21Shares Launches Dogecoin ETF on DTCC

21Shares has listed its Dogecoin ETF on DTCC, offering exposure to Dogecoin without owning the cryptocurrency directly.

Swiss asset management firm 21Shares has officially listed its Dogecoin-focused exchange-traded fund (ETF) on the Depository Trust & Clearing Corporation (DTCC) under the ticker TDOG, marking a significant step in diversifying crypto investment products.

The ETF allows investors to gain exposure to Dogecoin price movements without needing to hold the cryptocurrency directly, following a model similar to Bitcoin ETFs that became widely available in 2024.

Growing Institutional Acceptance of Meme Coins

The move highlights growing regulatory acceptance of meme coins in mainstream financial markets, as asset managers seek to provide broader access to digital assets within established financial frameworks. By listing on the DTCC, 21Shares enables institutional and retail participants to integrate Dogecoin into portfolios while navigating compliance and settlement processes through an established infrastructure.

$TDOG listed on the DTCC website Source:

DTCC.com

$TDOG listed on the DTCC website Source:

DTCC.com

Bloomberg Senior ETF Analyst Eric Balchunas also welcomed the listing in X(Twitter).

“JUST IN: 21Shares’ Spot Dogecoin ETF has been listed on the DTCC under ticker $TDOG.”

Not gonna lie $TDOG is a great ticker

— Eric Balchunas (@EricBalchunas) September 22, 2025

Broader Implications for Crypto ETFs

This listing represents a continuation of 21Shares’ efforts to expand beyond Bitcoin and Ethereum ETFs, reflecting a more diversified approach to crypto investment products. Industry observers note that such offerings may attract investors seeking alternative exposure to emerging digital assets, particularly those with high liquidity and widespread social attention. The ETF structure mitigates custody and security concerns, allowing market participants to focus on trading strategies rather than managing the underlying assets themselves.

The TDOG ETF launch also coincides with an environment in which regulatory authorities have accelerated approvals for crypto-related ETFs, encouraging innovation while maintaining oversight. Analysts suggest that regulatory clarity could further facilitate the growth of ETFs tied to other altcoins, potentially increasing the breadth of investable crypto products available through conventional channels.

Investor Considerations

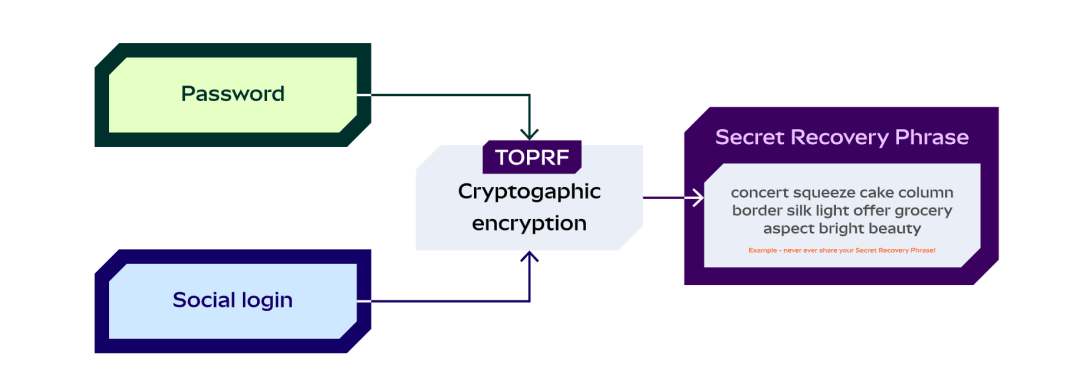

Investors interested in TDOG should consider both the volatility inherent to meme coins and the structural advantages of ETFs, which provide indirect exposure without the operational complexities of digital wallets or private key management. Market participants may view the ETF as a convenient option to access Dogecoin price dynamics while remaining within regulated frameworks, bridging the gap between traditional finance and the emerging crypto ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Galaxy Digital, Which Manages Billions of Dollars, Reveals Its Bitcoin, Ethereum, and Solana Predictions for 2026

A Brief History of Blockchain Wallets and the 2025 Market Landscape

Tom Lee responds to X's debate with Fundstrat over differing bitcoin outlooks

Egrag Crypto: Selling XRP Now Makes No Sense. Here’s Why