Lista DAO Adjusts Caps on APRs to Bring Stability to DeFi and Attract Institutional Investors

- Lista DAO caps borrowing APRs at 30% across all markets to stabilize DeFi lending and align costs with slisBNB’s yield. - Dynamic slisBNB/BNB rate limits borrowing costs to 70% of the token’s six-month average yield, balancing lender/borrower incentives. - The update aims to attract institutional investors by creating predictable lending conditions amid volatile crypto markets. - Lista’s $74M lisUSD stablecoin competes with MakerDAO while mitigating de-pegging risks through BNB Chain integration. - Despi

Lista DAO, a decentralized protocol for lending and stablecoins, has set a maximum annual percentage rate (APR) of 30% across all its borrowing platforms to help stabilize DeFi borrowing rates. This change, introduced as part of Interest Rate Model (IRM) v1.1, brings in a flexible cap for the slisBNB/BNB market, which is set at 70% of the average six-month yield for slisBNB. The goal of this modification is to maintain a fair balance between lender and borrower incentives while reducing the sharp price fluctuations that have previously caused instability in DeFi lending. According to the protocol’s governance, this step demonstrates a dedication to building a “predictable, equitable, and user-centric borrowing experience” Lista DAO (LISTA) introduces 30% APR ceiling to curb borrowing costs [ 1 ].

The slisBNB/BNB market, which plays a central role in Lista DAO’s ecosystem, now uses a yield-based cap to ensure borrowing rates reflect the performance of slisBNB, a liquid staking asset for Binance Coin. By linking the APR to slisBNB’s historical returns,

At the heart of Lista DAO’s platform is its lisUSD stablecoin, which is pegged to the US dollar and can be borrowed by providing collateral such as

Despite this significant update, LISTA, the governance token for Lista DAO, has experienced downward momentum in line with the broader market. On September 25, 2025, LISTA was valued at $0.2852, a drop of more than 10% in just 24 hours, mirroring a general decline in the crypto market. The total crypto market capitalization slipped below $3.8 trillion, falling by 2% in a single day. Although experts remain positive about the long-term outlook, short-term volatility continues, with forecasts indicating a possible 25.22% decrease to $0.217488 by October 25, 2025 Lista DAO Price Prediction 2025, 2026-2030 - CoinCodex [ 2 ].

The IRM v1.1 update highlights Lista DAO’s proactive approach to the unpredictable nature of DeFi, especially the fluctuating borrowing costs that can discourage institutional involvement. By placing a cap on APRs, the protocol hopes to appeal to a wider audience, including traditional financial players looking for reliable and transparent lending solutions. This initiative is in line with broader industry movements, such as the U.S. GENIUS Act, which seeks to clarify regulations for stablecoin issuers. While Lista DAO is not subject to U.S. regulations, its emphasis on stability is similar to the objectives of federally regulated stablecoin projects like Anchorage Digital’s USA₮ Tether Launches USAT Stablecoin in the U.S.: Here Is How It Could … [ 3 ].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

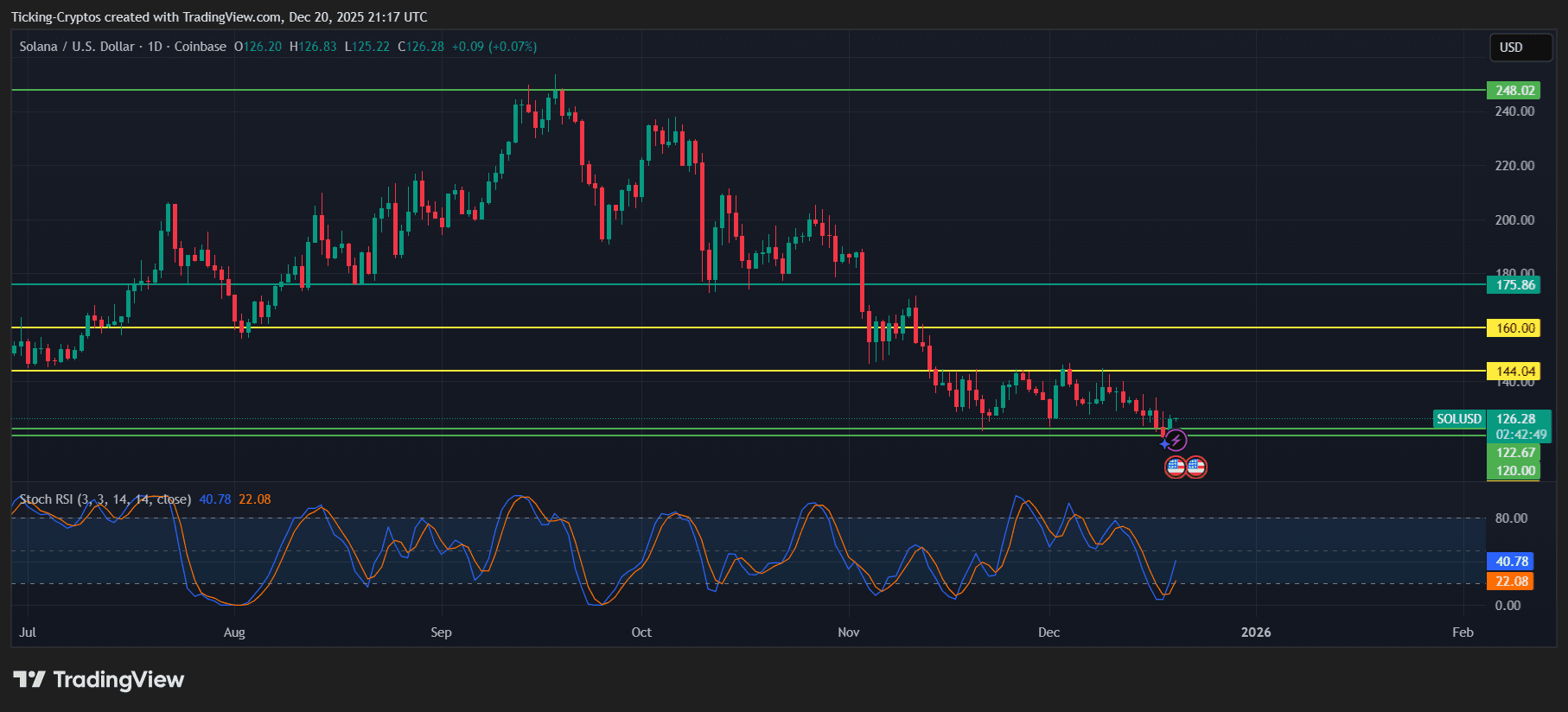

Crypto Price Today: Bitcoin, Ethereum, Dogecoin, and Solana at Key Levels

Banks Need XRP To Be Pricier—Here’s Why A Finance Expert Says So

Midnight Blockchain Draws Attention with Record Trading Volume and Strategic Partnerships

Ethereum Founder Vitalik Buterin Sells Three Altcoins, Onchain Data Shows