Solana’s vision to become the Onchain NASDAQ is strengthened as it acquires essential blockchain infrastructure

- Jito launches BAM on Solana, shifting to open-source to boost transparency, privacy, and app-level customization in block building. - BAM uses TEEs for secure transaction sequencing, with plugins enabling custom logic for ACE use cases like DeFi. - The move aims to expand Solana’s developer ecosystem, supporting its "onchain NASDAQ" vision and generating $15M+ annual revenue. - Market reactions are bullish, with SOL surging past $200 and institutional inflows reaching $39M weekly. - Jito plans phased ope

Jito has introduced its Block Assembly Marketplace (BAM) on the

The move to BAM is set to greatly broaden Solana’s developer community. Cindy Leow, Drift’s co-founder, commented that BAM could help Solana achieve its goal of becoming an “onchain NASDAQ” by supporting financial tools that need sequencing control and privacy guarantees Jito launches BAM on Solana mainnet amid rising competition [ 1 ]. JitoDAO, the protocol’s governance body, will benefit directly, as $JTO holders have recently voted to allocate

BAM’s design tackles persistent issues in Solana’s MEV system, such as lack of transparency in transaction ordering and risks of front-running. By keeping transactions confidential until they are executed and supplying cryptographic proofs, BAM limits harmful MEV extraction and enables programmable blockspace. For example, Plugins allow oracle services like

The BAM launch comes as competition in Solana’s infrastructure intensifies. Competitor Raiku recently secured $15 million in early funding rounds led by Pantera Capital, while Anza is enhancing its Agave validator client for better speed and stability Jito launches BAM on Solana mainnet amid rising competition [ 1 ]. Despite this, Jito remains the leading infrastructure provider on Solana, with more than 97% of the network using its validator client and jitoSOL holding the top market share. Early BAM Validators include Triton One,

Market sentiment towards BAM has been positive. Solana (SOL) climbed above $200 for the first time since March 2025, fueled by investor confidence in BAM’s ability to improve transaction throughput and generate revenue from blockspace Solana Breaks $200 as Jito’s BAM Draws Bullish Bets [ 7 ]. Institutional interest in Solana is also on the rise, with weekly inflows into

Jito’s BAM roadmap features staged rollouts to ensure both security and decentralization. The initial “Launch” stage has Jito Labs running BAM Nodes while validators like Triton One and Helius join the network. The “Scale” stage targets expanding BAM Node operators and validators to over 30% of network stake, with the first Plugins starting to generate fees. The “Accelerate” phase will open-source BAM’s codebase, encouraging community-led development and increasing node operators to more than 50 globally distributed participants Introducing BAM: The Future of Block Building on Solana [ 2 ].

The Ecosystem Advisory Committee, which includes the Solana Foundation, will oversee BAM’s growth to ensure it aligns with decentralization objectives. Jito Labs intends to phase out its governance role, handing over control to the DAO as BAM evolves into a permissionless platform. This transition highlights the protocol’s dedication to community governance while relying on Jito’s technical strengths for ongoing reliability Introducing BAM: The Future of Block Building on Solana [ 2 ].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Big Bull Cathie Wood Discusses Bitcoin Price: “The Four-Year Cycle Is No More”

New Arbitrum Wallet Executes TWAP to Buy $2M Worth of HYPE Tokens While Holding About $7M USDC

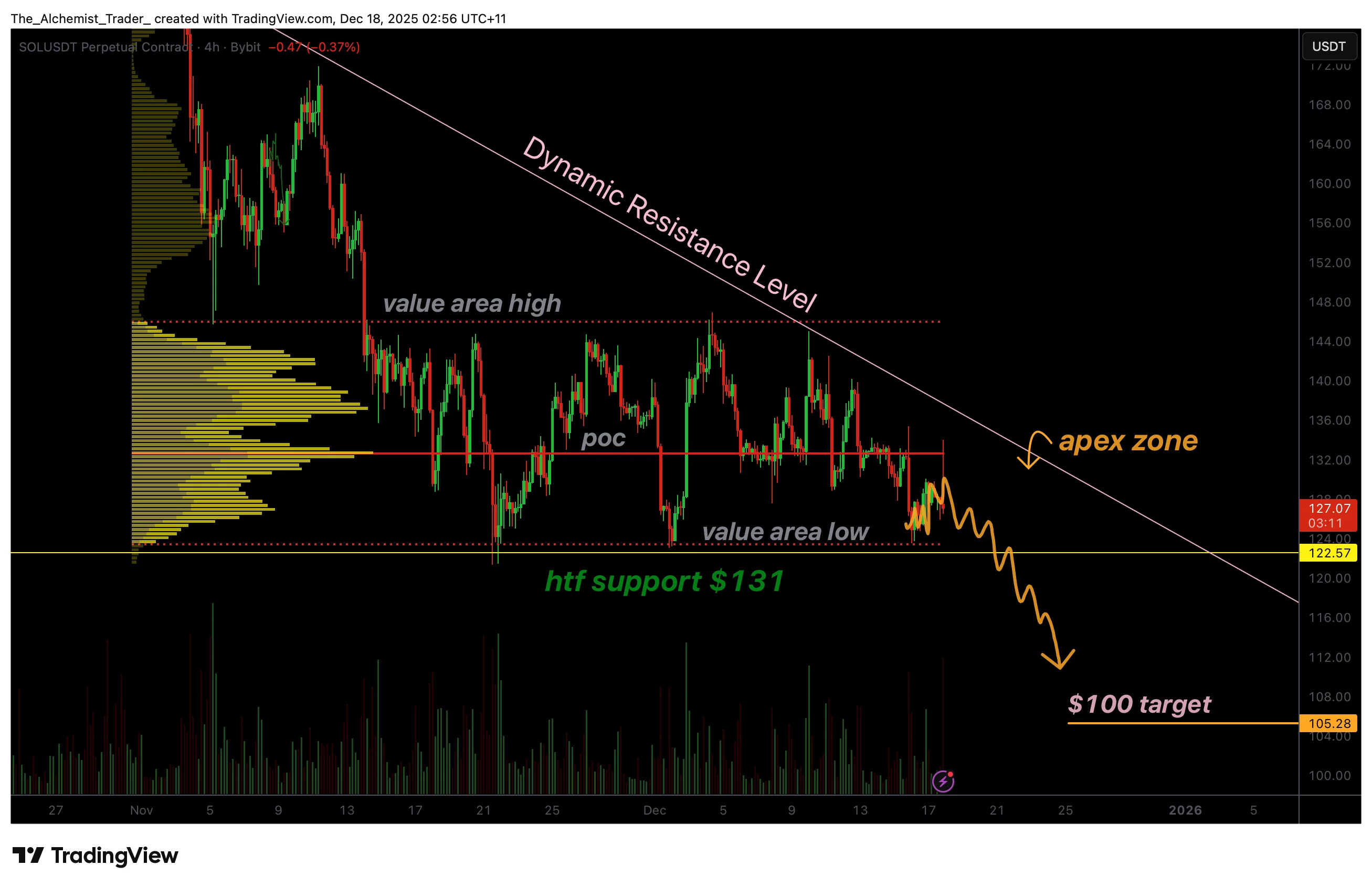

Solana price compresses into triangle apex, breakout risk builds

Ethereum price forms an ABCD correction pattern, putting $2,500 in focus