HBAR Bulls Could Likely Lose $30 Million As Per This Technical Setup

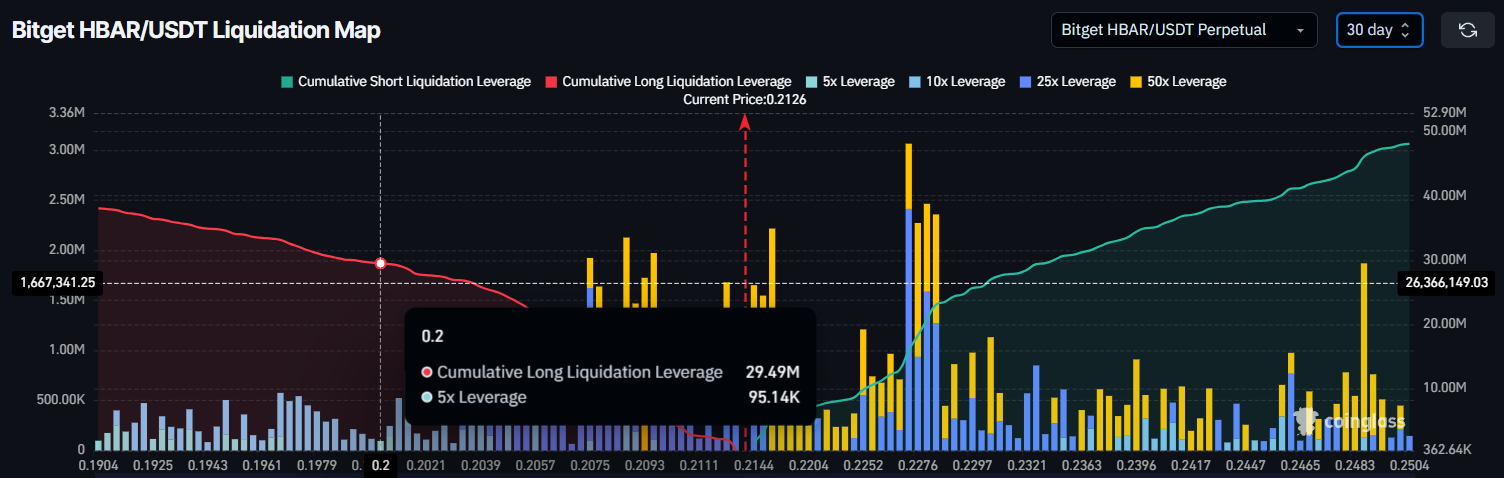

HBAR’s downtrend puts $30 million in long liquidations at risk near $0.200. Reclaiming $0.219–$0.230 is crucial to invalidate the bearish outlook and restore confidence.

Hedera’s native token, HBAR, is facing a challenging technical setup as bearish signals intensify. The altcoin has been stuck in a persistent downtrend, raising concerns about further losses.

If selling pressure continues, the decline could extend into the Futures market, putting millions in bullish contracts at risk.

Hedera Traders Are In Danger

According to the Liquidation Map, HBAR could face significant pressure if its price slides to $0.200. At this level, nearly $30 million worth of long positions are vulnerable to liquidation. Such a move would undoubtedly rattle traders who have remained optimistic despite the recent market downturn.

These potential liquidations could weaken overall sentiment as leveraged traders may scale back on exposure. If the price continues to hover near the liquidation trigger zone, bullish confidence may fade.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

HBAR Liquidation Map. Source:

HBAR Liquidation Map. Source:

From a technical perspective, momentum indicators are signaling a bearish tilt. The Relative Strength Index (RSI) has slipped below the neutral 50.0 mark, showing that sellers are in control. A further dip in the indicator would confirm increasing downside momentum, reinforcing the likelihood of price weakness.

The loss of momentum highlights that HBAR is not gaining enough buying pressure to offset selling activity. Unless market conditions improve quickly, bearish sentiment could dominate. Without renewed demand, the altcoin risks slipping into deeper declines before any signs of recovery surface.

HBAR RSI. Source:

HBAR RSI. Source:

HBAR Price Faces Decline

At the time of writing, HBAR is trading at $0.212, showing clear signs of weakness. The descending wedge pattern suggests the token could retest the lower trend line, signaling further short-term downside. This aligns with the overall bearish sentiment surrounding the market.

The key support sits at $0.202, a level that, if breached, may trigger the $30 million in long liquidations. Such a development would put added pressure on HBAR holders. While recovery may come later, the immediate outlook remains pessimistic unless conditions change quickly.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

However, a shift in momentum could alter the narrative. If HBAR price reclaims $0.219 or even $0.230 as support, it would invalidate the bearish thesis. This would provide traders with renewed optimism and the chance for a potential recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

BEAT heats up, rallies 30%! A key level stands before Audiera’s ATH

Trending news

MoreDTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

Bitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low