Solana Set to Break 4-Year September Win Streak as Network Activity Slumps

Solana faces mounting bearish pressure as network activity declines, putting its four-year September win streak at risk. Support levels may be tested if sentiment fails to rebound.

Solana appears poised to close this month in the red, diverging from a four-year streak of historically positive September performances.

A broader dip in market sentiment, with key on-chain metrics pointing to declining network activity, could push SOL’s price lower as the month nears its end.

SOL Network Activity Declines, Market Sentiment Turns Negative

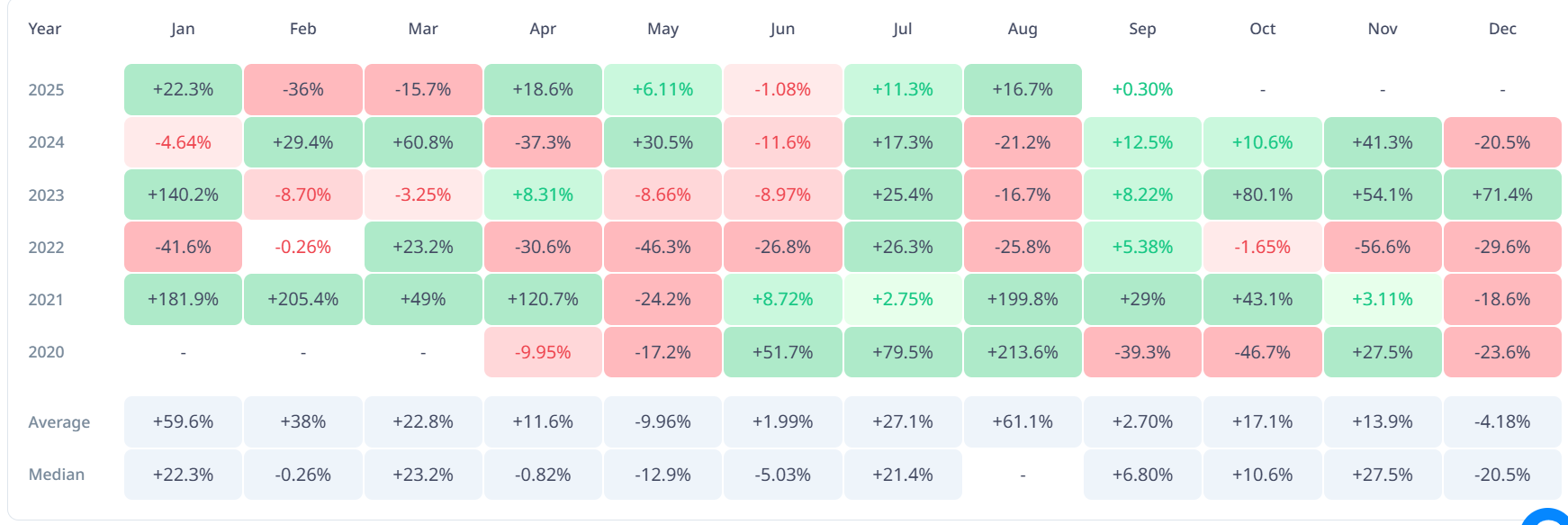

Over the past four years, September has consistently delivered gains for SOL. In 2021, SOL surged by 29%, followed by a more modest but steady 5.38% rise in 2022. The momentum strengthened in 2023, when the token climbed 8.22%, and continued in 2024 with a solid 12.5% increase.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

However, this year appears different, as SOL looks poised to close September at a low, breaking its winning streak.

Solana Historical Monthly Returns. Source:

Solana Historical Monthly Returns. Source:

Solana Historical Monthly Returns. Source:

Solana Historical Monthly Returns. Source:

Despite starting the month strongly, SOL peaked at $253.51 on September 18 but has since fallen roughly 17%, reflecting growing bearish pressure.

This drop is partly attributed to the waning bullish sentiment in the market and primarily due to the weakening user engagement on the Solana network.

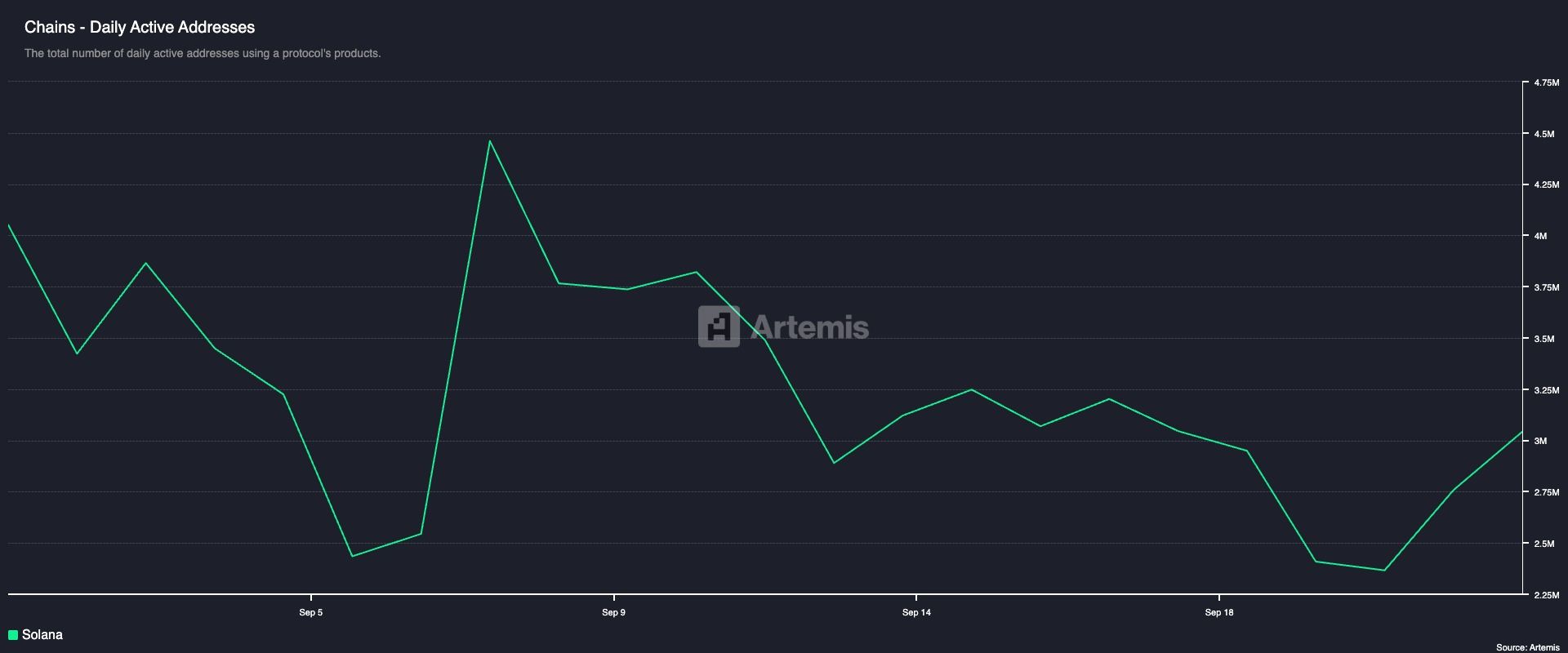

According to Artemis, the total number of daily active addresses interacting with Solana-based protocols has totaled 3.04 million month-to-date, declining by 25%.

Solana Daily Active Addresses. Source:

Solana Daily Active Addresses. Source:

Solana Daily Active Addresses. Source:

Solana Daily Active Addresses. Source:

Daily active addresses represent the number of unique wallets actively sending, receiving, or interacting with on-chain applications. When it falls, it signals weakening user engagement and lower network activity, which can reduce overall demand for the coin.

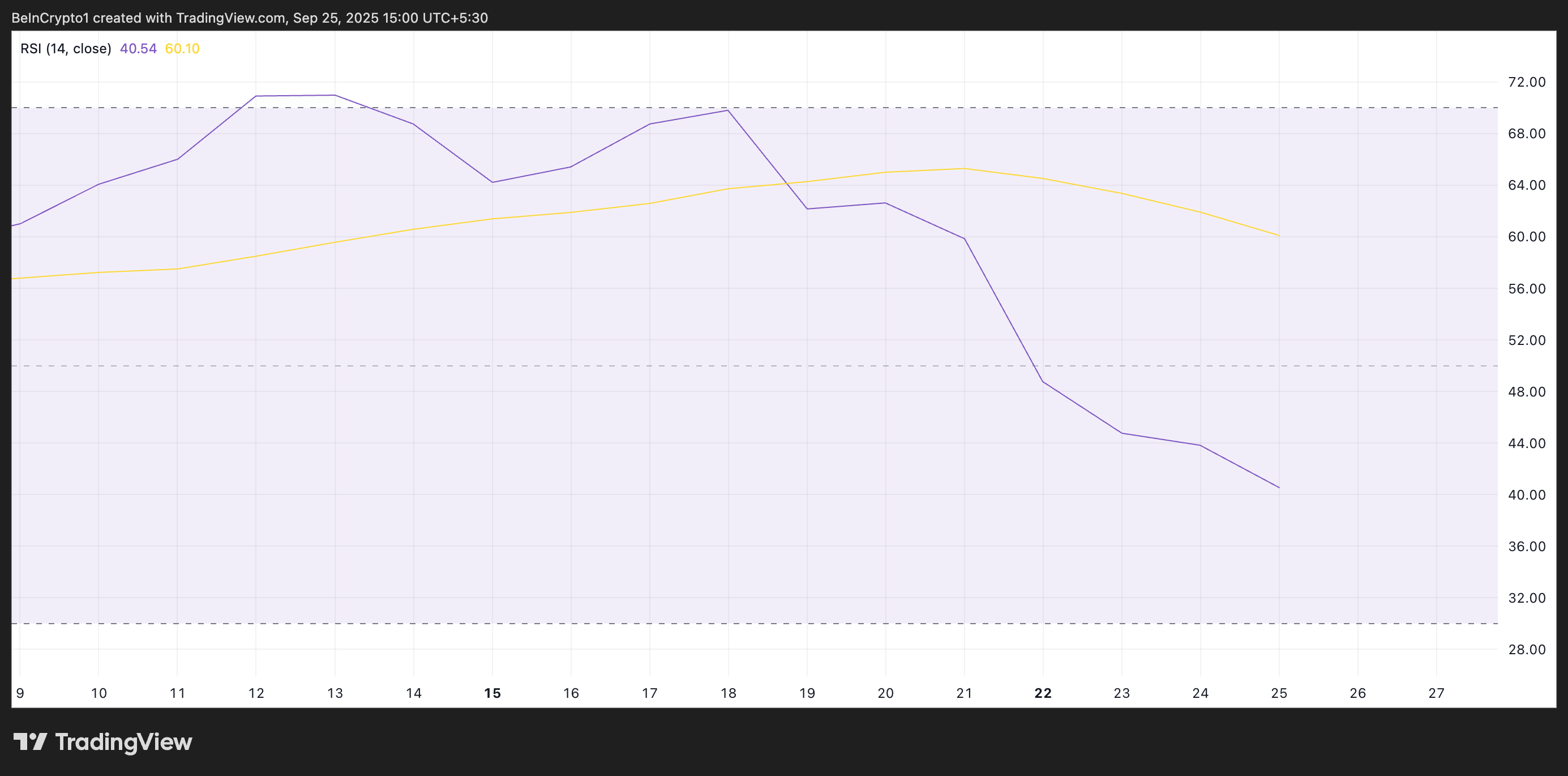

On the technical side, SOL’s plummeting Relative Strength Index (RSI) on the daily chart confirms the falling demand. At press time, this momentum indicator is at 40.54.

Solana RSI. Source:

Solana RSI. Source:

Solana RSI. Source:

Solana RSI. Source:

The RSI measures an asset’s overbought and oversold conditions, with readings above 70 suggesting overbought conditions and below 30 indicating oversold conditions.

At 40.54, SOL’s RSI is in bearish territory, indicating that selling pressure is outweighing buying momentum. While a capitulation phase may not be imminent, downward momentum could persist if bearish sentiment continues.

SOL Poised for Red September Close

If the downward trend continues, SOL may close September below its recent highs. In this scenario, its price could fall toward $195.55. If this support fails to hold, the coin’s price could dip further to $171.88.

Solana Price Analysis. Source:

Solana Price Analysis. Source:

Solana Price Analysis. Source:

Solana Price Analysis. Source:

However, a sudden surge in network activity or a reversal in broader market sentiment could mitigate losses and stabilize the price. With such a catalyst, SOL could rally toward $219.21.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?

Bitcoin rejects at key $93.5K as Fed rate-cut bets meet 'strong' bear case

Bitcoin price action, investor sentiment point to bullish December

Ether outpaces Bitcoin’s trend change: Is ETH on track for a 20% rally?