Tom Lee Exclaims "ETH Fair Value Is $60,000," Andre Kang Claps Back Calling Him "Like a Retard"

Andrew Kang believes Tom Lee is merely drawing lines under the guise of technical analysis to support his own bias.

Original Title: Tom Lee's ETH Thesis is Retarded

Original Author: Andrew Kang, Partner at Mechanism Capital

Original Translation: Azuma, Odaily Planet Daily

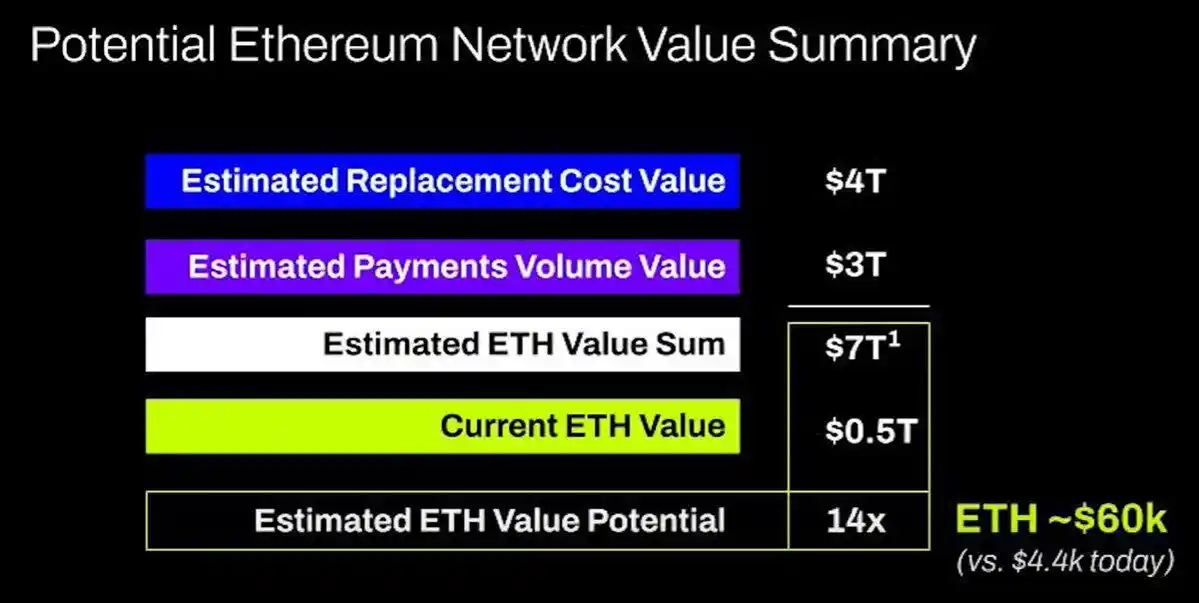

Editor's Note: Ever since Tom Lee became the Chairman of BitMine and advocated for continuous ETH accumulation through DAT, Tom Lee has become the industry's number one ETH bull. In various recent public appearances, Tom Lee has consistently emphasized ETH's growth expectations with various logics, and even boldly stated that ETH's fair value should be $60,000.

However, not everyone agrees with Tom Lee's logic. Mechanism Capital Partner Andrew Kang yesterday evening published a lengthy article refuting Tom Lee's views, openly mocking him as "retarded."

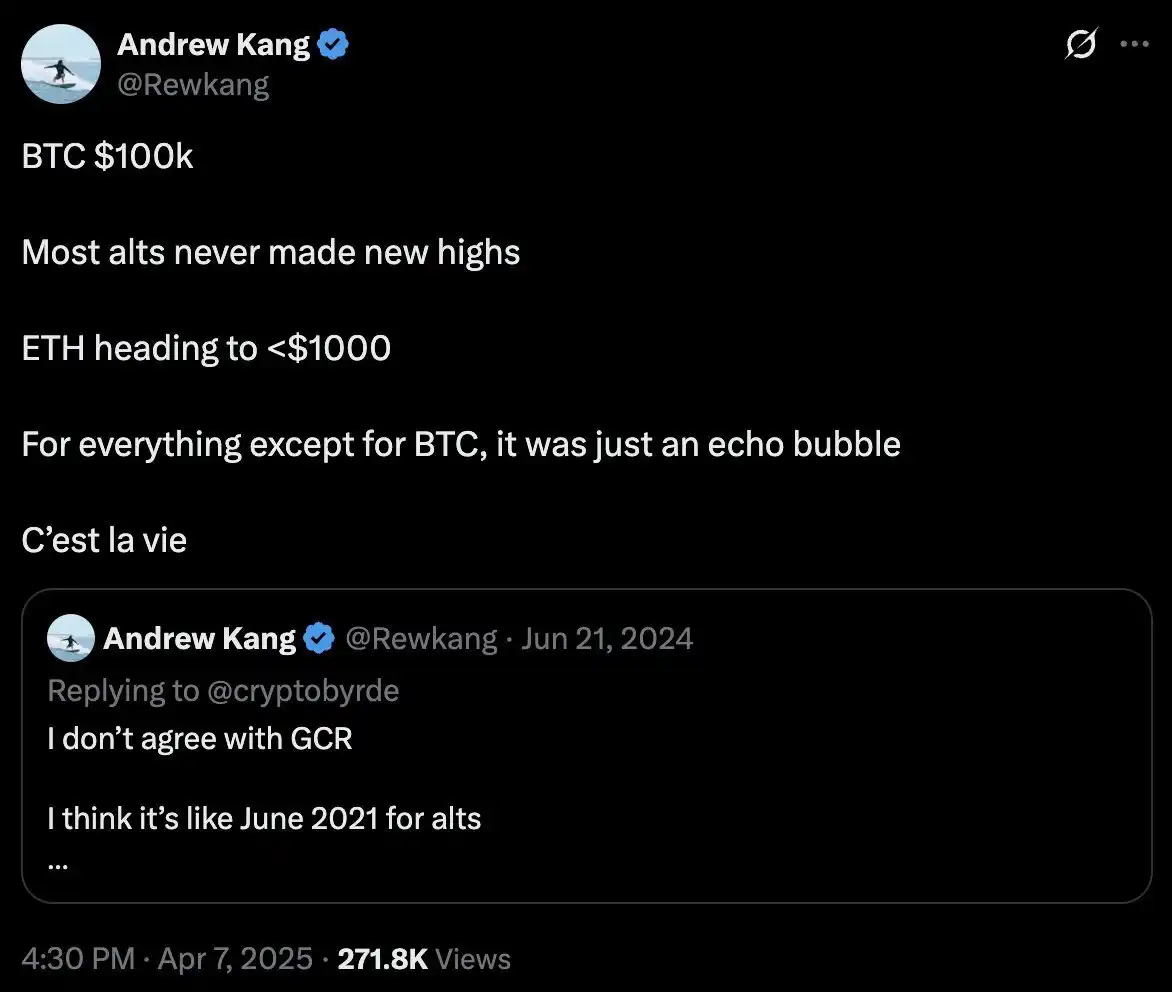

Additionally, Andrew Kang predicted in April of this year during an overall market correction that ETH would drop below $1,000. He has also expressed bearish views during ETH's subsequent rise... Positions shape minds, so his stance may be at the opposite extreme of Tom Lee's. It is recommended that everyone take a dialectical view.

Below is the original content by Andrew Kang, translated by Odaily Planet Daily.

In a recent article by a financial analyst that I have read, Tom Lee's ETH theory can be described as "one of the dumbest." Let's analyze his points one by one. Tom Lee's theory is mainly based on the following key points.

· Stablecoin and RWA (Real World Asset) adoption;

· Analogy of "digital oil";

· Institutions will purchase and stake ETH, providing security for the asset tokenization network and using it as operating capital;

· ETH will be equivalent to the total value of all financial infrastructure companies;

· Technical analysis;

I. Stablecoin and RWA Adoption

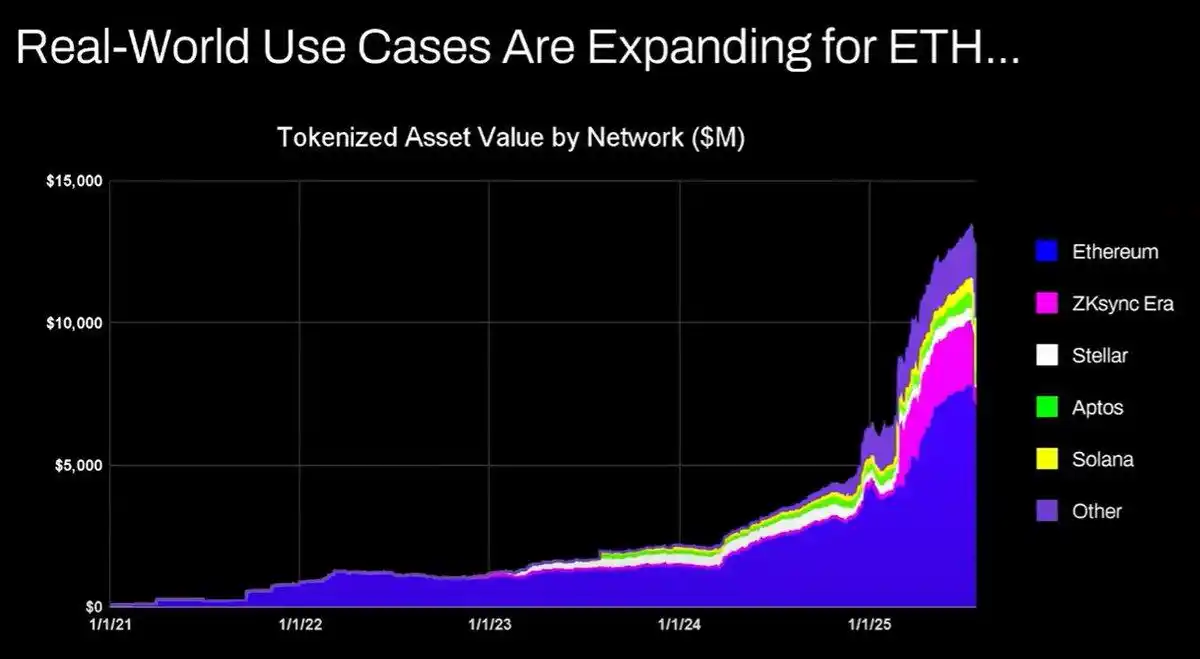

Tom Lee's argument states that stablecoin and asset tokenization activities will increase, boosting transaction volume and thereby increasing ETH's fee revenue. At first glance, this may seem reasonable, but a quick check of the data will reveal that the reality is different.

Since 2020, the value of tokenized assets and the trading volume of stablecoins have increased by 100-1000 times. However, Tom Lee's argument fundamentally misunderstands Ethereum's value accrual mechanism—he leads people to believe that network transaction fees will rise proportionally, but in reality, Ethereum's fee revenue remains at 2020 levels.

The reasons for this result are as follows:

· The Ethereum network will increase transaction efficiency through upgrades;

· Stablecoin and asset tokenization activities will flow to other blockchains;

· The fees generated by tokenizing low-liquidity assets are minimal—the relationship between tokenized value and ETH revenue is not directly proportional. People may tokenize a $100 million bond, but if it is only traded every two years, how much fee does this generate for ETH? Perhaps only $0.1, while the fee generated by a single USDT transaction far exceeds this.

You can tokenize trillions of dollars worth of assets, but if these assets are not frequently traded, then it may only add $100,000 in value to ETH.

Will blockchain transaction volume and fees grow? Yes.

However, most fees will be captured by other blockchains with stronger business development teams. In the process of moving traditional financial transactions to blockchain, other projects have seen this opportunity and are actively capturing the market. Solana, Arbitrum, and Tempo have all achieved some early successes, and even Tether is supporting two new stablecoin blockchains (Plasma and Stable), hoping to transfer USDT's trading volume to their own chains.

II. Analogy of "Digital Oil"

Oil is essentially a commodity. The real price of oil adjusted for inflation has remained in the same range for a century, occasionally fluctuating and returning to its original position.

I partially agree with Tom Lee's point that ETH can be seen as a commodity, but this does not necessarily mean a bullish view. I'm not entirely sure what Tom Lee is trying to convey here.

III. Institutions will buy and stake ETH, providing both network security and operational capital

Have large banks and other financial institutions already bought ETH into their balance sheets? No.

Have they announced any plans to purchase ETH? They have not.

Will banks stockpile barrels of gas because they constantly pay energy fees? No, the fees are not significant enough; they will only pay when needed.

Will banks buy stocks of the asset custody providers they use? They will not.

Four, ETH will be equivalent to the total value of all financial infrastructure companies

I am truly speechless. This is once again a fundamental misunderstanding of value accumulation, purely a fantasy, not even worth arguing about.

Five, Technical Analysis

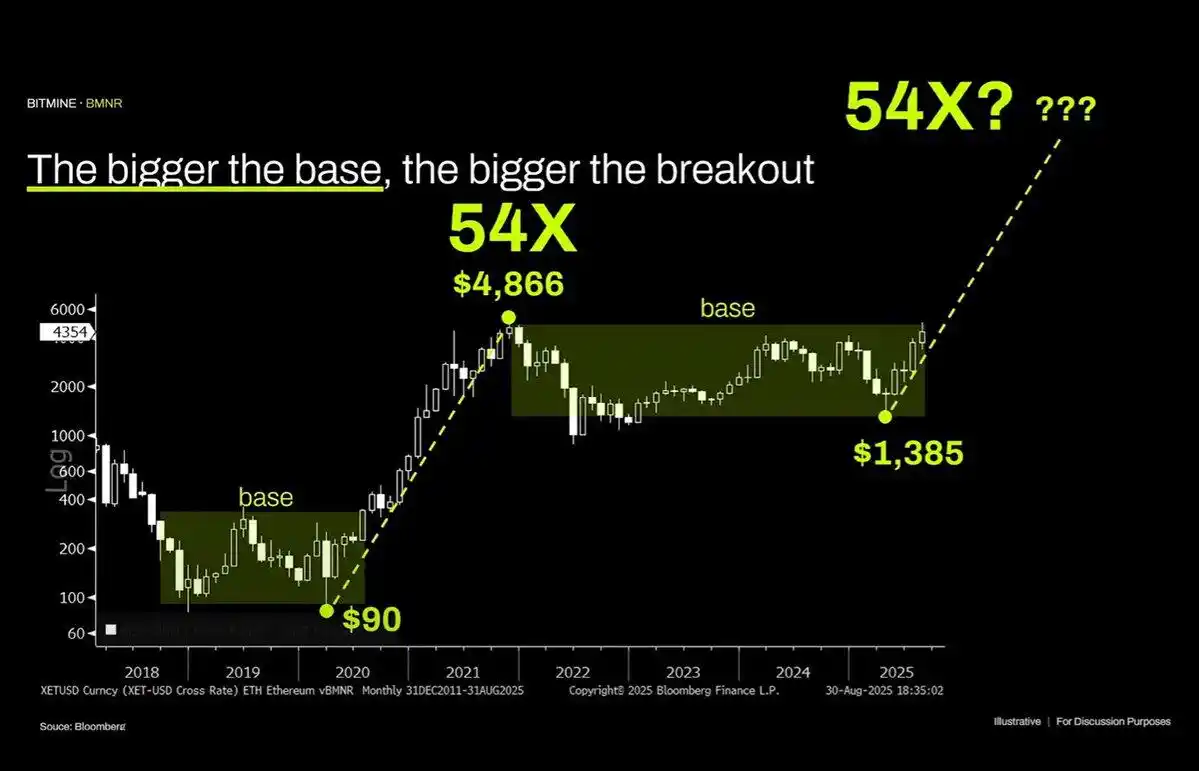

Personally, I am very fond of technical analysis and believe that when approached objectively, it can indeed provide a lot of valuable information. Unfortunately, Tom Lee seems to be using technical analysis as a pretext to blindly draw lines to support his bias.

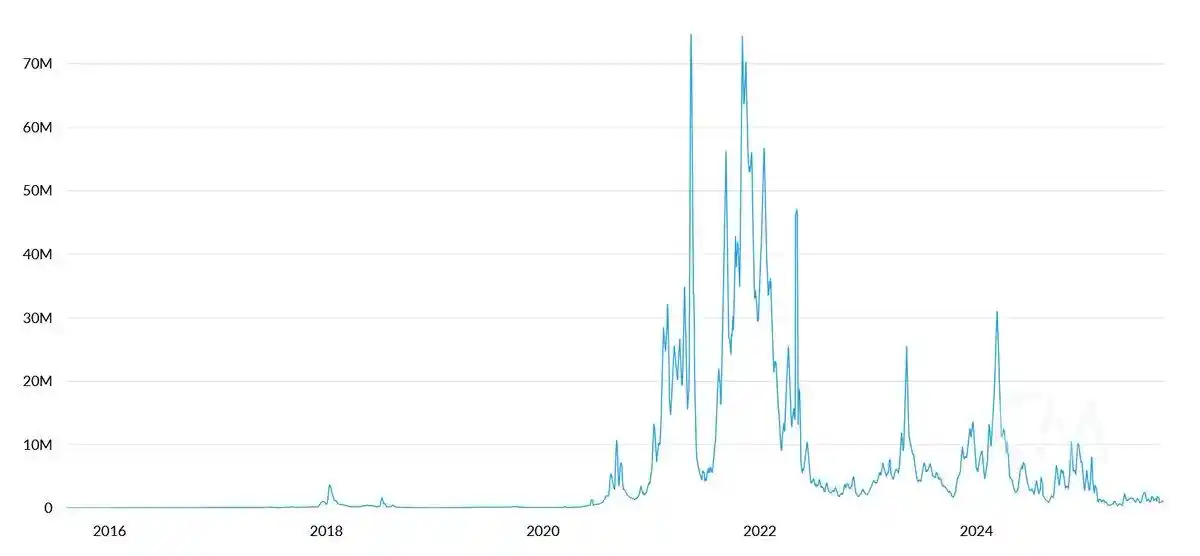

With an objective view of this chart, the most obvious feature is that ETH has been within a sustained multi-year consolidation range—reminiscent of the wide-ranging pattern of oil prices over the past three decades—just in a range-bound state and has recently failed to break through resistance after testing the upper boundary of the range. From a technical standpoint, ETH is showing a bearish signal, and the possibility of its long-term oscillation in the $1000 - $4800 range cannot be ruled out.

Just because an asset has experienced a parabolic rise in the past does not mean this trend will continue indefinitely.

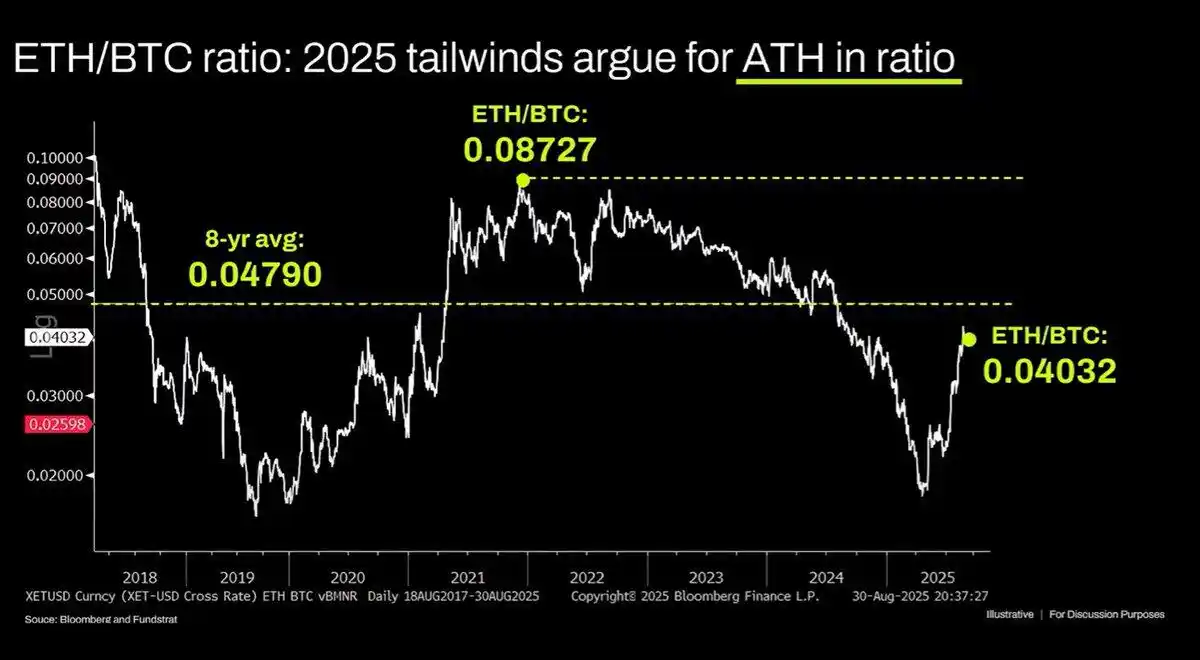

The long-term ETH/BTC chart is also being misread. Though it is indeed within a multi-year consolidation range, it has been overall constrained by a downtrend for the past three years, with the recent rebound only touching a long-term support level. This downward trend is rooted in Ethereum's narrative reaching saturation, with the fundamentals unable to support valuation growth, and these fundamental factors have not substantively changed to date.

Ethereum's valuation is essentially a product of financial cognitive dissonance. Fairly speaking, this cognitive bias can indeed support a considerable market capitalization (see XRP), but its support is not unlimited. Macro liquidity has temporarily maintained ETH's market value level, but unless a significant structural change occurs, it is likely to remain in a prolonged period of underperformance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Every country is heavily in debt, so who are the creditors?

As national debts rise, the lenders are not external forces, but rather ordinary people who participate through savings, pensions, and the banking system.

If Bitmain is sanctioned, which American mining company will fall first?

The U.S. government is conducting a stress test on Bitmain, with the first casualties likely to be domestic mining farms in the United States.

Aethir unveils strategic roadmap for the next 12 months, accelerating the construction of global AI enterprise computing infrastructure

Aethir's core vision has always been to drive the realization of universal, decentralized cloud computing capabilities for users worldwide.

Elon Musk Calls Bitcoin a "Fundamental" and "Physics-Based" Currency

Elon Musk stated, "In a future where anyone can have anything, I believe you will no longer need currency as a database for the allocation of labor."