Does Tom Lee, who bought 2.42 million ETH, actually not understand Ethereum at all?

Unless there is a major organizational change, Ethereum is likely destined to underperform indefinitely.

Unless there is a major organizational transformation, Ethereum is likely doomed to underperform indefinitely.

Written by: Andrew Kang, Partner at Mechanism

Translated by: AididiaoJP, Foresight News

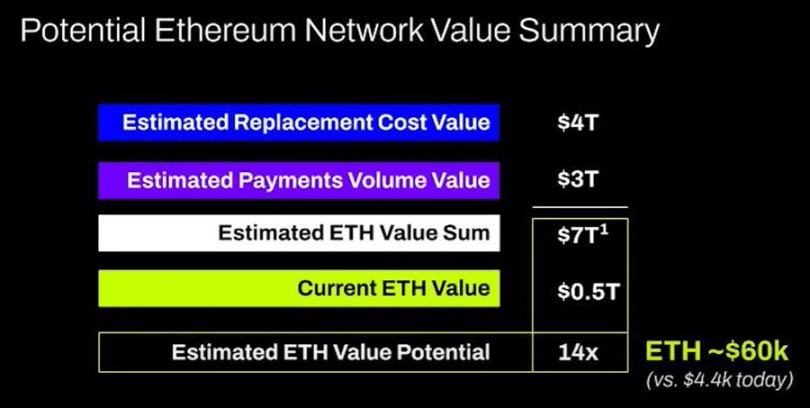

Tom Lee's ETH theory is one of the dumbest theories I've seen from a well-known analyst in a while, composed of arguments that are financially illiterate. Let's break it down one by one. Tom Lee's theory is based on the following points:

- Adoption of stablecoins and RWA

- The analogy of digital oil

- Institutions will buy and stake ETH, securing the network while tokenizing assets and using it as operating capital.

- The value of ETH will be equivalent to the sum of all financial infrastructure companies' value

- Technical analysis

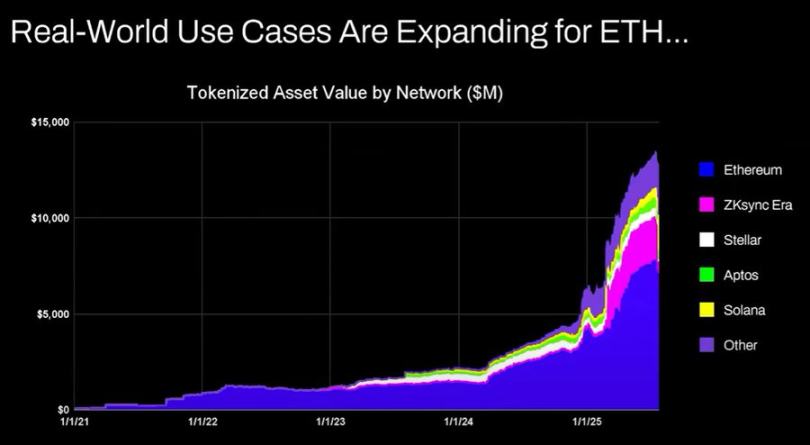

The argument goes roughly like this: activities involving stablecoins and tokenized assets are increasing, which should drive up trading volume, thereby increasing ETH fees and revenue. On the surface, this makes sense, but if you spend a few minutes and a brain cell to check the data, you'll find that's not the case.

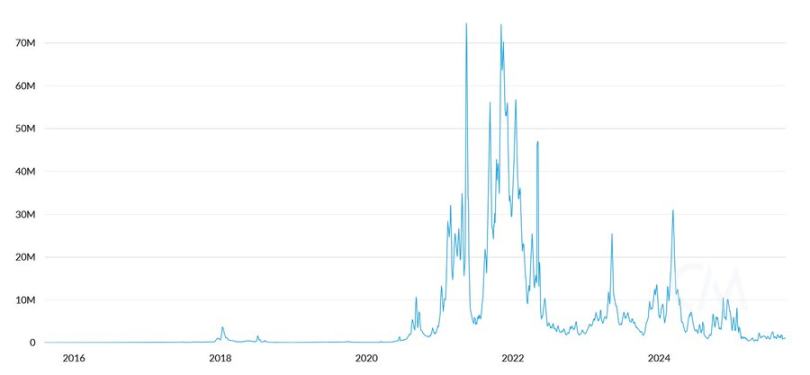

Daily ETH transaction fees (USD)

Since 2020, the value of tokenized assets and stablecoin trading volume have grown by 100 to 1000 times. Tom Lee's argument fundamentally misunderstands how value accrues, possibly leading you to believe that fees would grow proportionally, but in reality, they are almost the same as in 2020.

The reasons are as follows:

- Ethereum network upgrades have made transactions more efficient

- Stablecoin and tokenized asset activity has flowed to other public chains

- Tokenized low-turnover assets do not generate much in fees. The value of tokenization is not proportional to ETH's revenue. Someone can tokenize a 100 millions USD bond, but if it trades only once every two years, how much in fees does that generate for ETH? $0.10? A single USDT transaction might generate more fees than that.

You can tokenize assets worth trillions of dollars, but if these assets do not move frequently, it may only add $100,000 in value to ETH.

Will blockchain transaction volume and generated fees grow? Yes, but most of the fees will be captured by other public blockchains with stronger business development teams. In bringing traditional financial transactions on-chain, other competitors have seen the opportunity and are actively capturing the market. Solana, Arbitrum, and Tempo are winning most of the early major victories. Even Tether is supporting two new Tether chains, Plasma and Stable, both designed to shift USDT trading volume to their own chains.

Oil is a commodity. The real, inflation-adjusted price of oil has traded within the same range for over a century, with cyclical spikes and pullbacks. I agree with Tom's view that ETH can be seen as a commodity, but this is not directly bullish, nor is it clear what Tom is trying to express here!

Institutions will buy and stake ETH

Have large banks and other financial institutions purchased ETH on their balance sheets? No.

Have they announced any plans to do so? Also no.

Do banks hoard gasoline because they have to pay ongoing energy costs? No, it doesn't matter at all, they just pay the fees as needed.

Do banks buy shares of the custodians they use? No.

Come on, this once again shows a fundamental misunderstanding of value accrual, pure fantasy.

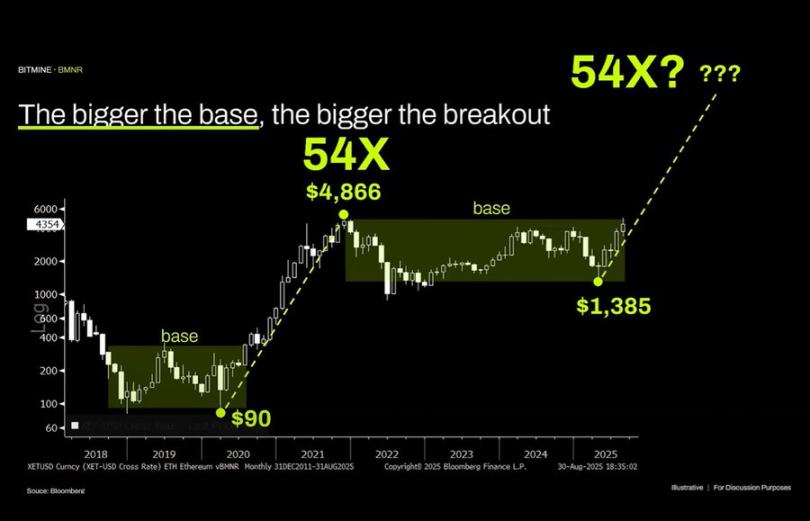

I actually really like technical analysis and believe it can be very valuable when viewed objectively. Unfortunately, Tom Lee seems to be drawing lines at random in technical analysis to support his bias.

Objectively looking at this chart, the most obvious observation is that Ethereum has been in a long-term consolidation range. This is not much different from crude oil prices, which have also traded in a wide range over the past thirty years. Not only are we within the range, but we recently touched the top of the range and failed to break through resistance. If anything, Ethereum's technicals are bearish. I wouldn't rule out the possibility of it consolidating in the $1,000 to $4,800 range for a longer period. Just because an asset has previously experienced a parabolic rise doesn't mean it will continue indefinitely.

Crude oil prices

The long-term ETH/BTC chart is also misunderstood. It is indeed in a long-term range, but in recent years it has been dominated by a downward trend, with a recent rebound at long-term support. The drivers of the downtrend are that Ethereum's narrative has become saturated and the fundamentals cannot justify valuation growth, and these fundamentals have not changed.

Ethereum's valuation is mainly derived from financial illiteracy. This can indeed create a fairly large market cap—just look at XRP. But valuations derived from financial illiteracy are not infinite. Broader macro liquidity allows ETH's market cap to be maintained, but unless there is a major organizational transformation, it is likely doomed to underperform indefinitely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Best Crypto to Buy Now – Dogecoin Price Prediction

Experts Warn Bitcoin Faces Critical Quantum Computing Challenges

Publicly hyping Ethereum while internal reports are bearish—can Tom Lee's team still be trusted?