Hyperliquid’s USDH Transforms Stablecoin Economics Through a Community-Driven Yield Approach

- Hyperliquid launched USDH stablecoin via on-chain voting to select an issuer, aiming to replace USDC in its ecosystem with yield-generating reserves. - Six major contenders, including Paxos and Sky, proposed distinct models, offering yield-sharing, liquidity incentives, and compliance-driven frameworks. - USDH diverges from traditional stablecoins by redirecting yield to Hyperliquid’s ecosystem via buybacks, avoiding direct interest payments to holders. - Regulatory challenges like EU’s MiCA ban on algor

Hyperliquid has introduced its USDH stablecoin after a fierce contest among leading crypto companies for the right to issue it, marking a significant development in the evolution of decentralized finance (DeFi) and stablecoin technology. The platform revealed the USDH stablecoin on September 5, 2025, utilizing a transparent on-chain voting process to determine the issuer. Validators will cast their votes, with the final decision set for September 14. The new stablecoin is designed to replace third-party tokens such as

Six major candidates entered the competition to issue USDH, each presenting unique advantages. Native Markets, established by Hyperliquid supporter Max Fiege, was the first to submit a proposal, utilizing Stripe’s Bridge payment system, though it met with resistance from the community. Paxos, a regulated stablecoin provider, offered to allocate 95% of reserve interest to HYPE token buybacks and partnered with

Unlike conventional stablecoins such as USDC, USDH incorporates mechanisms for generating yield and sharing revenue. In accordance with the U.S. GENIUS Act, USDH adheres to regulatory requirements while avoiding direct interest payouts to holders—a limitation faced by Circle’s USDC. Instead, USDH distributes returns within the Hyperliquid ecosystem through buybacks and validator incentives, creating a self-sustaining economic structure. This model could transform the stablecoin sector by channeling substantial yield back to the Hyperliquid community instead of external parties. However, the EU’s MiCA regulations, which prohibit algorithmic and yield-generating stablecoins, could restrict USDH’s international expansion.

The competition for issuance rights sparked heightened market activity, with HYPE’s value climbing 23.4% in the week ending September 8, 2025. Large-scale investors, including a $12 million HYPE acquisition by “qianbaidu.eth,” demonstrated strong faith in the ecosystem. Bernstein analysts observed that USDH’s adoption could pose a challenge to USDC’s leadership, especially in yield-focused DeFi sectors, though building liquidity will take time. Jamie Elkaleh of Bitget emphasized that USDH could decrease dependence on external stablecoins and reshape protocol incentives.

The issuer will be chosen based on validator votes, which are weighted by staked HYPE. Native Markets currently leads with about 70% of pledged votes, while Paxos has around 23%. The Hyperliquid Foundation has opted not to vote, ensuring the decision rests with the community. The winning issuer will gain access to Hyperliquid’s $5 billion in USDC reserves, a key resource for expanding USDH’s reach. Sky’s proposal, featuring an $8 billion balance sheet and a 4.85% yield, remains a strong competitor.

Industry observers warn that USDH’s future depends on regulatory certainty and robust liquidity infrastructure. Jeremy Allaire of Circle highlighted USDC’s strengths in liquidity and interoperability, while acknowledging the innovative governance behind USDH. The outcome of the vote will determine Hyperliquid’s direction, potentially transforming it from a high-volume trading platform into a self-sustaining DeFi ecosystem. With the introduction of USDH, Hyperliquid seeks to reshape stablecoin economics, aligning the interests of users, validators, and the wider crypto community.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

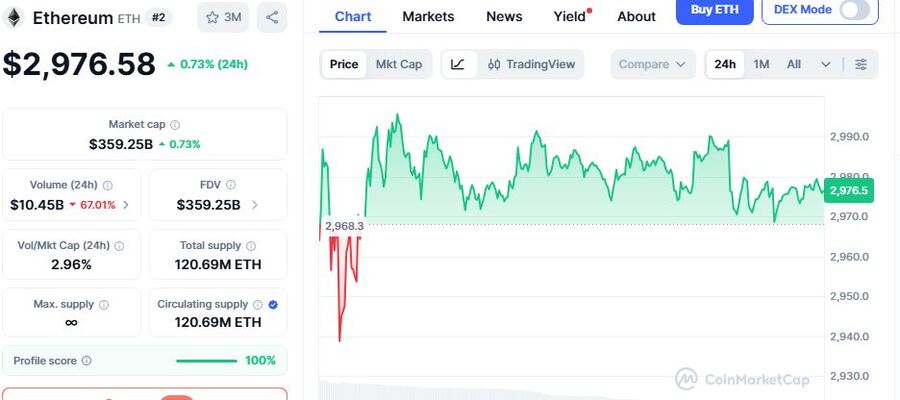

Ethereum New Wallet Addresses on Spike As ETH Consolidates at $2,977, Suggesting Looming Market Momentum

Digital Renminbi Fraud Traps: How Scammers Push Wallet Schemes and How to Protect Your Funds