Theta's $200M blockchain investment fund targets a 25% internal rate of return despite facing market volatility and regulatory hurdles

- Theta Capital Management launched its fifth blockchain fund, targeting $200M with a 25% net IRR. - The fund-of-funds strategy invests in crypto-native VCs like Pantera and Polychain, leveraging their expertise. - Despite 2025 market challenges (e.g., $1.7B Q2 crypto VC funding), institutional demand persists for early-stage blockchain opportunities. - Regulatory risks and AI/ETF competition remain, but Theta's prior 32.7% IRR (2018-2024) demonstrates sector resilience.

Theta Capital Management, an investment company based in Amsterdam with a focus on digital assets, has introduced its fifth blockchain-centric fund, Theta Blockchain Ventures V, with a fundraising goal of $200 million. The fund plans to back 10 to 15 venture capital (VC) firms that specialize in digital assets, aiming for a net internal rate of return (IRR) of 25%. This move highlights Theta’s ongoing commitment to blockchain advancement and fits within its broader strategy to seize early-stage opportunities in the digital asset space title1 [ 1 ] title6 [ 6 ].

Theta’s new fund adopts a “fund-of-funds” model, meaning it will invest in specialized crypto-focused VC firms rather than directly funding startups. This approach draws on the knowledge of established venture capital managers such as Pantera Capital, Polychain Capital, and CoinFund, all of which have a history of strong performance in the blockchain sector. Managing around $1.2 billion in assets, Theta has already proven the effectiveness of this strategy, posting a 32.7% net IRR across its previous four blockchain funds between 2018 and 2024 title6 [ 6 ] title7 [ 7 ].

The launch of this fund comes at a time when the blockchain venture capital environment is mixed. Although VC investment in the field has been relatively low in 2025, with just $1.7 billion going to 21 crypto-focused funds in the second quarter, there is still appetite for high-quality institutional opportunities. Galaxy Digital observed that competition from artificial intelligence (AI) and spot ETFs has drawn some investment away from crypto. Nevertheless, Theta’s emphasis on early-stage projects positions it to benefit as the industry evolves title6 [ 6 ] title4 [ 4 ].

This strategy also points to increasing institutional trust in blockchain technology. Theta’s earlier funds have backed significant contributors to the crypto landscape, helping to advance decentralized finance (DeFi), blockchain infrastructure, and digital asset protocols. By aiming for a 25% net IRR, Theta seeks to capture the sector’s growth potential while managing risk through a diversified selection of VC managers title1 [ 1 ] title7 [ 7 ].

Nonetheless, the sector still faces hurdles such as regulatory ambiguity and market fluctuations. The fund’s performance will rely on its ability to adapt to these challenges and select VC managers with a strong history of success. Ruud Smets, Theta’s managing partner, stressed the value of specialization, pointing out that VCs focused on crypto now have a notable advantage over generalist investors in early-stage deals.

Theta Blockchain Ventures V’s debut comes after the company’s recent $175 million fundraising for its previous fund, Theta Blockchain Ventures IV, which closed in 2025. This momentum mirrors wider industry trends, with blockchain venture capital investment jumping 54% year-over-year to $4.8 billion in the first quarter of 2025. Even though the number of deals has dropped, the total capital raised has more than doubled compared to the first quarter of 2024, indicating renewed investor confidence.

With a $200 million target for Theta Blockchain Ventures V, the firm is looking to further strengthen its position as a major force in blockchain investing. By concentrating on specialized VC managers and aiming for institutional-level returns, the fund is well-placed to take advantage of the sector’s long-term prospects, despite current market challenges title1 [ 1 ] title6 [ 6 ].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CLARITY Act explicitly leaves DeFi rules blank, risking a total retail protection collapse if negotiations fail

Watch Out: Numerous Economic Developments and Altcoin Events This Week! Here’s the Day-by-Day, Hour-by-Hour List

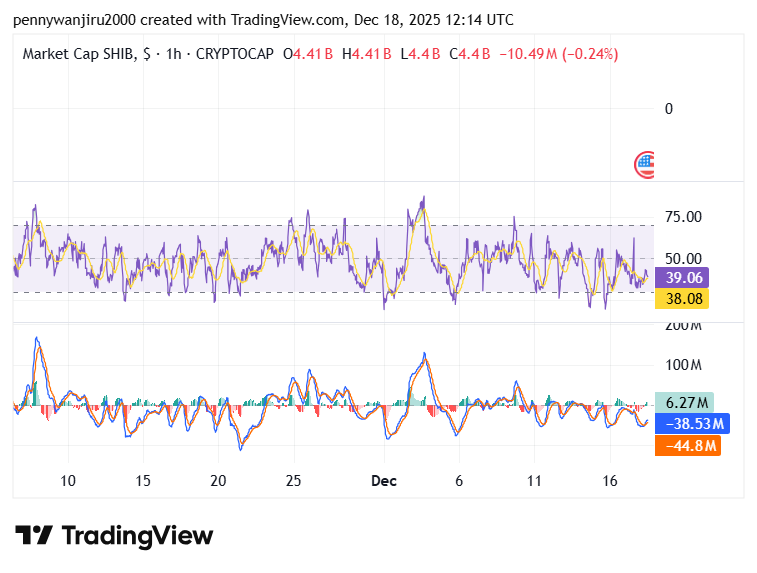

Shiba Inu Price Slips 2.9% as SHIB Defends $0.0574 Support Amid Tight Trading Range

The 15 Most Searched Altcoins in Recent Hours Have Been Revealed – Here’s the List