FTC Exposes Amazon's Deceptive Tactics in $2.5 Billion Settlement for Consumers

- FTC secures $2.5B settlement with Amazon over deceptive Prime enrollment and complex cancellation practices, including a record $1B civil penalty and $1.5B in refunds. - Amazon denied wrongdoing but agreed to overhaul subscription workflows, replacing ambiguous buttons with clear options and simplifying cancellation under third-party oversight. - The case affects 35 million consumers enrolled via "Single Page Checkout," with refunds prioritizing those enrolled without consent, marking the FTC's second-la

The Federal Trade Commission (FTC) has reached a landmark $2.5 billion agreement with

The FTC’s lawsuit, filed in 2023 during Lina Khan’s tenure as chair, alleged Amazon broke the FTC Act and the Restore Online Shoppers’ Confidence Act (ROSCA) by using “dark patterns” in its interface. The agency said these included misleading prompts such as “No, I don’t want Free Shipping,” which secretly enrolled people in Prime. Internal records showed Amazon executives were aware of the issue, with one describing the subscription process as “a bit of a shady world” and another calling unwanted sign-ups “an unspoken cancer.” The FTC also pointed to Amazon’s “Iliad Flow,” a drawn-out cancellation process that forced users through as many as six screens filled with persuasive messages to deter them from leaving Amazon to pay $2.5 billion to settle FTC allegations it duped… [ 2 ].

Amazon, while agreeing to the settlement, denied any misconduct, asserting it followed industry norms and that most Prime members joined willingly for the service’s perks. The company noted it offers several ways to cancel, including by phone and online. Nevertheless, the FTC argued that Amazon intentionally hid key details like auto-renewal and pricing during sign-up. The settlement compels Amazon to revamp its systems, replacing vague buttons with clear opt-out choices, fully disclosing subscription details, and making cancellation as straightforward as enrollment. An independent monitor will oversee the refund process to ensure compliance Amazon, FTC Agree To $2.5B Settlement In Prime [ 3 ].

The agreement could affect up to 35 million people who may have been signed up between June 2019 and 2025 through Amazon’s “Single Page Checkout.” Refunds will be prioritized for those who were enrolled without permission or who encountered obstacles when trying to cancel. The $1.5 billion in restitution is the FTC’s second-largest payout ever, surpassed only by the $5 billion Facebook privacy settlement in 2019. The deal also holds two senior executives—Neil Lindsay and Jamil Ghani—personally responsible, highlighting the FTC’s emphasis on individual accountability FTC is suing Amazon for making Prime Subscriptions tough to… [ 4 ].

This settlement follows a partial FTC win in August 2025, when a judge found Amazon broke consumer protection laws by collecting payment details before revealing Prime’s terms. The trial, which was expected to last a month, ended after the settlement was reached. While this resolves the Prime subscription dispute, Amazon still faces a separate FTC antitrust case over alleged monopoly practices, scheduled for trial in 2027. The outcome may influence the broader digital marketplace, as it establishes a standard for regulating “dark patterns.” A 2024 report found that 76% of subscription services use similar retention tactics, indicating the case could have wide-reaching effects on consumer protection Why Amazon is on trial for its deceptive ‘Iliad Flow’… [ 5 ].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

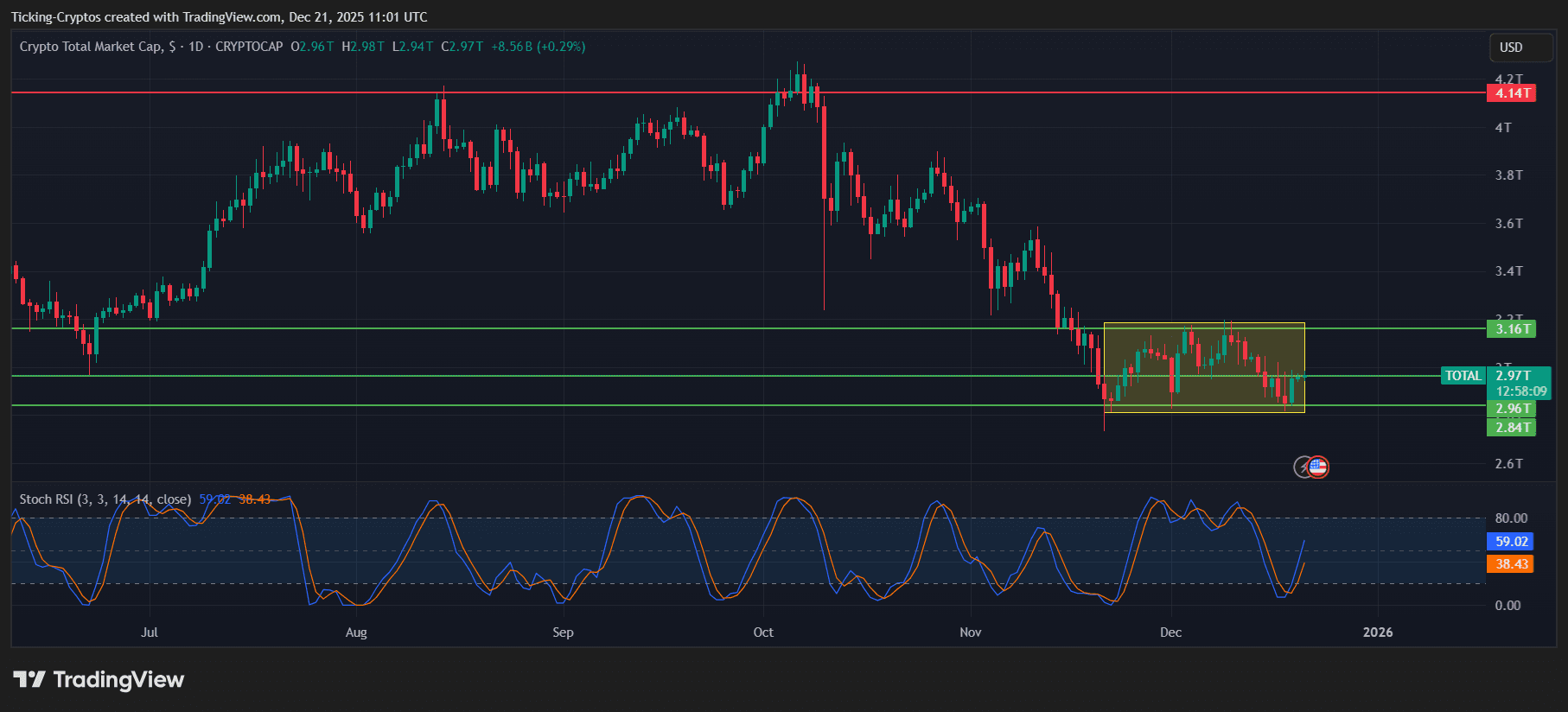

CryptoTicker News: Market Cap Stabilizes as Bitcoin, Ethereum, and XRP Headlines Shape Sentiment

Cryptocurrency Fortunes: Seizing Opportunities in Every Market Cycle

Husky Inu’s (HINU) Next Price Increase Will Take Token Value To $0.00024115

Trump voorspelt economie 2026: XRP koers naar $100? Nu!