Metaplanet Acquires 5,419 BTC Amid Share Price Decline

- Metaplanet acquires 5,419 BTC as shares decline 0.5%.

- Corporate Bitcoin strategy expansion continues.

- Share price down 27.5% for the month.

Metaplanet, led by CEO Simon Gerovich, has acquired 5,419 BTC worth approximately $632.53 million, positioning itself as a leading corporate Bitcoin holder on the Tokyo exchange despite share declines.

Metaplanet’s acquisition highlights the growing trend of corporate interest in Bitcoin, indicating its potential influence on market dynamics and investor sentiment.

Metaplanet has purchased 5,419 BTC for approximately $632.53 million, enhancing its Bitcoin reserves significantly. CEO Simon Gerovich emphasized the critical role of Bitcoin in the firm’s growth strategy.

Key figures include CEO Simon Gerovich and Director of Bitcoin Strategy Dylan LeClair. Both are steering this massive Bitcoin acquisition, positioning the company as a prominent public holder.

This acquisition affects the cryptocurrency market, boosting Metaplanet’s Bitcoin holdings to 25,555 BTC. The share value decreased by 0.5% following this strategic purchase announcement.

Simon Gerovich, CEO, Metaplanet, “Metaplanet’s Bitcoin accumulation business has become the firm’s engine of growth, and has generated consistent revenue and net income.”

With a year-to-date yield of 395.1%, Metaplanet’s financial strategy reshapes its market presence. Share prices have declined 27.5% recently, although they remain up for the year.

This move reflects the growing corporate interest in cryptocurrency investments. Simon Gerovich confirms ongoing efforts to expand Metaplanet’s Bitcoin treasury.

Metaplanet’s strategy mirrors MicroStrategy’s Bitcoin treasury expansion and impacts global crypto asset dynamics. Long-term, this may alter traditional corporate finance models toward digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysts Come Together to Reveal Expectations for 2026, Altcoin Pump Possibility Stands Strong

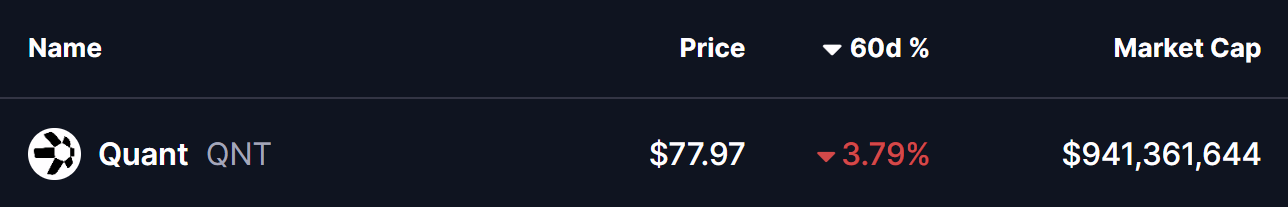

Quant (QNT) Dips To Test Key Support — Could This Pattern Trigger an Rebound?

World-Renowned Investor Ray Dalio Says, “Central Banks Will Never Hold Large Amounts of Bitcoin,” Explains Why