STBL Rockets 30% as Founder Announces Q4 Buyback, But Bearish Signals Loom

STBL’s 30% rally on buyback news excites investors, but bearish indicators reveal weakening momentum and the risk of a sharp pullback

STBL, the token backing the RWA stablecoin protocol of the same name, has seen its price surge more than 30% over the past day. The sharp rally follows protocol founder Avtar Sehra’s announcement on X that a buyback program is scheduled for the fourth quarter, sparking optimism among investors.

While this update has fueled STBL’s double-digit gains, technical indicators point to potential headwinds that could limit further upside.

Founder Confirms Q4 Buybacks in September

Sehra confirmed that buybacks are scheduled to begin in Q4, describing the initiative as a key step toward positioning STBL as a public utility for programmatic capital.

The founder outlined a vision for protocol-based treasury buybacks, where 100% of minting fees would be directed toward token repurchases, thereby driving value accrual for STBL.

STBL Surges 30%, But Divergence Signals Caution

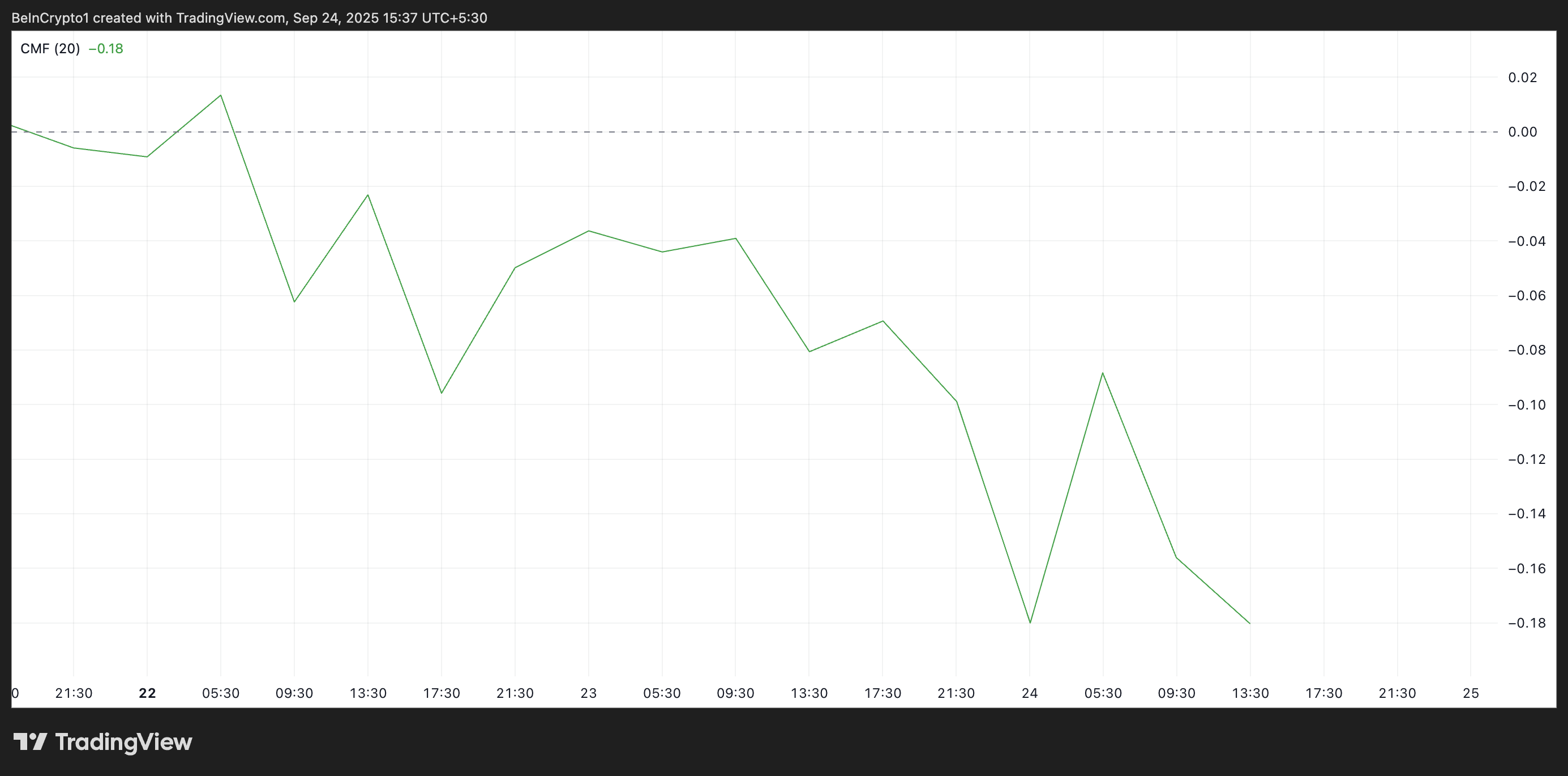

While the price continues to climb, STBL’s Chaikin Money Flow (CMF)—a key indicator that tracks capital inflows and outflows—is currently below the zero line and trending downward.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

STBL CMF. Source:

STBL CMF. Source:

The CMF measures the amount of money flowing into or out of an asset over a given period, giving traders a sense of whether buying or selling pressure is dominant. A reading above zero indicates that inflows outweigh outflows. This suggests strong buying momentum, while a reading below zero signals that selling pressure is prevailing.

When the CMF trends downward while the asset’s price rises, it creates a bearish divergence, implying that strong buying activity may not fully support the rally.

For STBL, this bearish divergence suggests that although the token has seen double-digit gains, the underlying buying pressure is weakening. Trends like this often precede a potential price correction or a period of consolidation, hinting at a pullback in STBL’s value in the near term.

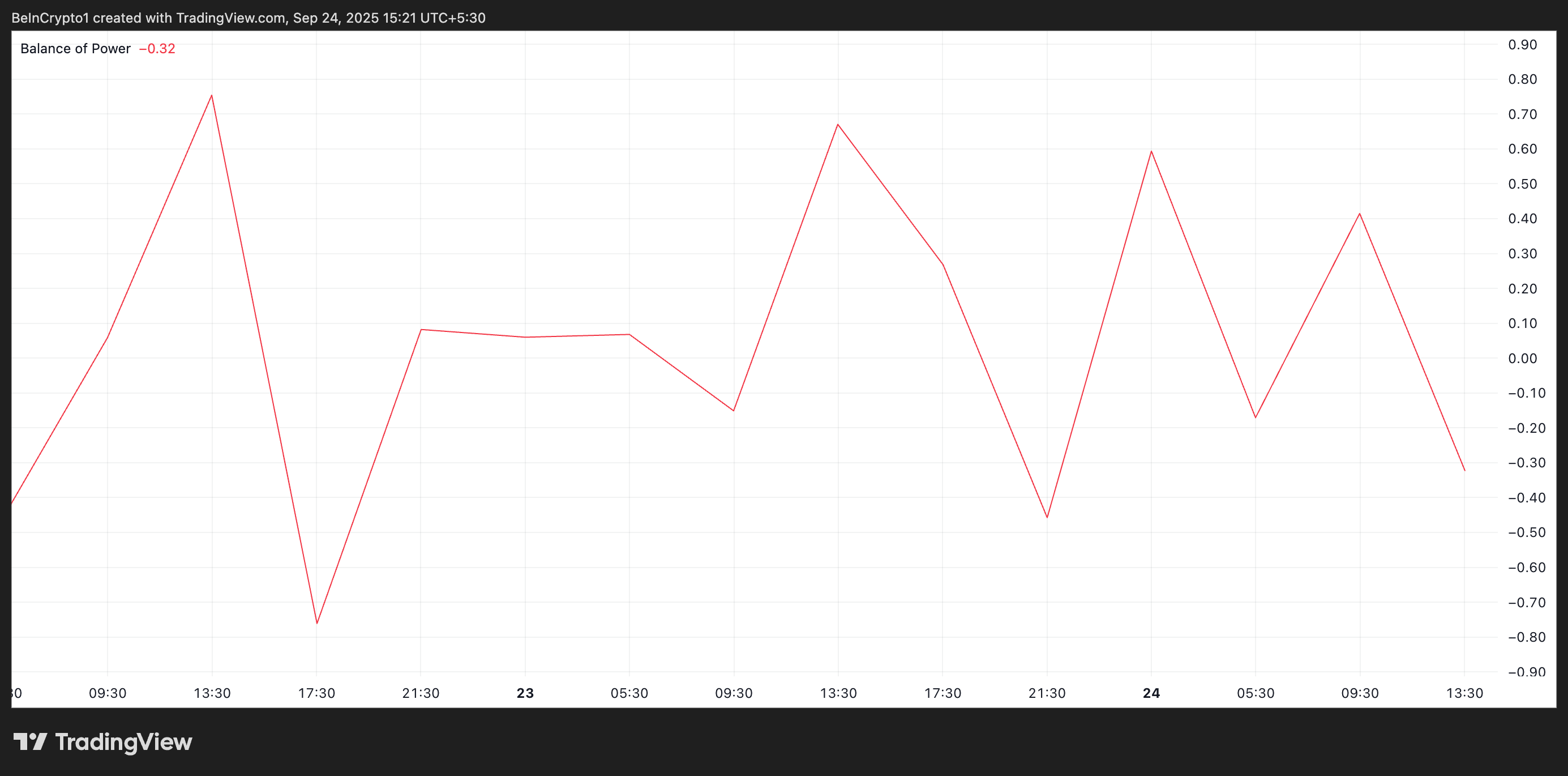

In addition, the token’s negative Balance of Power (BoP) adds to this bearish outlook. As of this writing, the momentum indicator is at -0.32.

STBL BoP. Source:

STBL BoP. Source:

The BoP indicator measures the strength of buyers versus sellers in the market. Positive values indicate buyers are in control, pushing the price higher, while negative readings suggest that sellers dominate trading activity.

A negative BoP during a price rally is particularly noteworthy, as it signals that selling pressure is quietly building behind the scenes even as the token’s market value climbs.

STBL’s Rally on the Edge

These signals suggest that STBL’s current rally may be backed by speculative noise rather than actual demand for the token. Hence, the gains could be at risk.

If selloffs worsen, STBL could reverse its upward trend and fall to $0.36.

STBL Price Analysis. Source:

STBL Price Analysis. Source:

On the other hand, if buyers gain strength, they could potentially drive STBL’s price upward to reach $0.53.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BGB holders' Christmas and New Year carnival: Buy 1 BGB and win up to 2026 BGB!

Bitget Trading Club Championship (Phase 20)—Up to 2400 BGB per user, plus a RHEA pool and Mystery Boxes

Subscribe to ETH Earn products for dual rewards exclusive for VIPs— enjoy up to 8% APR and share 30,000 USDT!

Bitget Spot Margin Announcement on Suspension of ICNT/USDT, PROMPT/USDT, CAMP/USDT, FARTCOIN/USDT, PEAQ/USDT Margin Trading Services