Matrixport: Low ETH Trading Volume May Increase Forced Liquidation Risk

Jinse Finance reported that Matrixport stated in an article that despite a favorable macro environment, Ethereum's current trading volume has dropped significantly, which may increase the risk of forced liquidations. Data shows that ETH open interest remains at the level of $14.6 billions, while trading volume continues to be sluggish. Analysts warn that following the Federal Reserve's FOMO meeting and the subsequent rise in US Treasury yields, market pressure has further intensified. If the price falls below key technical support levels, it could trigger a chain of stop-losses and rapid deleveraging. Investors are advised to control their risk exposure and maintain a cautious attitude.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Foundation sets strict 128-bit encryption rules for 2026

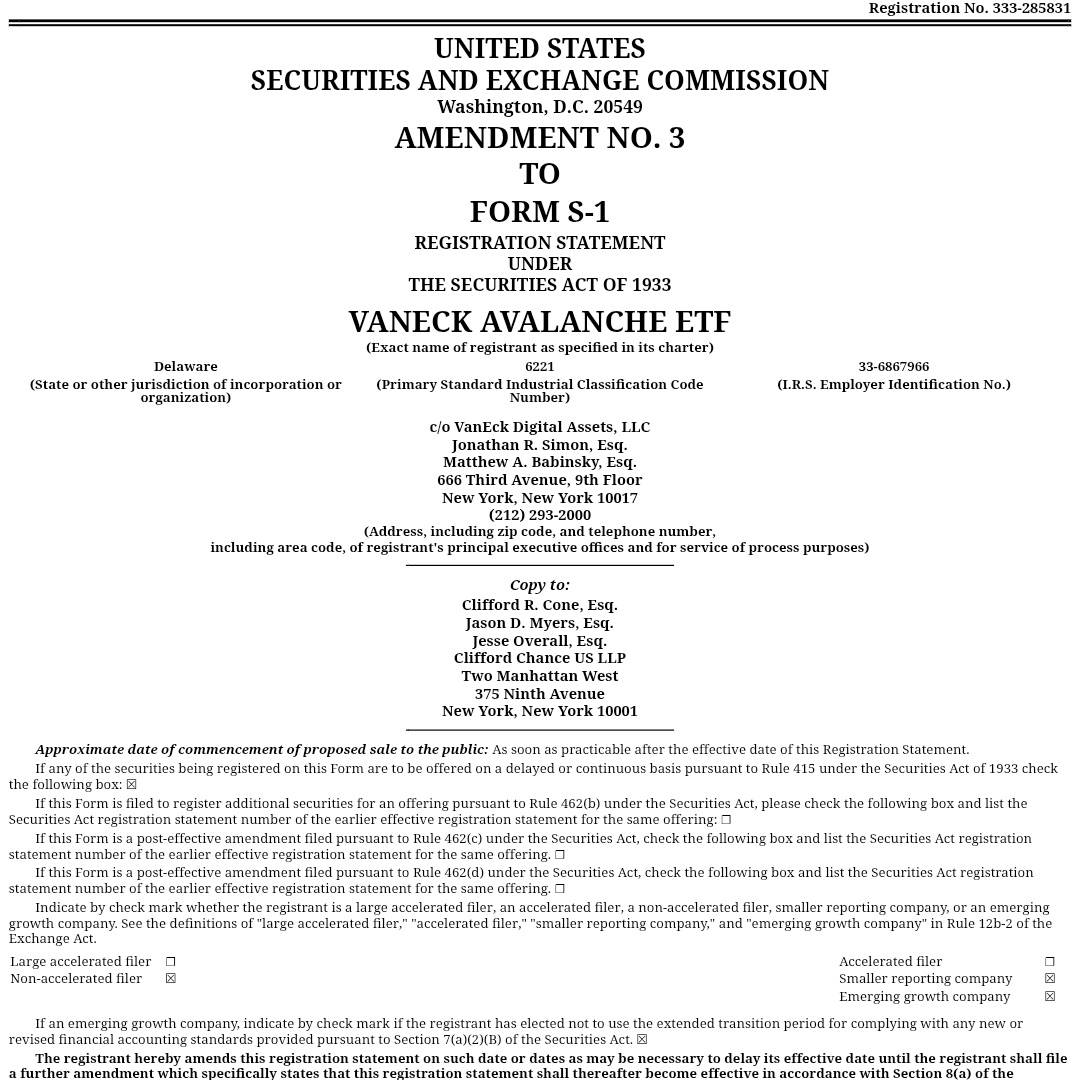

VanEck updates Avalanche ETF application to include staking rewards

VanEck submits spot AVAX ETF application to US SEC

Pi Network updates DEX and AMM features and launches holiday event