Authors: Ethan Chan & Hannah Zhang

Translation: TechFlow

This week, the Federal Reserve cut interest rates and hinted at further policy easing in the future. Almost all mainstream crypto news headlines are conveying the same message:

Lower capital costs → Increased liquidity → Bullish crypto.

But the reality is more complex. The market has long priced in expectations of a rate cut, and there has not been an immediate surge in capital inflows into BTC and ETH.

Therefore, let’s not stay on the surface, but instead examine how rate cuts affect a part of DeFi—lending.

On-chain lending markets like Aave and Morpho dynamically price risk rather than relying on regulatory directives. However, the Federal Reserve’s policies provide important context for this backdrop.

When the Federal Reserve cuts rates, two opposing forces are at play:

1) Reverse effect: Fed rate cuts → On-chain yields rise as people seek uncorrelated assets

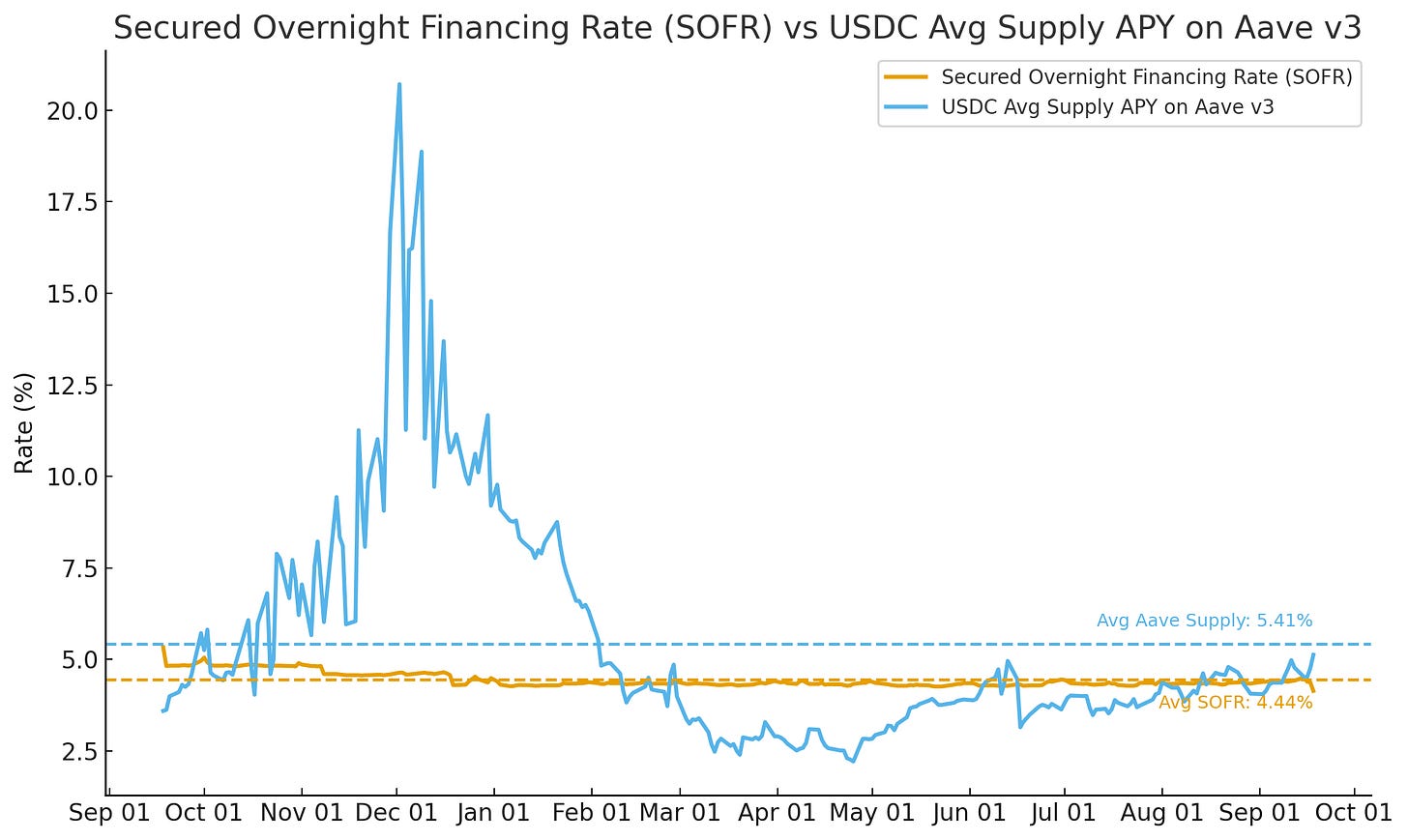

As capital seeks returns outside of traditional government bonds and money market funds, it may flow into DeFi, thereby driving up utilization and causing on-chain rates to rise. If we compare the supply annual percentage yield (Supply APY) of USDC on Aave with SOFR (Secured Overnight Financing Rate), we can see this trend gradually emerging before the Fed’s September rate cut.

Source: Allium

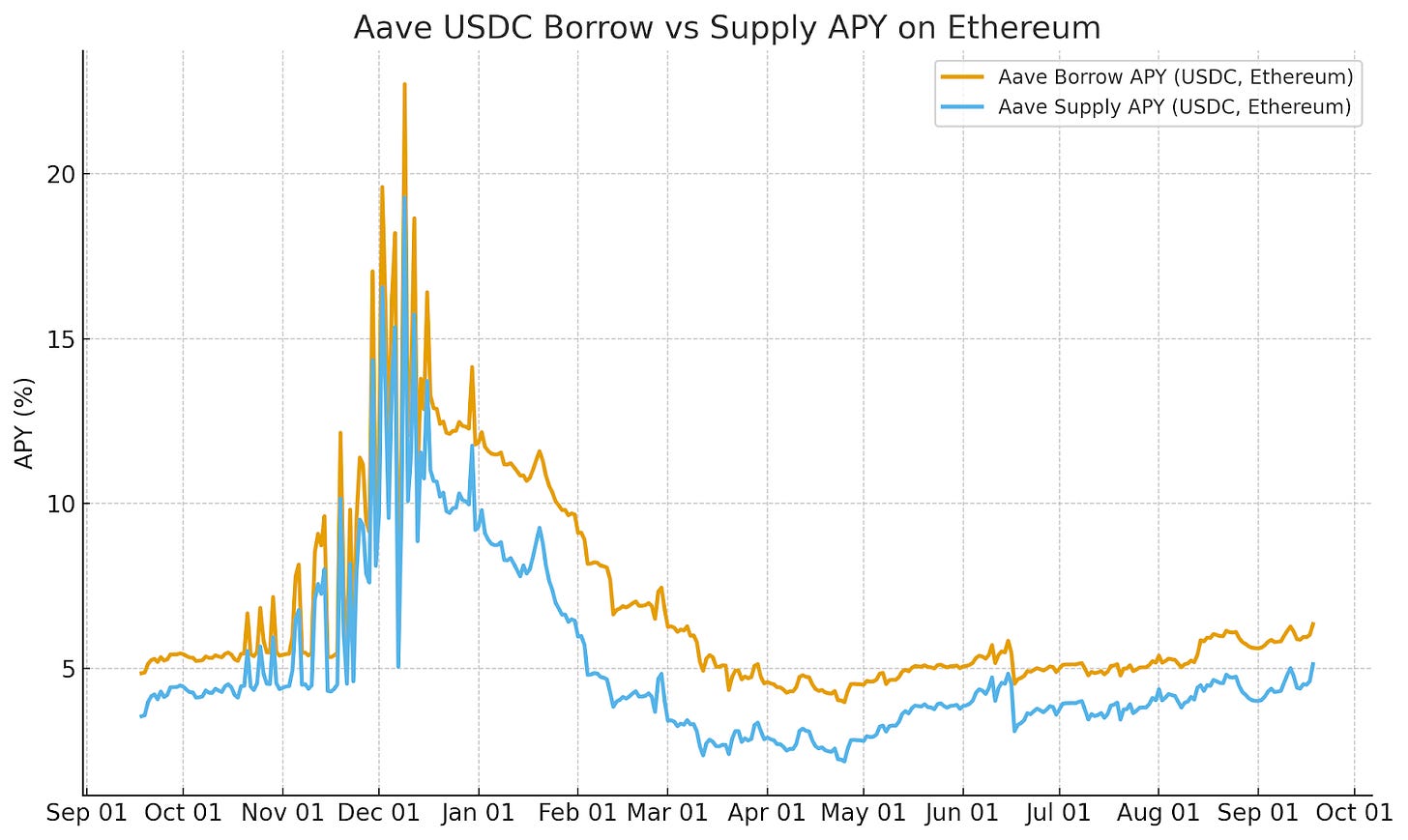

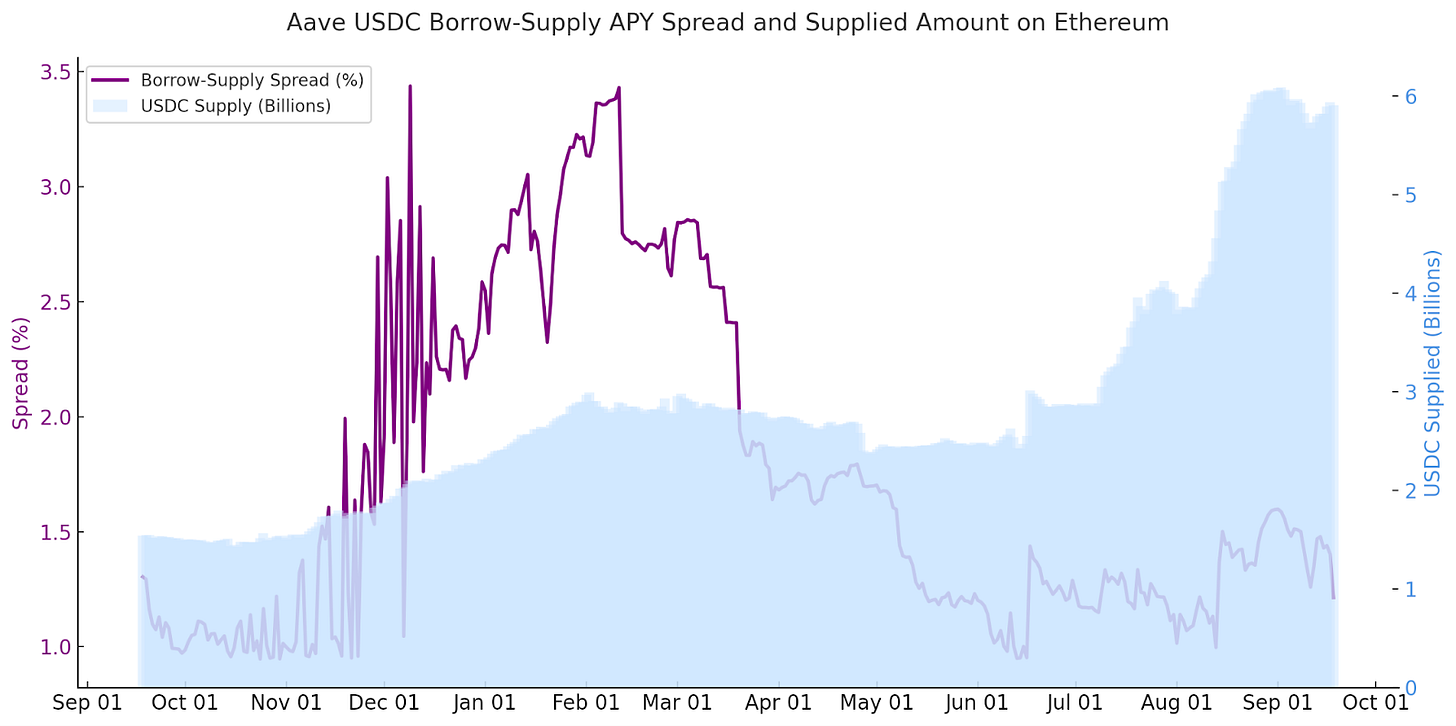

We also see this happening as the DeFi lending-supply yield spread narrows.

Taking the example of USDC lending on Aave on Ethereum, in the days leading up to the Fed’s rate cut announcement, the lending-supply yield spread gradually narrowed. This was mainly due to more capital chasing yields, supporting the short-term reverse effect.

Source: Allium

2) Direct correlation: Fed rate cuts → On-chain yields also fall as alternative liquidity sources become cheaper

As the risk-free rate falls, the cost of alternative liquidity sources such as crypto also declines. Borrowers can refinance or leverage at lower costs, thereby pushing down both on-chain and off-chain lending rates. This dynamic typically persists in the medium to long term.

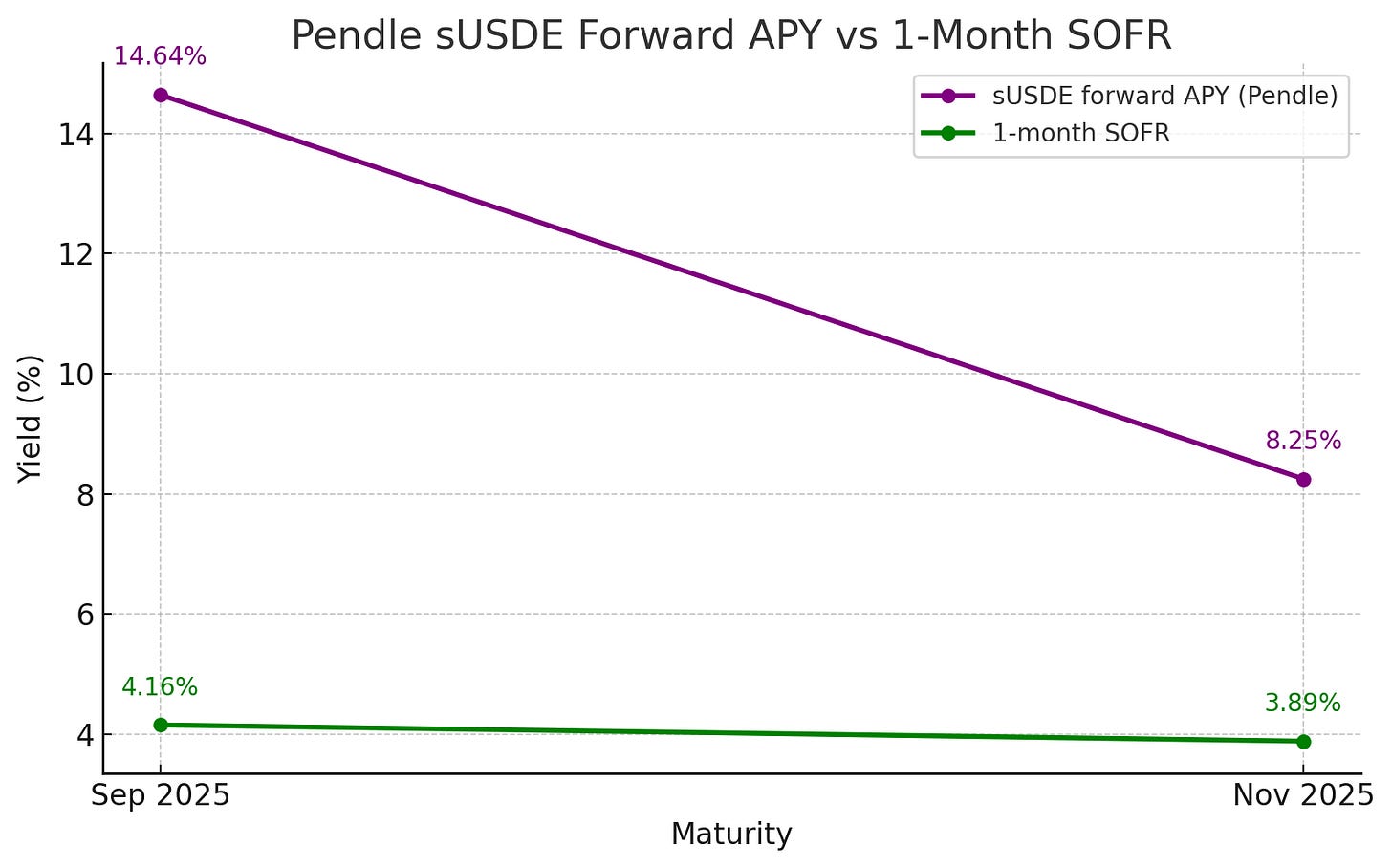

We can see signs of this in the forward yield market data.

Pendle is DeFi’s forward yield market, where traders can lock in or speculate on future DeFi annual percentage yields (APY). Although Pendle’s maturities do not perfectly match traditional benchmark rates, its maturities are very close to SOFR, making for a valuable comparison—for example, in late September and late November.

On these dates, the 1-month SOFR rate was about 4.2% (September) and 3.9% (November). The implied sUSDe yields for similar Pendle maturities were much higher in absolute terms (14.6% and 8.3%, respectively). But the shape of the yield curve says it all. Like SOFR, as expectations of further Fed easing are priced in, Pendle’s forward yields are also declining.

Source: Allium

Key point: Pendle’s trend is consistent with the direction of traditional rate markets, but with a higher benchmark. Traders expect on-chain yields to fall as macro policy changes.

Conclusion: The impact of Fed rate cuts on the crypto market is not as simple as the headlines suggest

Rate cuts do not only affect the crypto market (just as in traditional capital markets, rate cuts usually impact the stock market). Rate cuts also bring various effects—on-chain yields fall, rate spreads narrow, and forward yield curves shift—all of which ultimately shape liquidity conditions.

Beyond lending, we can further understand the impact of Fed rate cuts on the crypto market, such as how the circulation of stablecoins might change as issuer yields fall or as real yields decline, leading to increased ETH staking inflows.

By combining real on-chain data, we can go beyond news headlines and truly see how macro policy permeates the crypto market.