Date: Tue, Sept 23, 2025 | 03:10 PM GMT

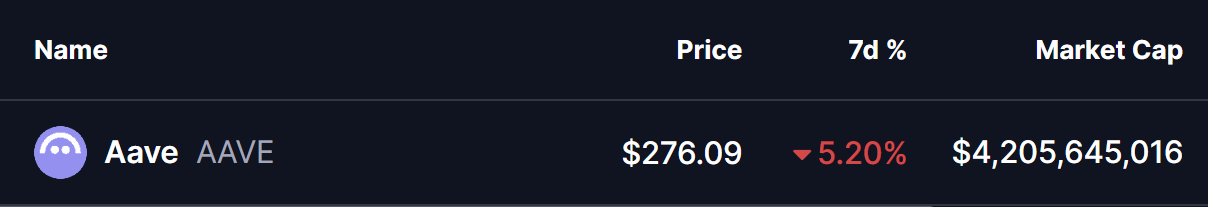

The cryptocurrency market continues to face heavy selling pressure, with Ethereum (ETH) sliding to the $4,200 level after a 6% weekly decline. Major altcoins are also struggling, including DeFi-focused token Aave (AAVE), which has shaded by 5% this week.

More importantly, AAVE has confirmed a bearish breakdown from a key technical structure that could dictate its next move.

Source: Coinmarketcap

Source: Coinmarketcap

Rising Wedge Breakdown

On the daily chart, AAVE had been climbing within a rising wedge since early June 2025 — a bearish reversal pattern characterized by higher highs and higher lows within converging trendlines.

After multiple rejections at the wedge’s resistance, AAVE finally broke below the critical support trendline near $293, as well as its 100-day moving average. This confirmed a breakdown, triggering a sharp sell-off.

Aave (AAVE) Daily Chart/Coinsprobe (Source: Tradingview)

Aave (AAVE) Daily Chart/Coinsprobe (Source: Tradingview)

The drop drove AAVE toward its 200-day moving average near $249, where it staged a slight rebound. As of now, the token is trading around $276.06, but the technical damage appears significant.

What’s Next for AAVE?

The bearish breakdown suggests that any rebound from current levels could simply retest the broken wedge support, which has now turned into resistance. A failure to reclaim this level would reinforce bearish momentum and set the stage for a deeper move toward the breakdown target near $180.

On the flip side, if AAVE manages to reclaim and hold above the $293 zone, particularly aligning with the 100-day MA, it would invalidate the current bearish setup and open the door for recovery.

For now, traders will be closely watching the $245–$293 range as the deciding zone for AAVE’s next major trend.