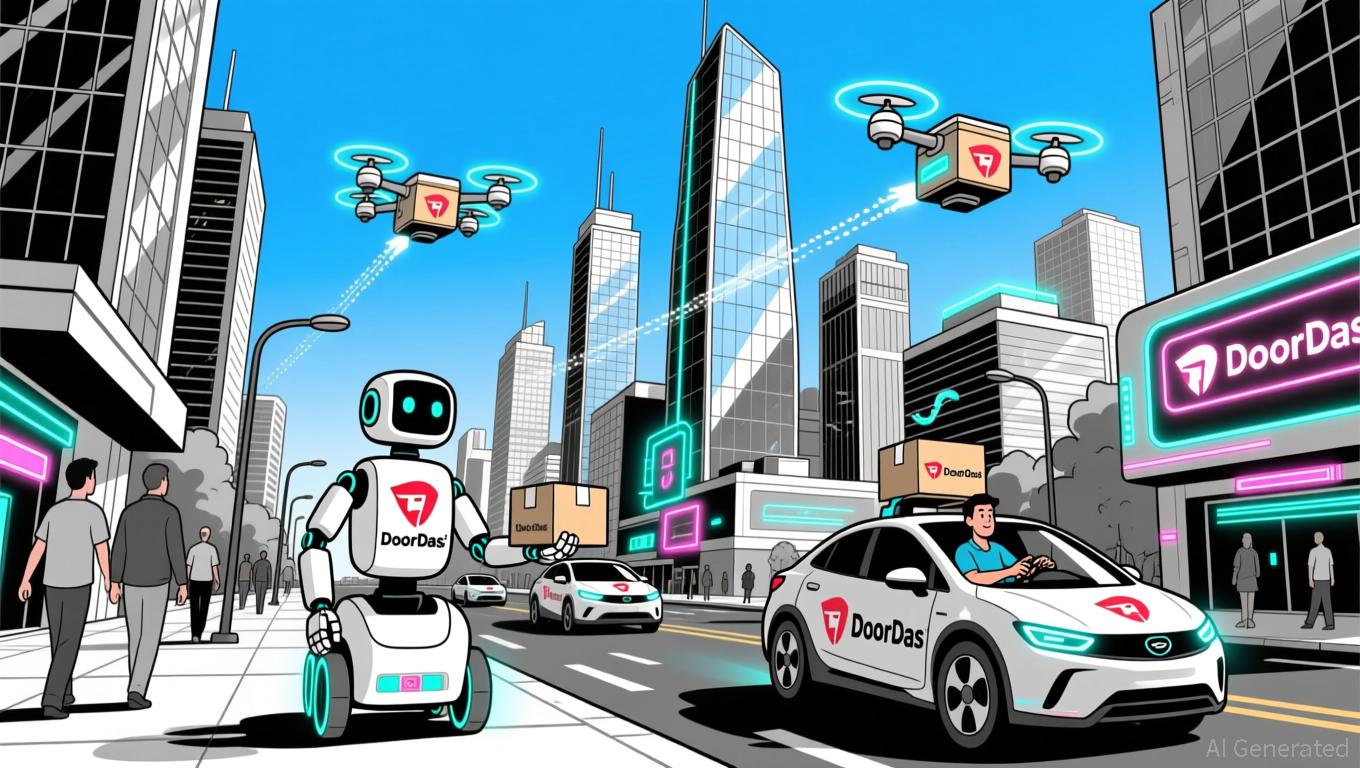

DASH Gains 5.78% Following DoorDash’s Expansion of Delivery Network and New Partnerships

- DoorDash's DASH stock surged 5.78% in 24 hours amid Q3 2025 results showing $3.4B revenue and $244M profit, driven by 27% YoY growth. - Strategic expansions include grocery delivery partnerships with Kroger/Family Dollar and robot delivery via Serve Robotics , enhancing its 68% U.S. food delivery market share. - Long-term investments in automation (Waymo, Dot robot) and $1.2B SevenRooms acquisition aim to boost efficiency but caused a 20% post-earnings stock pullback. - Favorable regulatory shifts (Prop

BCH sees a 32.36% increase over the past year as the network undergoes upgrades and mining adjustments

- Bitcoin Cash (BCH) surged 32.36% in a year due to network upgrades, mining shifts, and positive market sentiment. - Price hit $574.7 on Dec 5, 2025, with 6.34% 30-day and 0.03% 24-hour gains. - 2024 protocol upgrade boosted transaction throughput, fees, and real-world payment adoption. - Mining pools shifted hashrate to BCH, enhancing security and decentralization. - Institutional support and fixed supply model drive BCH’s appeal as a scalable payment alternative.

ZEC Rises 11.19% in the Past 24 Hours Amid Increasing Average Short Positions

- Zcash (ZEC) rose 11.19% in 24 hours to $395.27 but fell 4.99% weekly/monthly amid mixed performance. - "Calm Long King" trader increased ZEC short positions to $2.51M, raising average entry price to $360 with 20% unrealized gains. - ZEC shorting reflects cautious optimism as traders adjust exposure amid volatility, with BTC/SOL shorts showing $160k combined losses. - The trader's recent 15-trade winning streak contrasts November setbacks, highlighting shifting market dynamics in altcoin trading.

ZEC Value Rises 5.73% as Short Sellers Adjust Positions During Market Fluctuations

- ZEC surged 5.73% in 24 hours to $385.59, defying 9.19% weekly/monthly declines but rising 590.63% annually amid market turbulence. - "Calm Long King" trader increased ZEC short positions to $2.51M (10x leverage) with a $20K unrealized gain, contrasting losses in BTC and SOL shorts. - The trader's $17.29M ZEC short exposure reflects volatile market dynamics, with leveraged positions showing mixed gains/losses as crypto prices swing sharply. - ZEC's 24-hour rebound highlights risks for short sellers in a m