Key Notes

- SOL experiences five consecutive losing days since September 21, marking its worst performance in over three weeks.

- Derivatives data shows extreme bullish capitulation with $45M in long liquidations versus only $2M in short positions.

- Technical indicators including RSI at 37.47 and BBP at -35.47 signal continued bearish momentum ahead.

Solana SOL $199.7 24h volatility: 6.3% Market cap: $108.55 B Vol. 24h: $11.22 B price plunged below $200 on Thursday, Sept. 25, trading at a 23-day low of $197.65 on Coinbase. The 6.1% price downtrend on Thursday places Solana price firmly on course for a five-day freefall after booking consecutive losing days since Sept. 21.

Solana Price Falls Below $200 Amid $45M Long Liquidations

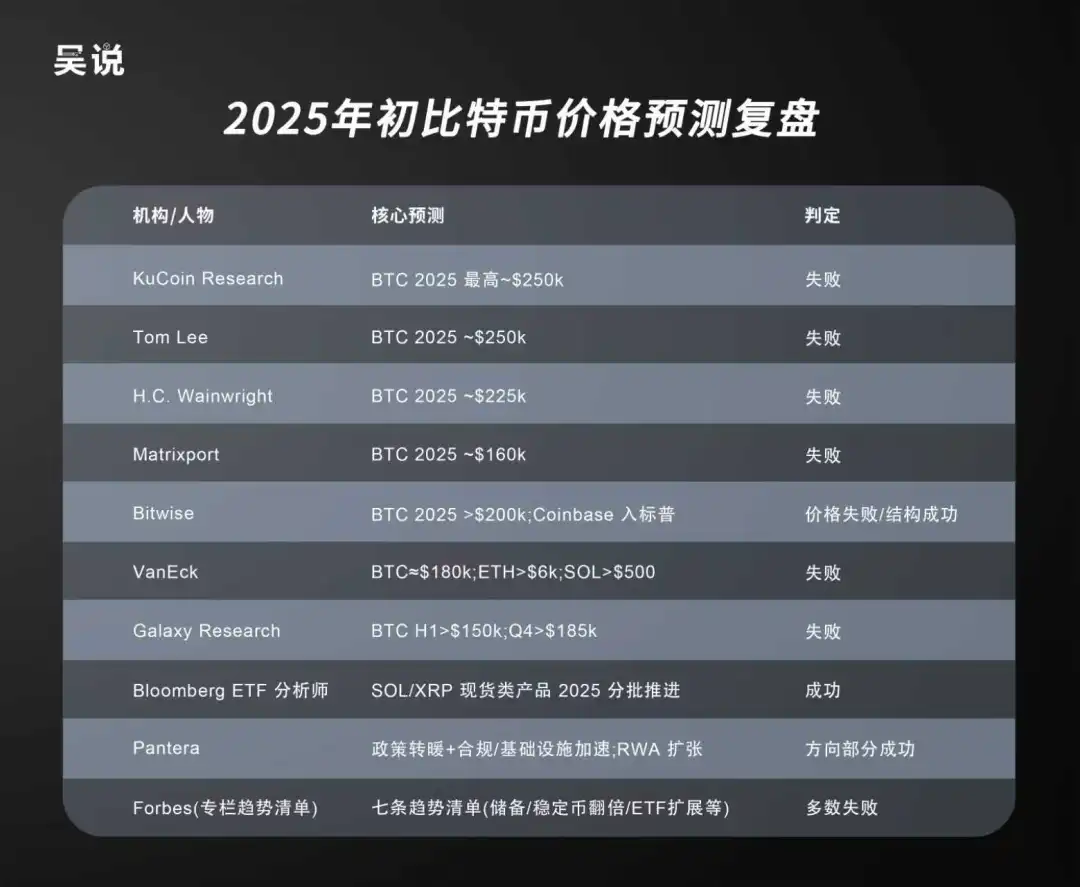

Coinglass data reveals clear signs of panic selling among bullish traders. Solana open interest declined 4.52% to $14.2 billion while intraday trading volume spiked 8.2% to $29.5 billion. This validates bearish overreaction as the 6.1% SOL spot price decline exceeded the futures markets contraction.

Solana Derivatives Market Analysis | Source: Coinglass

More so, Solana derivatives markets saw over $45 million in long positions liquidated, compared with just $2 million in short positions. This imbalance emphasizes how bullish traders capitulated en masse on Thursday after consecutive days of losses, leading to the rapid breakdown below the $200 price level.

Solana’s weak market performance aligns with top crypto assets with Ethereum ETH $3 937 24h volatility: 5.4% Market cap: $475.09 B Vol. 24h: $60.15 B also 6% retracing below $4,000 for the first time in September, while XRP XRP $2.80 24h volatility: 5.1% Market cap: $167.64 B Vol. 24h: $8.94 B also backslid 5.7% to settle at multi-week lows near $2.78. Meanwhile, Bitcoin BTC $109 636 24h volatility: 3.3% Market cap: $2.19 T Vol. 24h: $70.86 B price managed to rebound from $110,650, supported by news of fresh corporate inflows from Europe .

Solana Price Forecast: Can $197 Support Prevent a Deeper Collapse?

Solana price now hovers precariously near the $197.65 support. A decisive close below this key level could expose SOL price to further downturns toward the $189.81 zone.

The Relative Strength Index (RSI) has slipped to 37.47, firmly in bearish territory, suggesting momentum remains tilted against the bulls. Meanwhile, the BBP indicator sits at –35.47, reinforcing weak buyer participation and the dominance of bearish sentiment. The Chande Kroll Stop also sits higher at $209.11, confirming considerable resistance cluster overhead.

Solana (SOL) Price Forecast | TradingView

For bulls, reclaiming the $210 resistance cluster would be the first signal of a bullish reversal. Beyond that, a rebound toward the $254.72 could be on the cards if broader sentiment improves. Conversely, failure to hold $197 opens the door for a sharper retracement, toward the $189 zone before buyers attempt a recovery.

Solana’s near-term price outlook remains relatively fragile. An early bounce from $197 remains unlikely without a significant boost in spot-trading volumes and broader market sentiment.

Given the weight of recent liquidations, buyers appear unwilling to defend their positions within the current macroeconomic conditions .

next