Cardano $0.823993 ( ADA ) and Ethereum (ETH) $4,179 have captured attention as both cryptocurrencies navigate significant ecosystem updates. The Cardano Foundation is amplifying ADA’s market potential by allocating billions towards stablecoin liquidity, creating a robust foundation for potential price appreciation. On Ethereum’s side, the approval of ETFs by the SEC has heightened expectations for long-term institutional legitimacy.

Liquidity Boost Fuels ADA’s Upward Potential

Since early September, the price of ADA has established a robust base within a targeted demand zone. Currently priced at $0.8178, ADA has bounced twice from a $0.7682 support line forming a double bottom pattern. If the resistance at $0.9614 is breached, ADA could climb towards $1.20, representing a potential 50% increase from current levels.

The Cardano Foundation aims to deepen the stablecoin market with an eight-figure ADA allocation. This initiative seeks to bolster decentralized finance stability and provide a stronger infrastructure. Moreover, the redistribution of 220 million ADA to community representatives fosters a more inclusive governance structure. Redirecting 2 million ADA to the Venture Hub opens doors for new projects.

Cardano’s roadmap also includes a $10 million initiative focusing on real-world asset integration. These developments demonstrate ADA’s expansion beyond speculative realms, offering a broad spectrum of real-world applications. Consequently, ecosystem enhancements are expected to ground ADA’s price on more stable long-term fundamentals.

Ethereum’s ETF Approval Attracts Institutional Interest

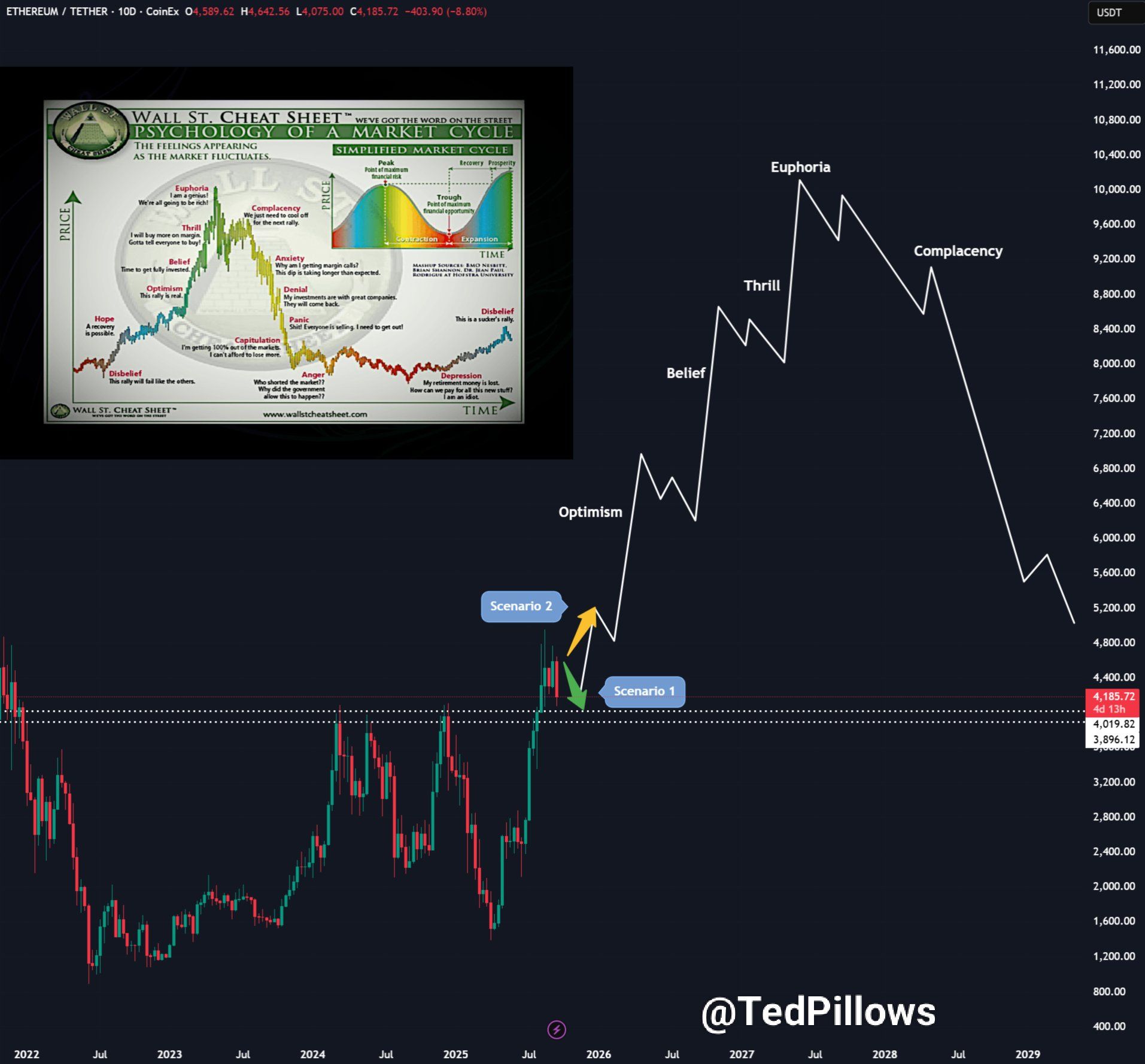

Ethereum is trading at $4,149, with analyst Ted Pillows highlighting the market’s cyclical nature. He suggests a possible short-term dip to the $3,600–$3,800 range, a historically strong support where market sentiment often shifts from optimism to doubt. Nonetheless, Ethereum’s long-term roadmap targets $10,000, characterized by stages of conviction and enthusiasm.

Ted Pillows’ Ethereum Analysis

Ted Pillows’ Ethereum Analysis

The SEC’s move to categorize Grayscale’s Ethereum ETFs under general listing standards marks a significant milestone. Ethereum-based investment products can now be traded alongside commodity-based instruments, accelerating the process for issuers and providing a more transparent, accessible environment for institutional investors.

The approval of ETFs accelerates Ethereum’s integration into traditional finance and reinforces long-term price growth prospects. With clearer regulation and increased access, demand for ETH is likely to spur an upward price trend. Thus, despite short-term fluctuations, Ethereum is positioning itself on a sturdy institutional footing for the future.