Tether Loads the “Gunpowder” for Q4 Rally: USDT Reserves Hit All-Time High in September

Tether’s record USDT issuance in September signals growing liquidity on exchanges. With Q4 historically strong, Bitcoin may see a rally fueled by this cash-ready “gunpowder.”

In the final week of September, many traders faced heavy liquidation losses as nearly $200 billion in market capitalization was wiped out. However, this shock seemed to trigger renewed demand. Fresh data on USDT circulation points to significant buying potential.

Tether accelerated its USDT printing in September, pushing its market capitalization to a new record. At the same time, the volume of USDT deposited on exchanges also rose.

Tether Accelerates USDT Printing During Market Correction

Today, Whale Alert reported that Tether minted an additional 1 billion USDT. Earlier this week, when market capitalization dropped by almost $200 billion, Tether issued another 1 billion USDT.

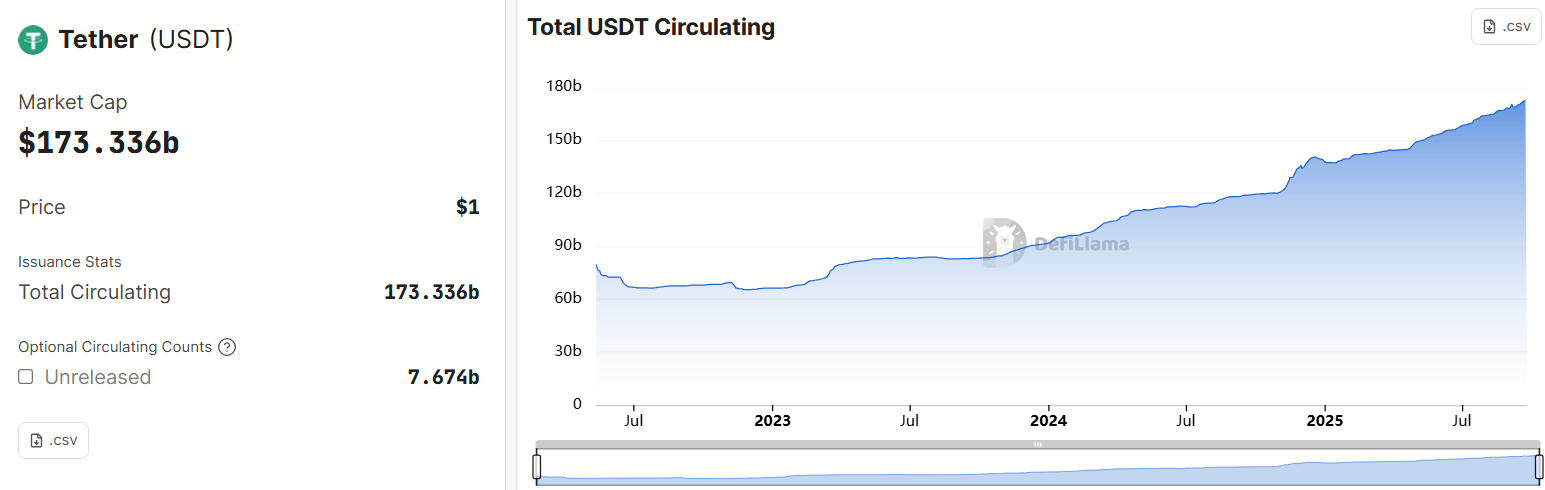

Lookonchain highlighted that Tether’s minting activity surged in September, driving its market capitalization to over $173 billion.

Tether (USDT) Market Cap. Source:

DefiLlama

Tether (USDT) Market Cap. Source:

DefiLlama

“Prices are down, but Tether is printing out fresh USDT. New mints have surged in the last few days-to-weeks,” analyst Maartunn reported.

This constant issuance indicates demand for USDT remains strong despite market corrections. It may also reflect investors’ strategy of waiting for better price levels to buy in.

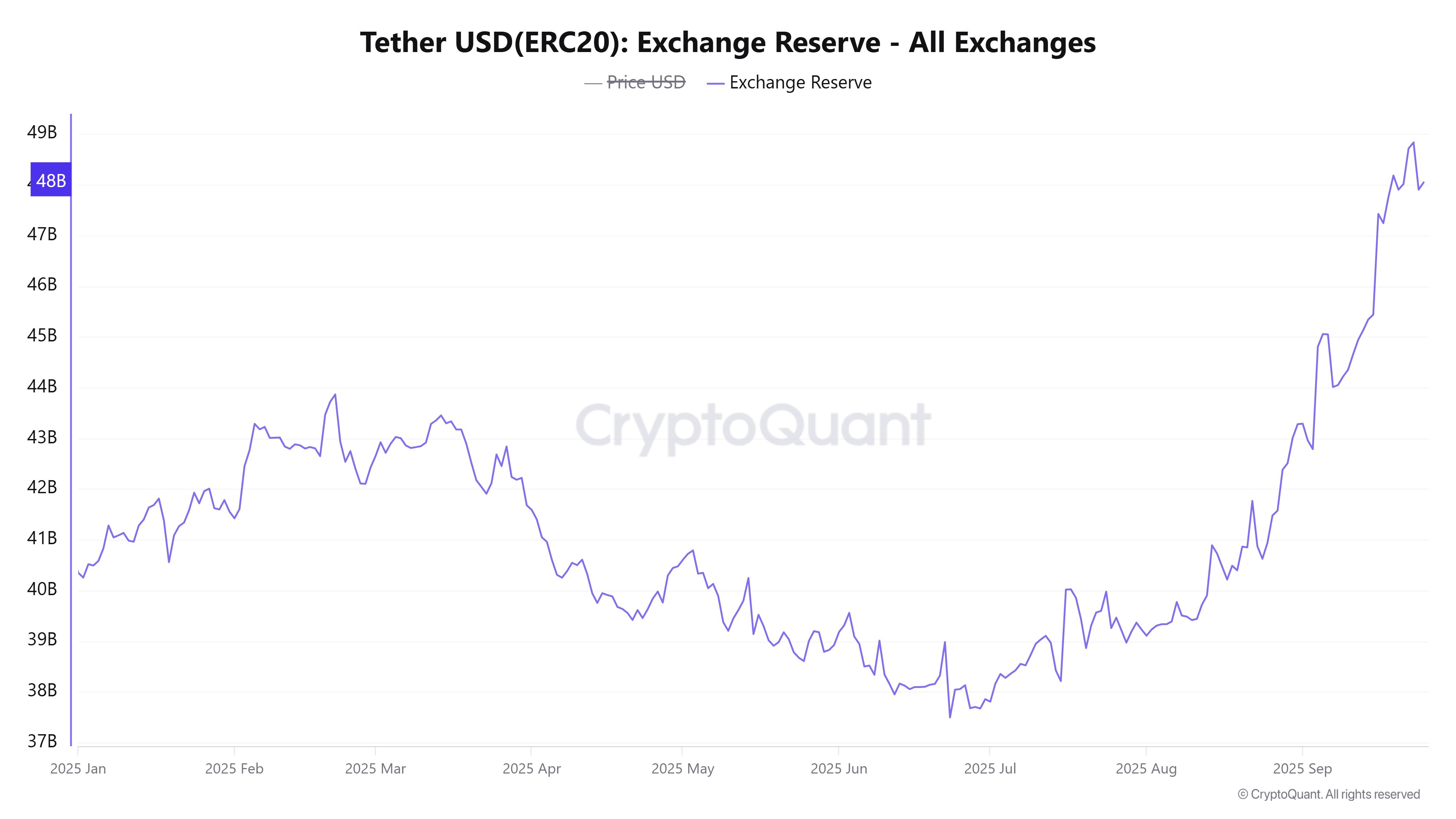

Data from CryptoQuant reinforces this outlook with two key points.

First, USDT (ERC-20) reserves on exchanges climbed from 43 billion USDT to 48 billion USDT in September, an all-time high. A growing balance of USDT on exchanges signals readiness to deploy liquidity when traders spot opportunities in price swings.

Tether (ERC-20) Exchange Reserve. Source:

CryptoQuant

Tether (ERC-20) Exchange Reserve. Source:

CryptoQuant

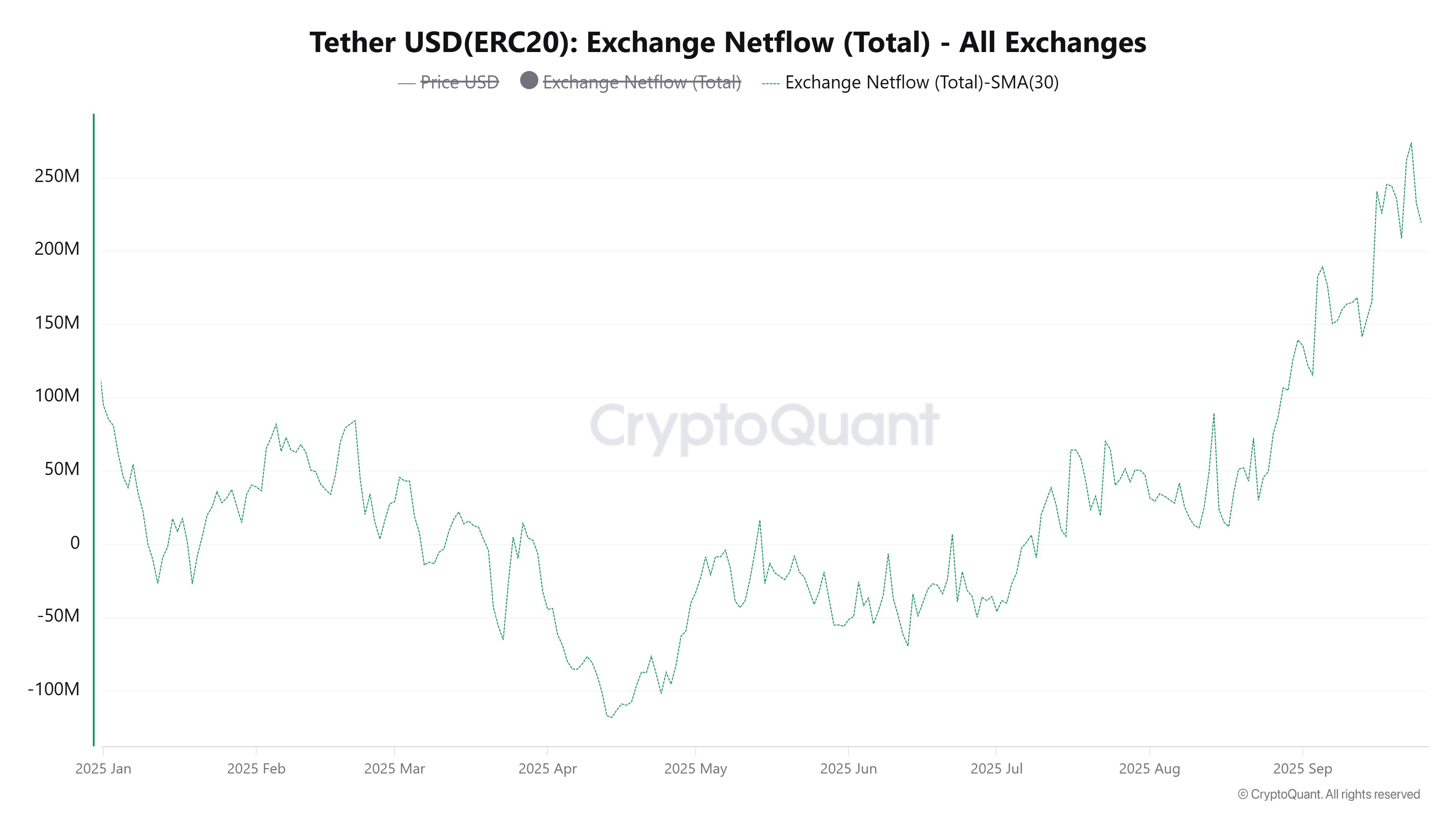

Second, USDT netflow reached a new high in September after steadily climbing since April. Netflow measures the difference between inflows and outflows. A strongly positive netflow means more USDT is moving onto exchanges than leaving them.

Tether (ERC-20) Exchange Netlfow. Source:

CryptoQuant.

Tether (ERC-20) Exchange Netlfow. Source:

CryptoQuant.

Historical data also shows that Tether’s periods of accelerated issuance often preceded major Bitcoin rallies, as seen in early 2023 and late 2024.

Tether “Custoimer” Manipulate Market. Source:

CryptoQuant.

Tether “Custoimer” Manipulate Market. Source:

CryptoQuant.

“They have minted 8 billion USDT this month alone, and there are still 5 days left. I think big whales are getting ready with huge liquidity to buy dips before a big rally,” investor BitBull predicted.

Market statistics add weight to this view. Over the past decade, October has consistently been Bitcoin’s best-performing month, with an average gain of 21.9%. Q4 also stands out as the strongest quarter, with an average return of 85.4%.

The key uncertainty lies in timing—when investors will deploy their USDT balances on exchanges to buy Bitcoin and altcoins. Yet, the “gunpowder” is loaded and could ignite at any moment if a strong catalyst emerges.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What’s going on with restaking?

A deep review of EigenLayer's journey in restaking: the pitfalls encountered and the achievements of EigenDA have all paved the way for the new direction of EigenCloud.

Is the 69 million FDV + JUP staking exclusive pool HumidiFi public sale worth participating in?

An overview of tokenomics and public offering regulations.

Why is the short seller who made $580,000 now more optimistic about ETH?

The truth behind Bitcoin's overnight 9% surge: Is December the turning point for the crypto market?

Bitcoin strongly rebounded by 6.8% on December 3 to $92,000, while Ethereum surged 8% to break through $3,000, with mid- and small-cap tokens seeing even larger gains. The market rally was driven by multiple factors, including expectations of a Federal Reserve rate cut, Ethereum’s technical upgrades, and policy shifts. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.