Trader Says Bitcoin Could Crash by Double Digits, Outlines Path Forward for Ethereum and XRP

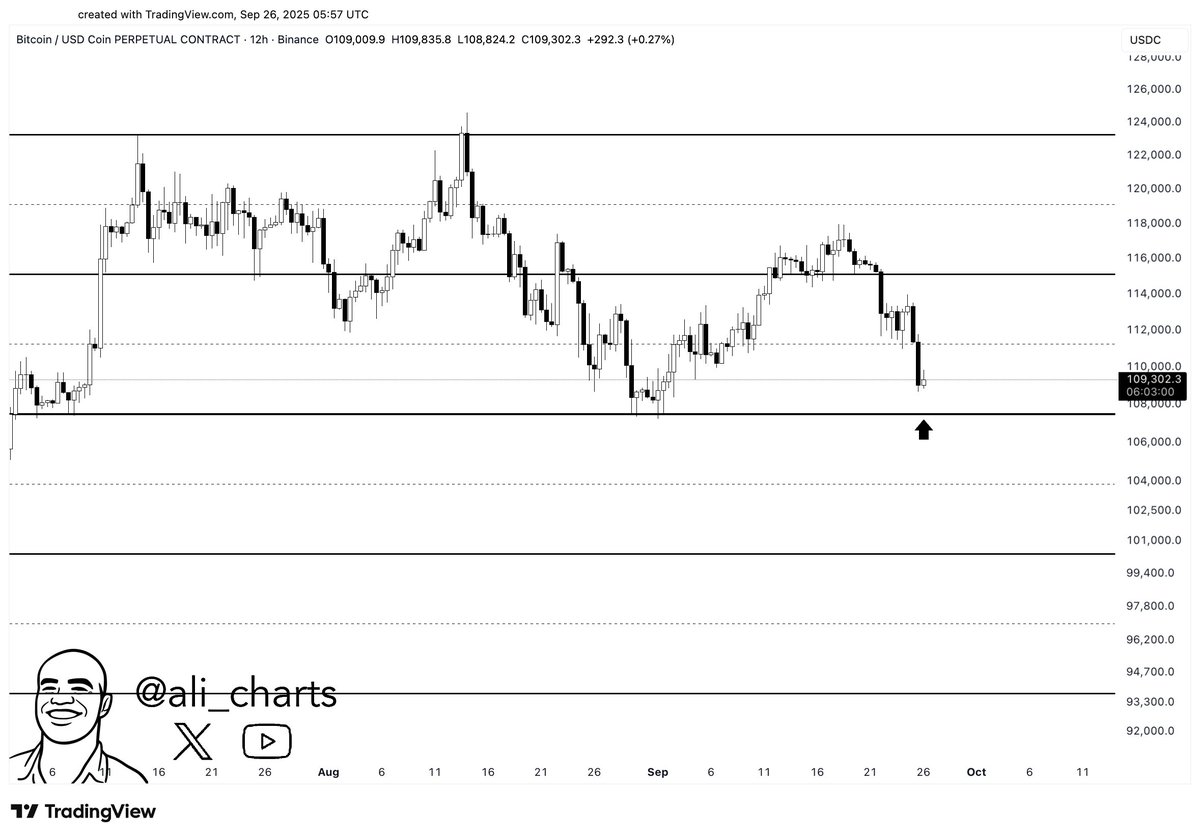

Cryptocurrency analyst and trader Ali Martinez is warning of a massive Bitcoin crash if BTC fails to hold one key level as support amid this week’s market decline.

Martinez tells his 158,100 followers on X that Bitcoin may decrease more than 14% from its current value if the flagship crypto asset fails to hold $107,200 as support.

“$107,200 is the crucial support for Bitcoin. Lose it, and $100,000 or even $93,000 come into play.”

Source: Ali Martinez/X

Source: Ali Martinez/X

Bitcoin is trading for $109,020 at time of writing, down 2% in the last 24 hours.

Next up, the analyst says that based on the MVRV (Market Value to Realized Value) Extreme Deviation Pricing Bands, if Ethereum holds $4,841 as a support level ETH may soon hit a new all-time high.

The MVRV Extreme Deviation Pricing Bands are used in on-chain analysis to identify potential market tops and bottoms.

“Ethereum must break $4,841 to reverse the downtrend and aim for $5,864. Fail, and a correction to $2,750 comes into play.”

Source: Ali Martinez/X

Source: Ali Martinez/X

ETH is trading for $3,953 at time of writing, down 1.2% in the last 24 hours.

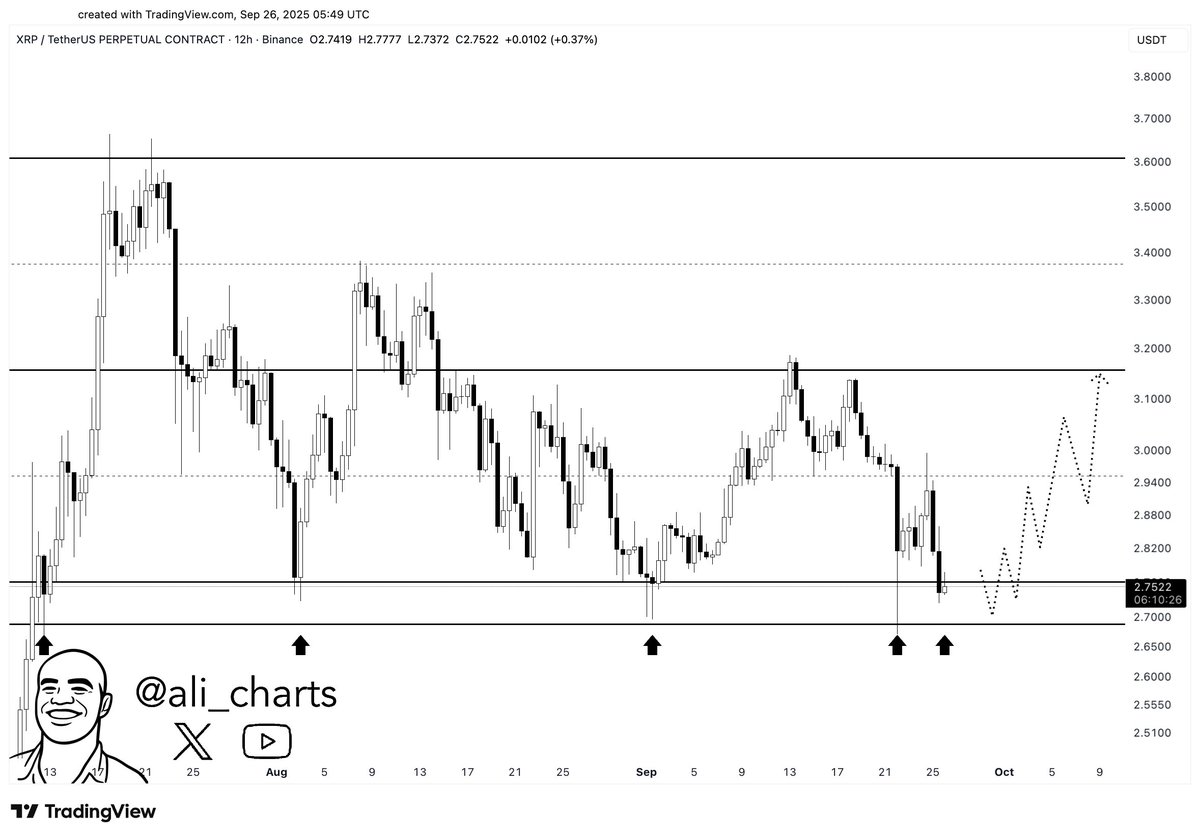

Looking at XRP , the analyst says that the payments token must hold $2.70 as support to potentially regain bullish momentum in the near term.

“XRP must hold $2.70 support to keep the chance of a rebound to $3.20 alive!”

Source: Ali Martinez/X

Source: Ali Martinez/X

XRP is trading for $2.74 at time of writing, down 3.2% on the day.

Featured Image: Shutterstock/IgorZh

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KITE Price Forecast Post-Listing: Understanding Market Reactions and Institutional Strategies Amidst a Fluctuating IPO Environment

- Vyome Holdings (KITE) adopts a dual-listing strategy on Nasdaq and SGX-Nasdaq bridge to diversify investors and liquidity, aligning with high-growth tech IPO trends. - Institutional ownership remains fragmented (0.43% held by major banks as of Nov 2025), reflecting cautious hedging amid regulatory and economic uncertainties. - While tech IPOs thrive on AI-driven narratives, KITE faces retail real estate sector challenges including $0.07/share Q3 losses and anchor tenant bankruptcies. - Clinical progress

Sony launches USDSC stablecoin for Soneium blockchain

XRP Compresses in a Tight Range as Major Liquidity Builds Above $2.10

BNB Trades Near $910 as Price Holds Above Key Support at $893.11