XPL surges by 1227.7% within a day as robust upward momentum and institutional purchases drive gains

- XPL surged 1227.7% in 24 hours to $1.3662, driven by institutional buying and strong retail participation. - Technical analysis shows XPL breaking resistance levels and trading near an ascending channel's upper bound, reinforcing bullish patterns. - Analysts project continued momentum above $1.20 support, with RSI in overbought territory signaling caution but not reversal. - A backtesting strategy tests the trend's reliability by simulating a long-position with stop-loss and profit-locking parameters.

On September 27, 2025,

This recent price action seems to be fueled by a significant wave of institutional investments. Several substantial purchase orders have been observed on leading exchanges in the past 72 hours, reflecting growing confidence in XPL’s future prospects. Although retail traders are still highly active, the scale of institutional buying indicates that major investors are building positions, possibly with a long-term outlook. The asset has surpassed earlier resistance points and is now trading close to the top of a well-defined upward channel, a technical pattern typically linked to ongoing bullish trends.

Looking at technical indicators, XPL’s price chart displays a consistent pattern of higher highs and higher lows, which supports a positive outlook. Experts believe that as long as the price stays above the $1.20 support mark, the upward movement could persist in the short term. Should this support fail, a brief pullback may occur, but the strong buying activity suggests a prolonged drop is unlikely. The RSI indicator has entered overbought levels, so while some caution is advised, a minor dip may not necessarily mean a trend reversal.

The asset’s recent gains have also sparked conversations about market sentiment and psychology. The rapid and substantial price jump is considered unusual for assets outside of major macro categories, with some comparing it to past speculative booms in digital currencies. Still, the involvement of institutional investors offers a different perspective, hinting that this rally may not be solely driven by retail speculation.

Backtesting Strategy

To evaluate the reliability of XPL’s current technical setup, a backtesting approach has been proposed. This method simulates entering a long position at the breakout point of the ascending channel, setting a stop-loss at the latest support level. The exit strategy relies on a 15% RSI divergence from the overbought area, combined with a trailing stop to secure profits. The premise is that this tactic would have captured most of the 24-hour surge and exited before any significant pullback. The goal is to determine whether similar technical patterns have historically produced favorable risk-adjusted returns in comparable market environments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Role of Stablecoins in Building Modern Financial Systems

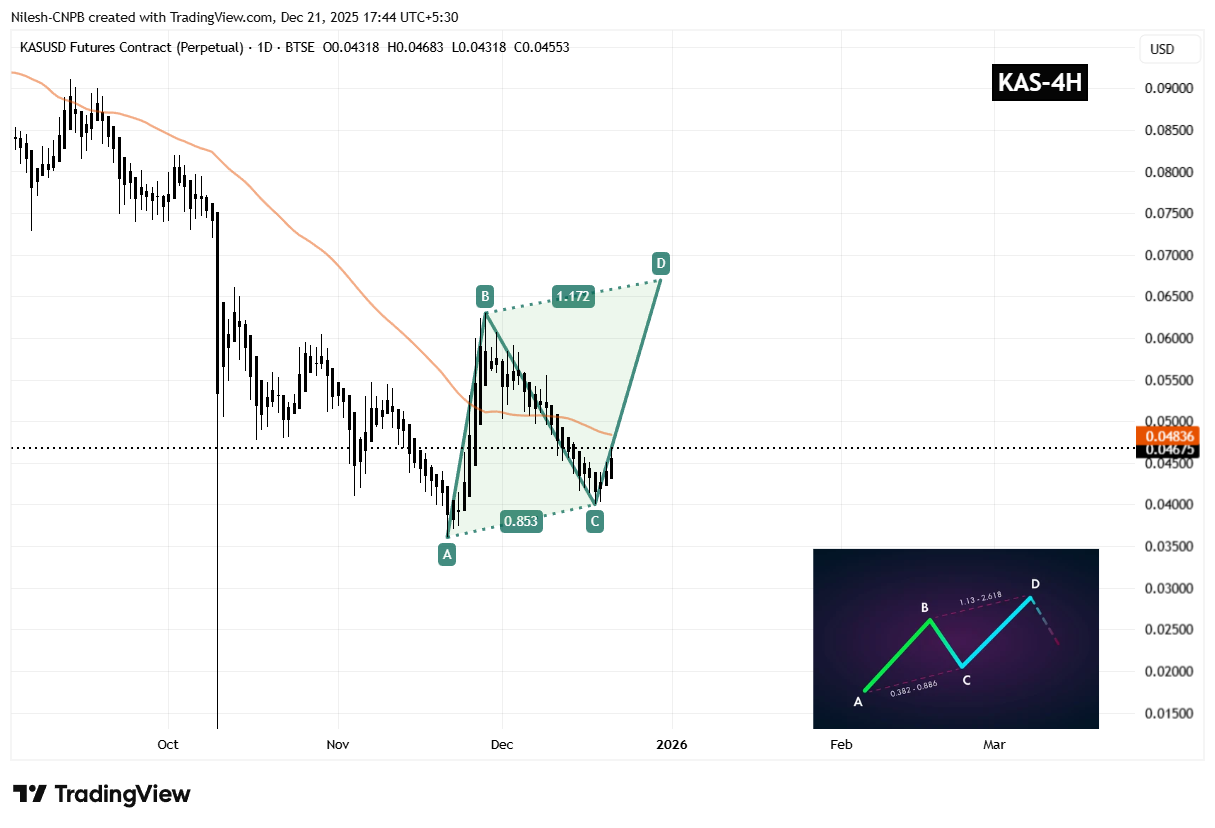

Kaspa (KAS) To Climb Higher — Key Emerging Pattern Formation Suggest So!

Best Crypto to Buy Now December 2025: DeepSnitch AI’s 100X Narrative Captures the Interest of Mantle and Toncoin Investors