Justin Sun Reportedly Controls Over 60% Of Tron’s (TRX) Supply

A new report alleges that Justin Sun holds most TRX tokens, casting doubt on Tron's decentralization and fueling market uncertainty.

A new report claims that Justin Sun holds over 60% of all Tron tokens. Although the project ostensibly aims to promote decentralization, one man allegedly holds control over TRX.

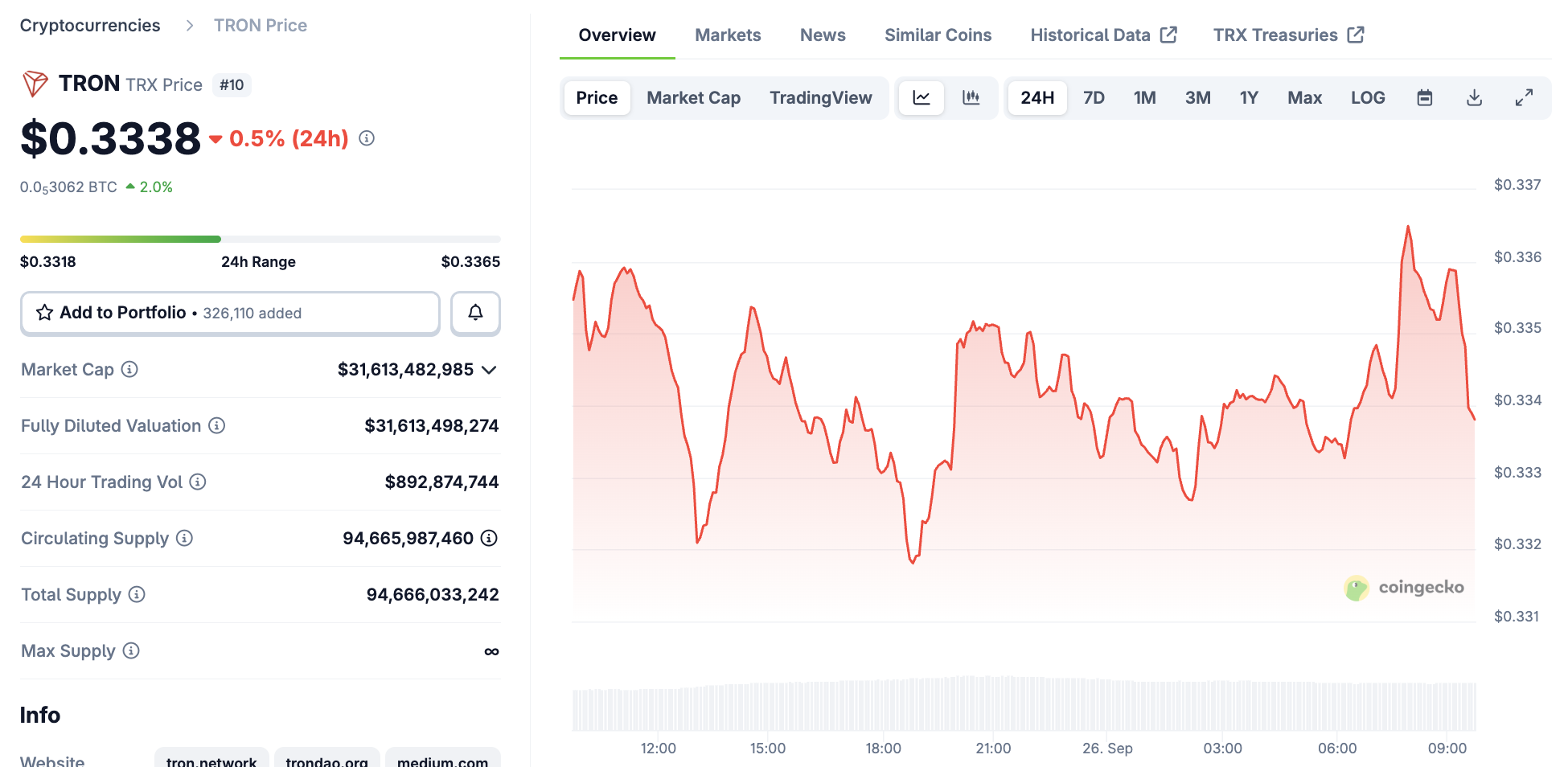

TRX price hasn’t wildly reacted to this rumor yet. The jury’s still out as to whether or not this scandal causes lasting reputational damage.

Justin Sun’s Tron Holdings

Justin Sun has been involved in a few controversies this month, apparently offering to invest in WLFI after World Liberty froze his wallets.

Today, however, a new report from Bloomberg made a bold claim that Justin Sun himself controls over 60% of all Tron (TRX) tokens.

This report, which allegedly sourced its Tron data from Justin Sun’s own team, would be a bombshell for the community. TRX is marketed as a decentralized blockchain smart contract system, aiming to advance decentralization across the Internet.

Simply put, there’s nothing decentralized about one man owning more than half of all circulating tokens. Tron’s price has been volatile througout the week, but it hasn’t reacted wildly to the latest rumors.

Tron Price Performance. Source:

CoinGecko

Tron Price Performance. Source:

CoinGecko

One Battle After Another

Justin Sun has been pursuing a legal battle against the publication over these Tron claims, although the courts ruled against him this week.

In past years, Sun has levied lawsuits towards a few media outlets regarding critical press coverage, but this effort has apparently been unsuccessful. If he wishes to sue Bloomberg for libel, that’ll force both parties to publicize their proof.

All things considered, social media chatter has been fairly tame, with most commentators acting unsurprised. To be clear, reactions have not been positive, but crypto analysts have been more likely to affectionately call Justin Sun “the second-biggest market manipulator in the game” over his Tron holdings than act indignant.

Justin Sun is the second best MM in the game behind senor CZ & https://t.co/kzzuPjGpUt

— woods.ai (@robw00ds) September 26, 2025

It’ll be interesting to see how these bold claims actually impact TRX’s market performance in the long run. Justin Sun already faced controversy when Trump’s SEC dropped its investigation after huge WLFI purchases.

Will one more round of bad press change the community’s opinion any further?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Increasing Economic Strain of Alzheimer’s Disease and Its Effects on Healthcare Systems and Long-Term Care Industries

- Alzheimer's disease's global economic burden is projected to surge from $1.6 trillion in 2023 to $14.5 trillion by 2050, straining healthcare systems and public infrastructure. - The Alzheimer's therapeutics market is growing at 23.4% CAGR, driven by disease-modifying therapies and tech innovations like AI-driven care platforms. - Strategic investments in dementia infrastructure include $3.9B U.S. NIH funding and startups like Isaac Health securing $10.5M for in-home memory clinics. - Public-private part

Building Robust Investment Portfolios: Insights Gained from Economic Crises and Policy Actions

Hyperliquid (HYPE) Price Rally: The Role of DeFi Advancements and Investor Sentiment in Driving Recent Market Fluctuations

- Hyperliquid (HYPE) surged to $59.39 in 2025 before retreating, driven by DeFi innovations and volatile market sentiment. - Technical advancements like HyperBFT consensus and USDH stablecoin attracted 73% of decentralized trading volume, while institutional partnerships stabilized the ecosystem. - Despite short-term volatility near $36, bullish RSI patterns and $3 trillion trading volume suggest potential for a $59 rebound, though sustained momentum above $43 is critical. - Analysts project HYPE could rea

The Driving Forces Behind Economic Growth in Webster, NY

- Webster , NY, transformed a 300-acre Xerox brownfield into a high-tech industrial hub via a $9.8M FAST NY grant, boosting industrial and real estate growth. - Public-private partnerships enabled infrastructure upgrades, attracting $650M fairlife® dairy projects and 250 high-paying jobs by 2025. - Industrial vacancy rates dropped to 2%, while residential values rose 10.1% annually, highlighting synergies between infrastructure and economic development. - The model underscores secondary markets' potential